A Bankrupt Population is a National Security Risk

By Mitchell Vexler, December 3, 2025

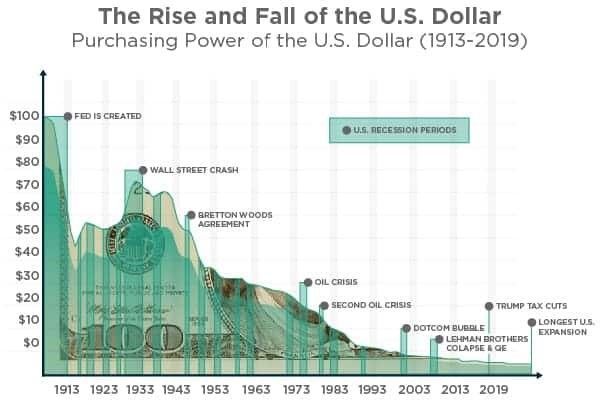

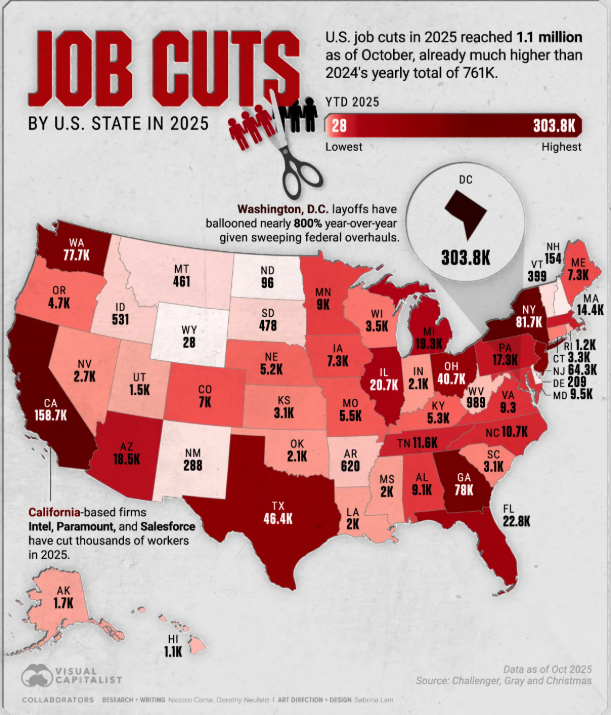

This is the history of the purchasing power of our dollar, in 5-year increments, since 1913:

- 1913 1017.80

- 1918 715.90

- 1923 595.00

- 1928 578.80

- 1933 775.40

- 1938 702.40

- 1943 591.40

- 1948 421.40

- 1953 375.00

- 1958 349.30

- 1963 328.60

- 1968 293.30

- 1973 234.30

- 1978 159.80

- 1983 102.10

- 1988 86.40

- 1993 70.10

- 1998 61.90

- 2003 55.00

- 2008 47.40

- 2013 43.40

- 2018 40.30

- 2023 33.40

Here's how it looks on a graph:

From 1017.80 in 1913 down to 33.40 in 2023

And now, as of September 1, 2025, down further to 30.80.

30.80 is just 3% of 1017.80, meaning the U.S. dollar has lost 97% of its international/global purchasing power since 1913.

What causes the loss of purchasing power?

The loss of purchasing power is primarily caused by inflation.

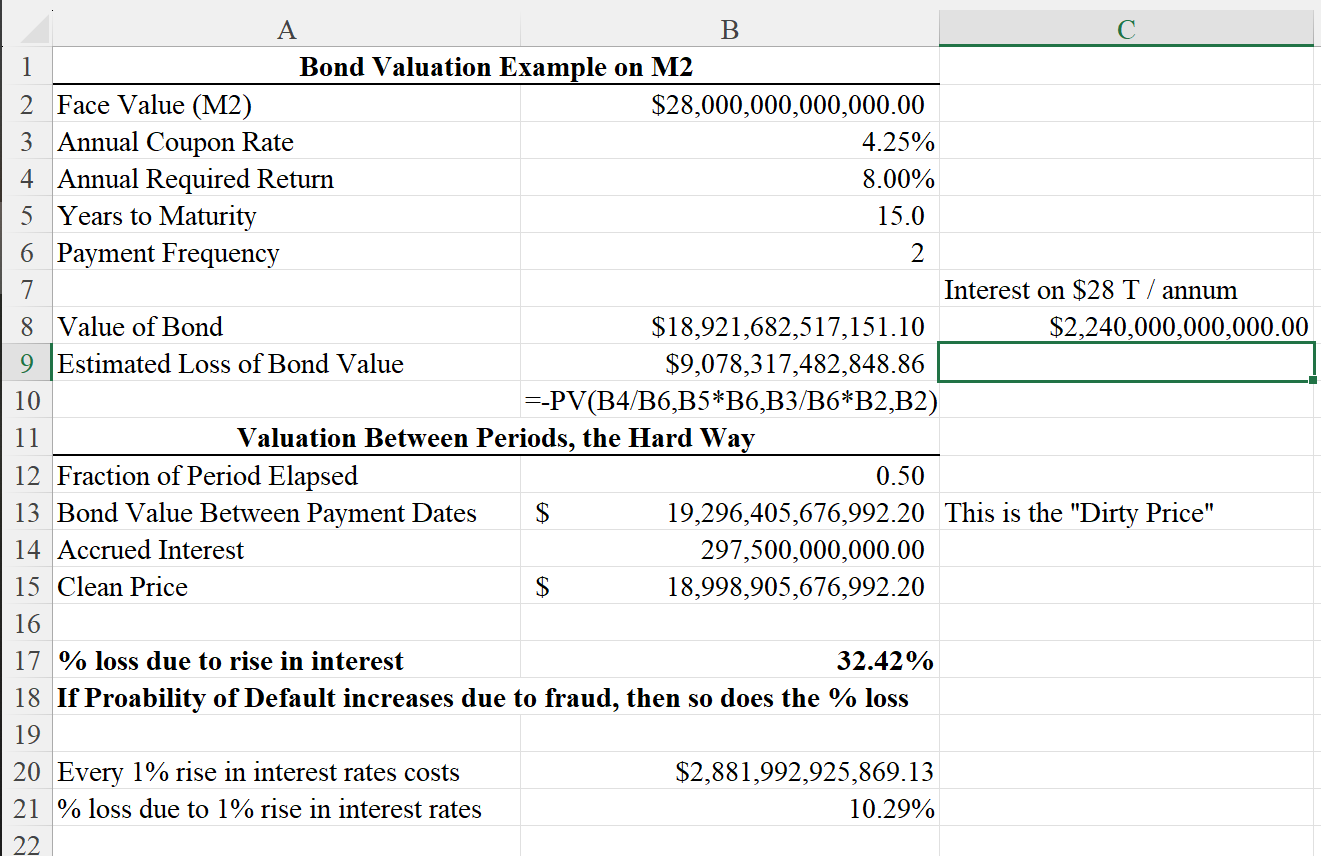

What is inflation? Inflation is created when the Federal Reserve requires that the U.S. Treasury print money which is not backed by an asset and that money is used to A.) increase the money supply and or B.) to cover off deficits on U.S. National Debt, which are created when compound interest on the debt increase is greater than the revenue received by the government in the form of taxation.

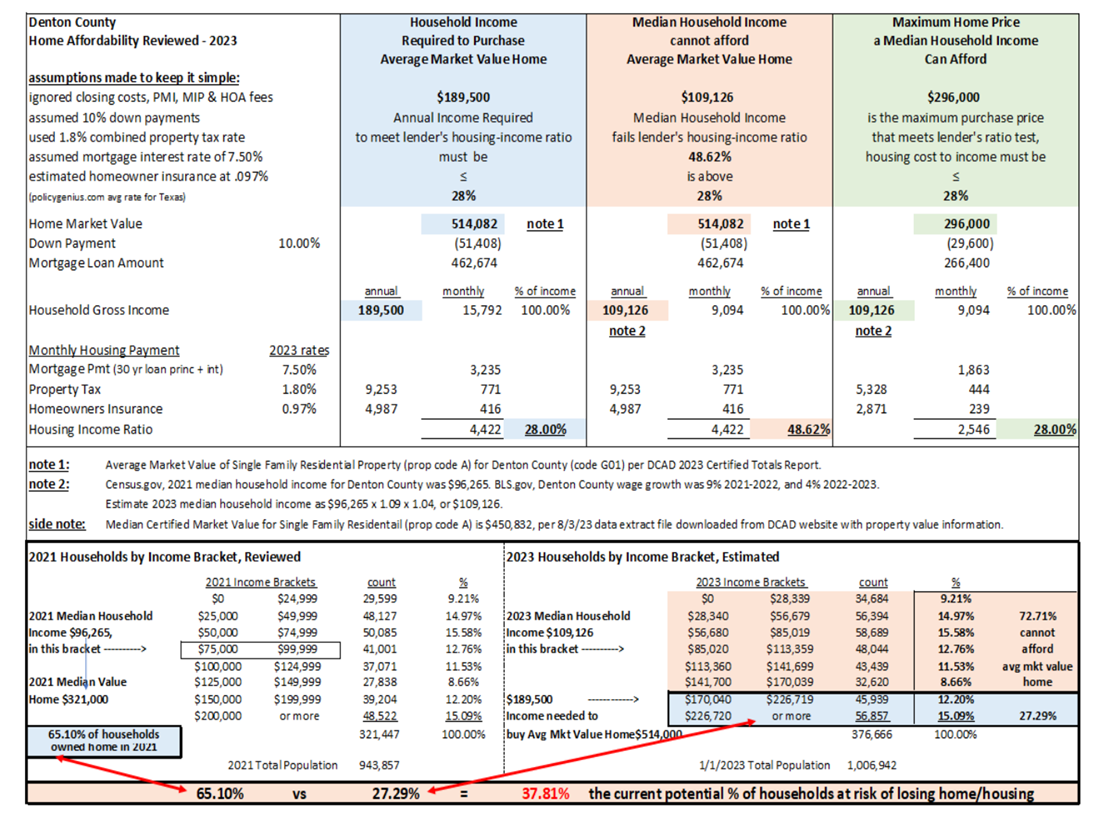

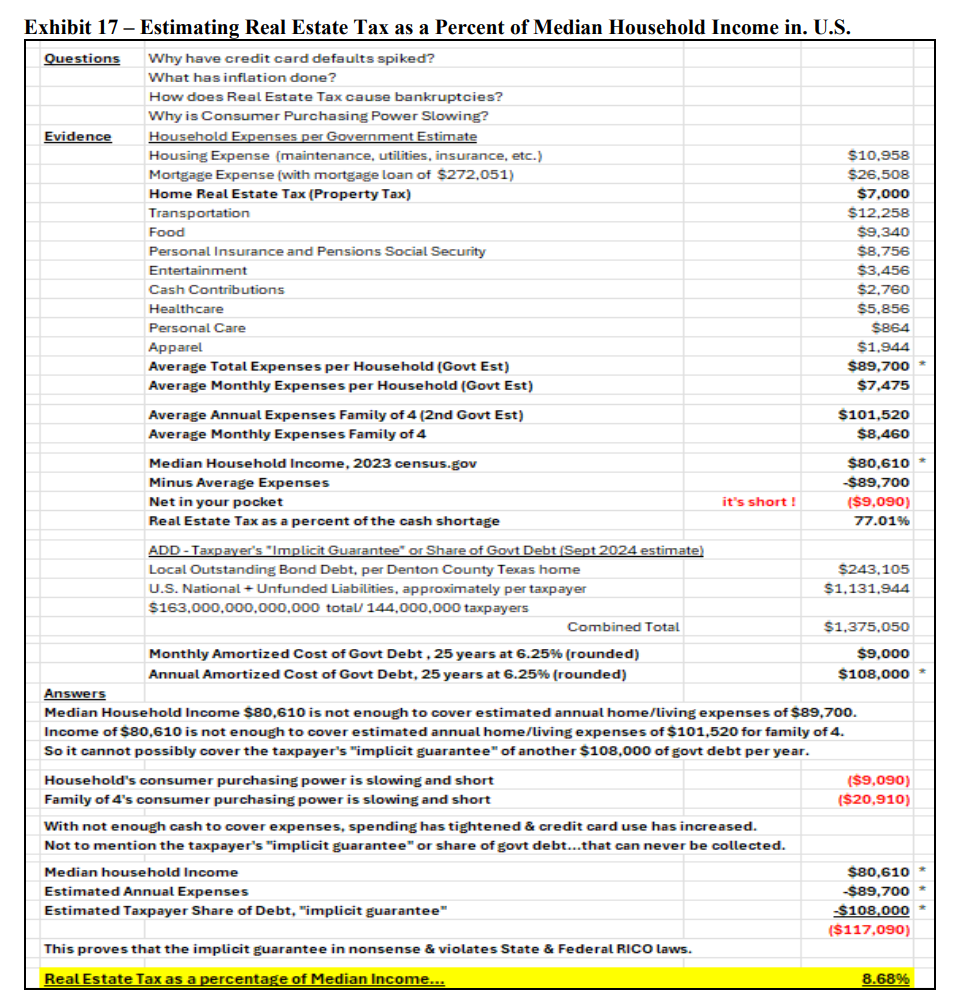

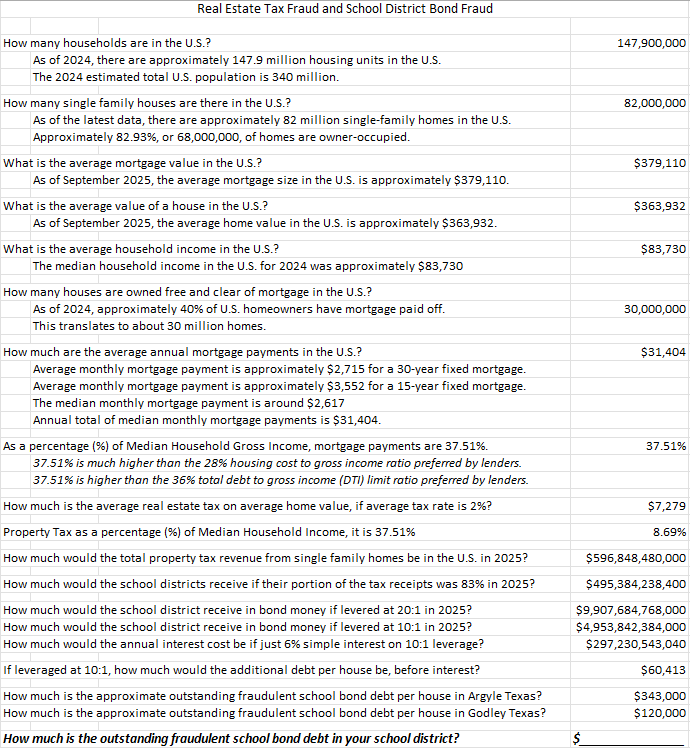

Further Inflation occurs at the local level in the form of fraudulent property overvaluation and subsequent over taxation.

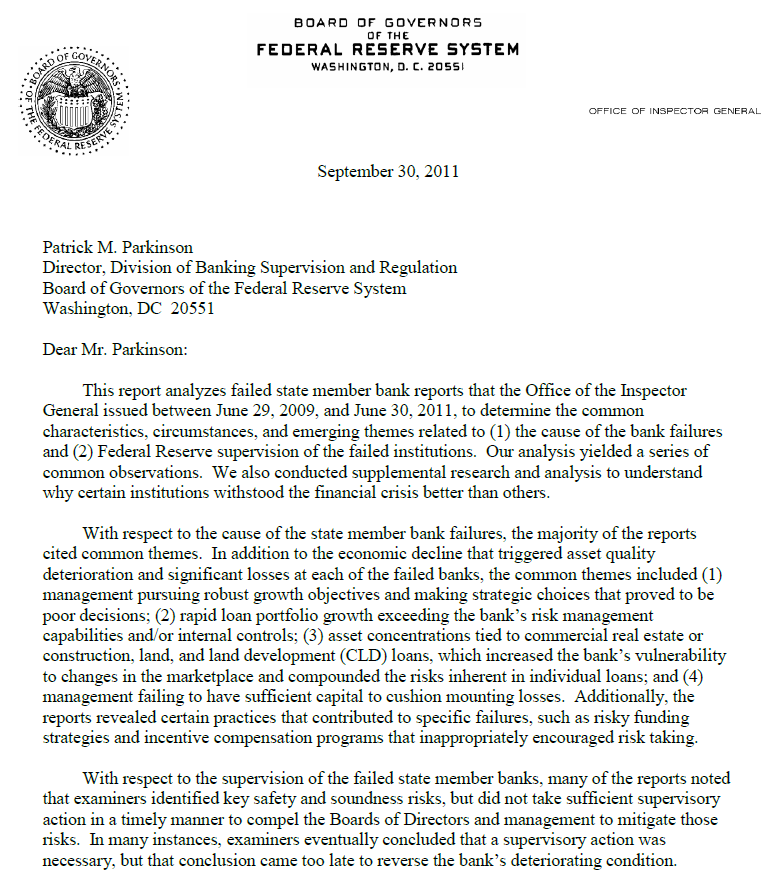

Inflation, which in both cases as outlined above, is fraud and causes a rise in prices of goods and services over time. When prices increase faster than income, consumers buy less with the same amount of money, leading to a decrease in purchasing power.

Businesses and Individuals try to buy the equivalent with less money, but both suffer from the reality of inflation overcoming the ability to produce more top line revenue. Businesses start decreasing labor, or cost of goods by importing lesser product which in the long run causes the business to fail as the quality of goods and service is simply not worth the lesser price and there are alternatives to cheaper competition.

Clueless politicians try to shift the blame over to Demand-Pull Inflation which occurs when demand for goods exceeds supply, causing prices to rise. Clearly in an economic downturn, this is utter nonsense.

Cost-Push Inflation occurs when there is rising cost of production, such as labor and raw materials which drive prices up.

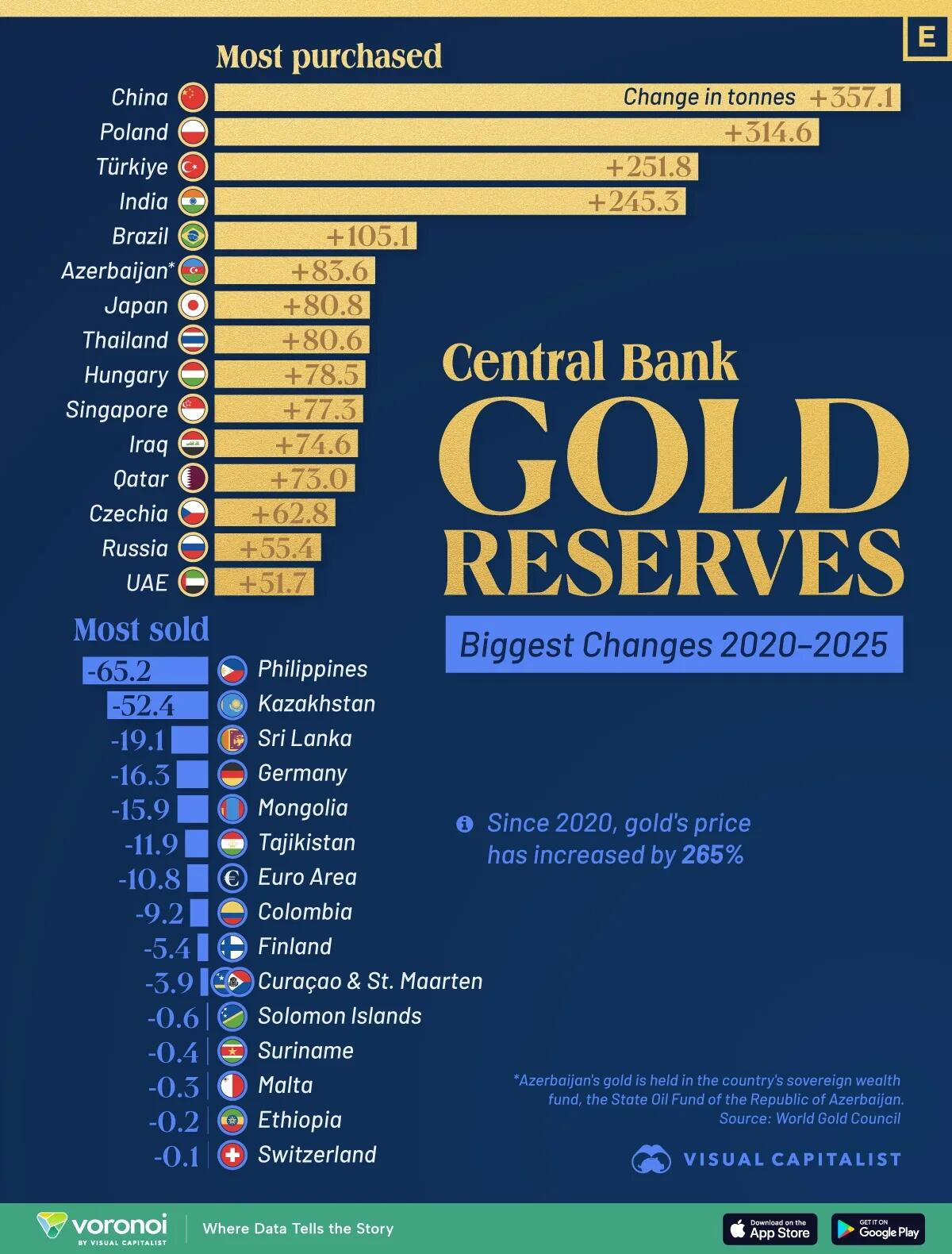

In addition, there are external influences, including exchange rates, which can create a weaker currency which makes imports more expensive, contributing to higher prices domestically.

Global economic conditions such as geopolitical conflicts or supply chain disruptions (COVID) can lead to increased costs and inflation.

Shutting down the economy as what occurred in COVID led to increased costs, disruptions of the global supply chain, economic destruction, psychological issues, and thus increased costs and inflation.

When wage growth stagnates where the wages do not keep pace with inflation, consumers can afford less which reduces their purchasing power.

Fixed Incomes: Individuals on fixed incomes, such as retirees, may find their purchasing power eroded as prices rise without corresponding income increases.

Understanding these factors can help individuals understand what is happening in their lives and provide the reason for those individuals to get involved (advocacy) and to demand that their policymakers address the challenges posed by declining purchasing power including the fraudulent overvaluation and over taxation of property for the sole benefit of their local school districts (the majority of which are bankrupt) and that school districts co-conspirators being the boards and the local central appraisal district.

The quality of both standard goods and luxury goods has been decreasing due to inflation which results in a shift to cheaper mass-produced items and the outsourcing of manufacturing, which often prioritizes cost over craftsmanship. Look at the quality of homes being produced. The quality of the home goes down as the land price fraudulently goes up because of too much money being printed so the Fed can allegedly inflate its way out of debt. Look at the quality of shoes, clothing, food, and those in government who allowed these conditions to expand into where we are, which is at the precipice of Terminal Failure, being the creation of Institutionalize Systemic Moral Hazard.

Your buying habits are being shaped / manipulated into less quality while the socialists who allowed this to occur get paid to transfer your wealth to their pocket and to their pet projects, which are financed by banks or bonds utilizing compound interest to the point that the original principal cannot be paid off because the income does not exist to do so. The increasing cost of interest, which is the deficit, is temporarily covered by the printing of more money which is the definition of a Ponzi scheme. You get less / go bankrupt, and the socialists who created this nightmare, get more all in violation of the black letter of the law.

Consumers are manipulated into trendy, low-cost items that are designed for short-term use. This has led to a culture of disposability, where products are discarded after a few months and then the consumer is forced to buy the cheap junk again. The hamster is on the wheel and can’t get off because there is not enough money to pay for the ticket to get off the ride.

As I stated many times in writing and on video, price is what you pay, and value is what you receive.

This applies not only to the health risks of low-quality food and medicine, but also to the type of people allowed into the political arena.

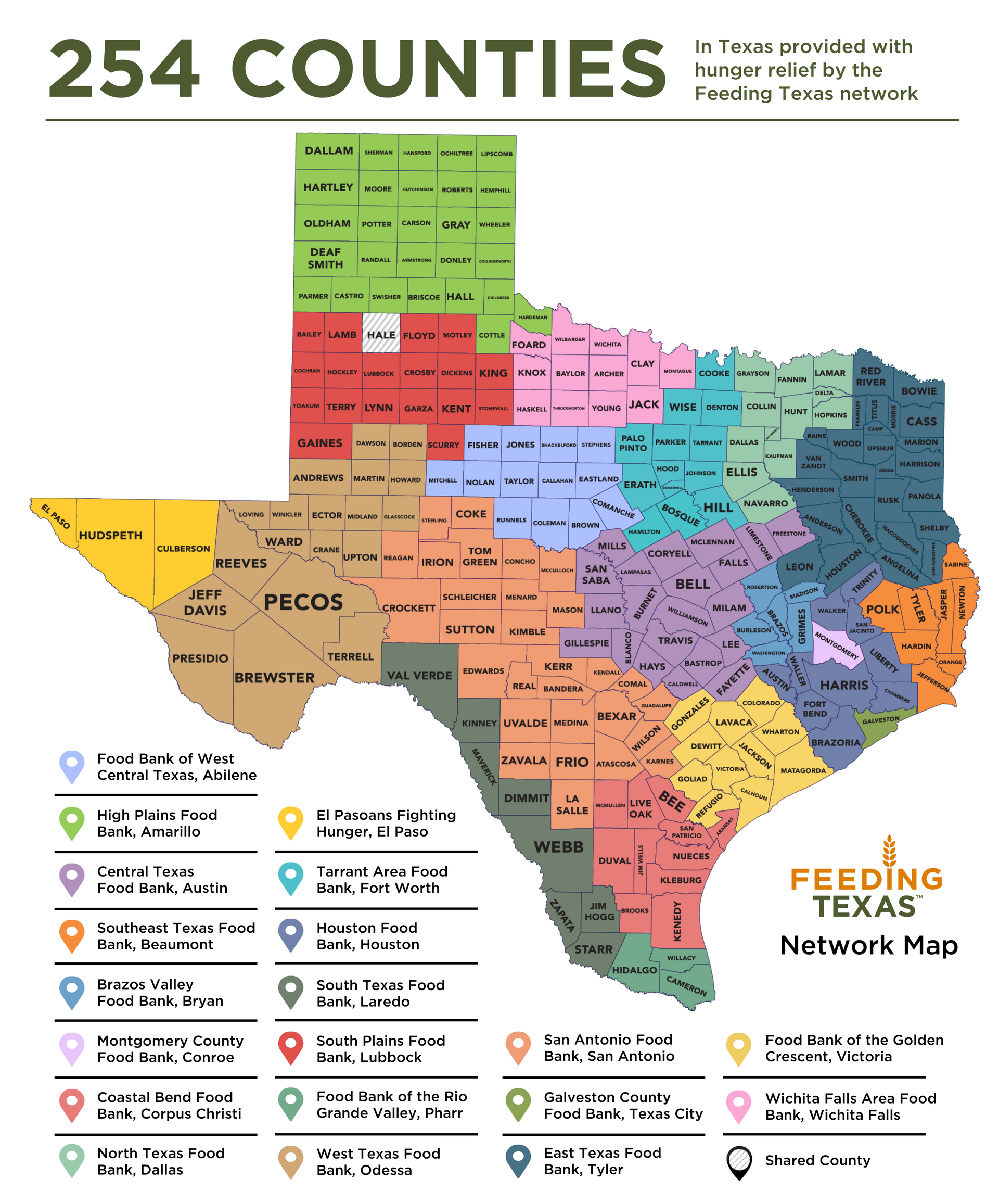

The real national security risk is the 37.8% (42,000,000) households that are in harms way of bankruptcy or losing the roof over their head.

The real national security risk is an all hands-on deck requirement to make those in office change the trajectory by repealing all property tax in favor of the Uniform States Sales Tax which restores the American Dream of true homeownership.

Data Source:

Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/CUUR0000SA0R.