Why Silver?

By Mitchell Vexler, February 16, 2026

In addition to:

1. Got Metals

2. Your Money (METALS)… Your Future… Neither a borrower, nor a lender be

3. The Federal Reserve is a Failure - Thesis & Fact Part 2

4. Precious Metal Manipulation, Market Manipulation, Your Manipulation

5. Either the law exists or it doesn’t. We are about to find out.

and

6. Metals Moment - Analysis & What Do You Really Own

I now add:

1. Government for the sake of government is the definition of tyranny. Billionaires are now being taxed out of California, including Zuckerberg (socialist) heading to Florida.

2. Hedge against inflation.

3. Hedge against economic uncertainty.

4. Considered a safe-haven asset.

5. Significant industrial demand, particularly in technology and renewable energy sectors, may drive its value higher over time.

6. Physical demand is outpacing production.

7. Basel III

Risk Weighting: Silver is subject to an 85% Net Stable Funding Ratio (NSFR) requirement, which complicates its use as a capital asset for banks.

Market Dynamics: The lack of special provisions for silver, combined with its high paper-to-physical leverage ratio of 300:1, creates unique market pressures. This could lead to significant price volatility as banks unwind their paper positions.

Comparison with Gold:

| Attribute | Silver | Gold |

|---|---|---|

| Tier 1 Status | No | Yes |

| Paper-to-Physical Ratio | 300:1 | 100:1 |

| NSFR Requirement | 85% | Lower Risk Rating |

| Regulatory Support | None | Strong Central Bank Advocacy |

8. Silver is not currently classified as a Tier 1 capital asset like gold as it is treated similarly to base commodities under Basel III regulations, which imposes stricter funding requirements on banks holding silver. This lack of special provisions for silver contrasts with gold's status, which allows it to be treated as a highly stable asset. However, given all the issues outlined above, there is a high probability that silver will outperform gold on a rate of return basis.

9. Increased volatility swings allows for better risk reward entry levels and ability to scale in.

10. Affordable.

11. Transportable.

12. If your silver holdings are large enough you can borrow against it.

13. You could diversify with 60% gold, 30% silver and 20% platinum.

14. The ultimate form of savings, outside of a very fragile banking system.

15. Silver is widely used in various industries due to its excellent electrical and thermal conductivity, reflectivity, and antimicrobial properties. Key applications include electronics (printed circuit boards and switches), solar energy (photovoltaic cells), medical devices, and water purification systems.

| Application | 2024 Demand | Key Features |

|---|---|---|

| Electronics | 445 million ounces | best electrical conductor, used in PCNBs &devises |

| Solar Energy | 197.6 million ounces | essential for photovoltaic cells |

| Automotive | 90 million ounces | used in electrical contacts & switches |

16. Industrial applications consumed 680 million ounces of silver in 2024, representing 59% of total global demand.

17. Warren Buffett made significant investments in silver, notably acquiring over 129 million ounces in the late 1990s, which he viewed as undervalued due to its industrial demand and limited supply. He prefers silver over gold because of its practical uses in various industries, aligning with his value investing principles. His regret is that he sold too early.

18. Don’t sell and you don’t have to worry about exit premiums.

19. You can shop for best premiums above spot with legitimate broker dealers.

20. Stocks and bonds generate income that can help offset inflation, but they carry contractual risks. Bonds have a high probability of default (aka School District bonds), and corporate bonds (High Yield Junk Bonds) can fail bringing their underlying stocks down with them. I would make the argument that printing money to cover interest on the fraudulent principal of the bonds is itself a default by the U.S. Treasury that prints the money (counterfeiting not backed by assets) at the behest of the Federal Reserve.

21. Silver does not have 3rd party counter risk. It is a physical asset that does not depend on anyone else’s promises. But, unlike stocks or bonds, silver doesn’t produce income (unless you lease it out but that comes with other risk), so returns depend entirely on price appreciation which given what could be devaluation (debasement and or inflation) of the U.S. dollar and related assets, metals seem like an appropriate investment, under your direct ownership.

22. Cash has its own tradeoff. Cash should be available outside of the bank for emergency use. It offers immediate access but loses value to inflation over time. Silver maintains its spending power better, though it requires more effort to convert back to cash if and when needed.

23. President Trump designated silver as a critical mineral in November 2025, as part of the U.S. Critical Minerals List. This designation highlights silver's importance to the U.S. economy and national security. Isn’t it interesting that China produces 70% of the worlds electronics and now it has prohibitions of silver leaving the country. President Trump intends to bring the manufacturing back into the U.S.

24. Silver Price Crashes 3rd Hardest in 6 Years

Silver price crashed 10% Thursday, February 12, 2026 in its third-worst decline since 2020, losing $9 per ounce in a single session.

Price trades at $78 Friday, testing $80 resistance, while $70 support and $55 major support remain intact.

25. As I stated on video showing my chart, there is a support zone forming around the $70 level, defined by local lows from late December. Even if this level breaks, the next significant support zone appears around $55.

26. Could this be more manipulation? To a certain extent…probably.

The press needs a story: Fed policy, profit-taking after extreme rally being a 65% surge in January 2026 following a 150% gain in 2025; cross-asset correlation wherein silver dropped alongside tech stocks and crypto; liquidity concerns or margin requirements and or whatever the flavor of the day is being this bank said this and that bank said that all of which is just white noise.

27. What is next? I don’t know. What I do know is given the above and knowing that white noise exists to manipulate, investing for the long haul and not speculating (short term futures and options) in physical silver may be the appropriate course of action.

28. The COMEX is currently facing a significant imbalance between open interest and registered silver inventories, with about 400 million ounces of open interest against only 100 million ounces of registered silver. However, it is unlikely to run out of physical silver imminently, as deliveries often involve transfers of ownership rather than actual movement of metal from the vaults.

This significant discrepancy raises concerns about the ability to meet delivery obligations.

The upcoming March contracts are particularly critical. If a substantial percentage of contract holders demand physical delivery, the COMEX may struggle to fulfill these requests due to limited inventory.

29. Demands for cash by the big banks = 2008 type crash warning wherein the Fed is pumping tens of billions into the too big to fail banks. $80 billion + per bank roughly. JPM sold 500,000 tons of silver it does not own. The price tripled, creating a short squeeze and need for cash from which the Federal reserve, the corporate socialist printed money and moved the liability to the taxpayers. The stock market may fall by 30-50%, which decreases output which means that the debt continues to compound as does the liability on the back of the taxpayers which today cannot pay off the interest on the debt, never mind the debt, thus the setup for a massive liquidity crises which is why the Fed is pumping money now. However it won’t work because the calculations are void of the fact that the Median Household Income does not exist to pay for their financial crimes.

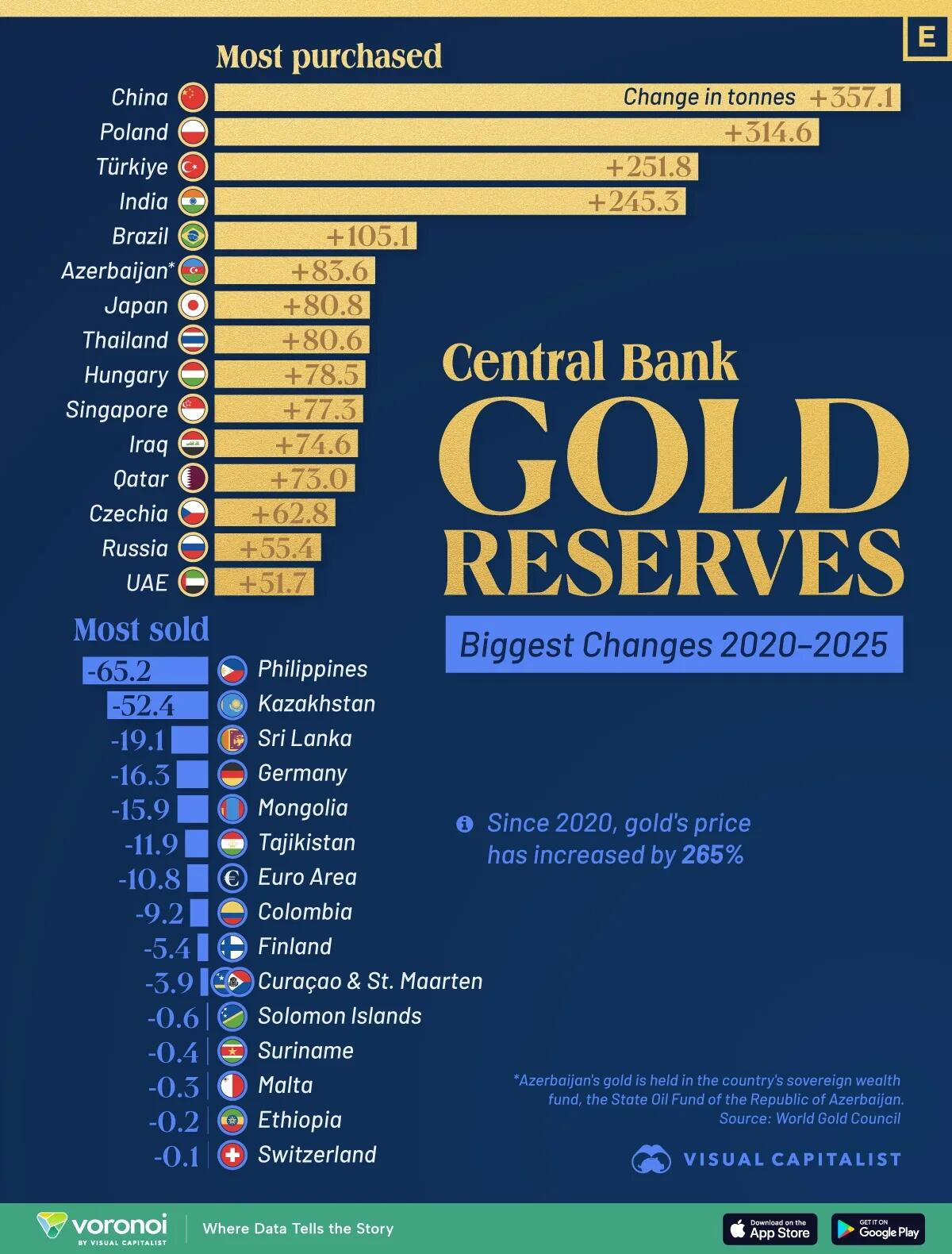

30. Countries are acquiring gold. See graphic prepared by Visual Capitalists.

31. The prospect of European (the UK, for example) civil war increases daily.

32. U.S. treasuries are not favored by foreign countries for a variety of reasons such as the seizure of Russian Assets. If the U.S. can seize assets and the U.S. can seize oil (Venezuela) then what else can it seize and for what reason? There is no doubt that the foreign policy of the U.S. was non-existent and that allowed the growth of China to perhaps jump the U.S. and that could be part of the plan to balance the nations. However, it does not change the lack of trust issue on both sides of nation builders.

33. U.S. is not building mines in the U.S. or Mexico, so one should question what is this Greenland play about? Is it a natural resource play? Canada would be an easier play for natural resources. Is it a way to prohibit shipping? The problem is that the bureaucratic reasons for the action are very seldom the true reasons, i.e. “This is for the kids” excuse for the $5.1 Trillion in school district bond fraud.

34. Copper is in a bull market.

35. Silver as a Geopolitical hedge.

36. Is there an Energy bull market in U.S.? TBD. Is there an Energy bull market in Asia? Yes. What can people truly afford to pay for? Compound Cumulative Interest on Fraudulent Debt cannot be paid for by property owners and income tax payers.

Due Consideration

Do you believe that your IRA, 401K, RRSP, are safe from government seizure or government peeling away the intended purpose? Do you believe that your retirement vehicle is hedged against inflation? Does inflation eat away at your retirement nest egg?