Equity Stripping

Your Money, Your Future

By Mitchell Vexler, November 27, 2025

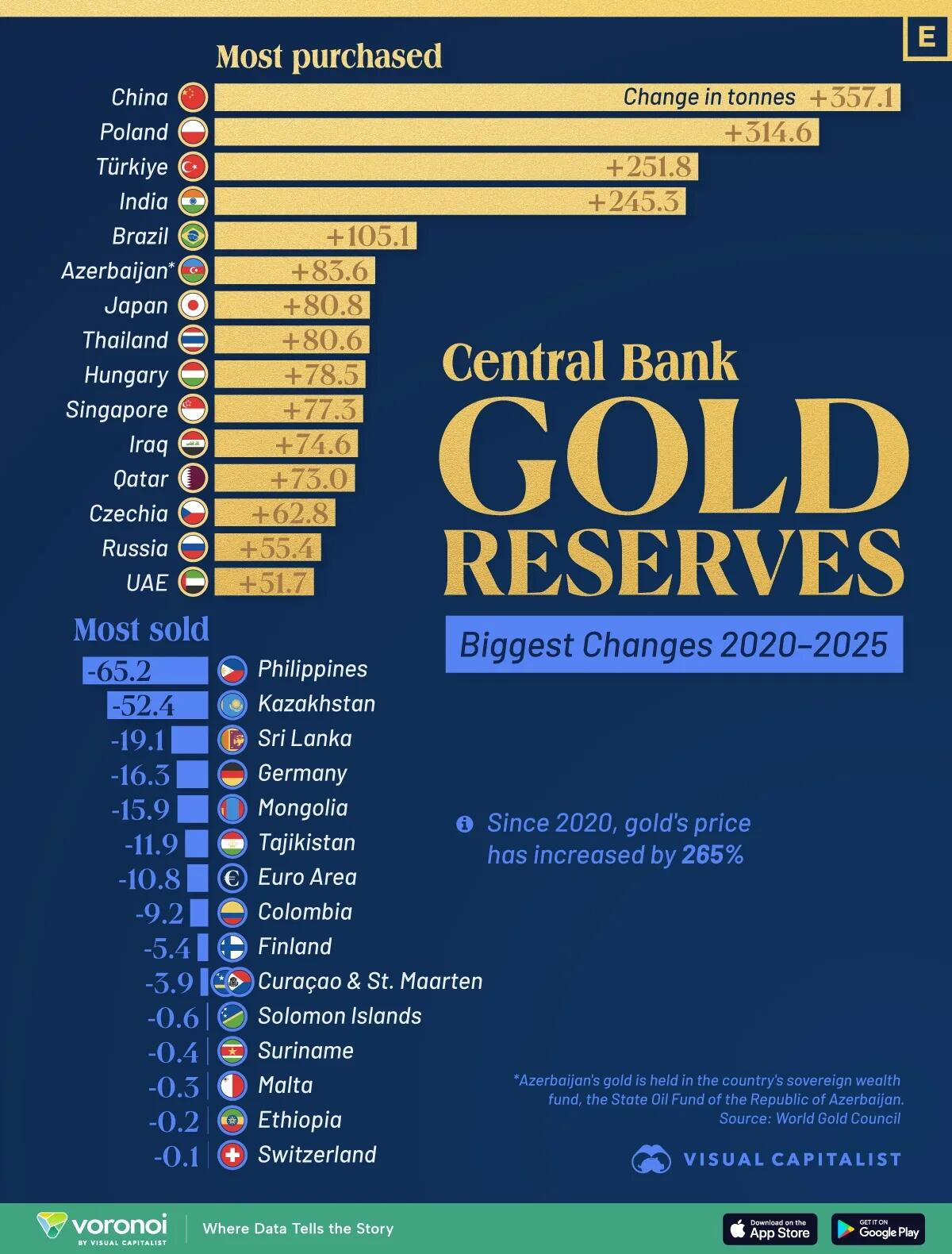

As can be seen in the Home Affordability Graphic...

- 72.71% of Denton County (DC) households cannot afford average market value home.

- With average market value at $514,082, only 27.29% can.

- In 2021, 65.10% of households owned home.

- In 2023, 37.81% of households are at risk of losing their home (65.10% - 27.29%).

- Households need annual gross income of $189,500 to afford a $514,082 home.

- With 2023 median household income of $109,126 they fail lender’s ratio (48% > 28%).

- 2023 median income households can only afford home valued at $296,000.

- 72.71% of DC households would fail loan approval on $514,082 avg mkt value home.

- Certified average home values of $514,082 are overvalued by 42% based on affordability.

($514,082-$296,000 = $218,082; $218,082/$514,082 = 42%) - Average home values in this dollar $514,082 range are obviously being valued, as if, NEW.

- Median home value per data extract file downloaded from DCAD was $450,832.

- DCAD is using new homes (bad comps) to value existing homes.

- New construction homes should not be used as comparisons against older homes.

When you compare the 2023 analysis above with a similar analysis done for 2021, the following was seen:

- In 2021, Median Household Income could afford a home valued at $358,300.

- This $358,300 is higher than Median Home of $331,000 & Average Home of $339,784 for 2021.

- In 2023, Median Household Income CANNOT afford $358,300 like 2021, but only $296,000.

- 13.36% estimate increase in Median Household Income from 2021 to 2023

- 40.45% increase in Median Home Market Values from 2021 to 2023.

- 51.30% increase in Average Home Market Values from 2021 to 2023.

- Median Home Values have increased 3 times faster than Household Incomes.

- 450,832 vs 321,000 = 40.45% value increase.

- 109,126 vs 96,265 = 13.36% income increase.

- 40.45 / 13.36 = 3.03 times faster.

… your equity is being stripped from you while you sleep and while the CADs, School Districts, State Comptroller, Attorney General, Governor, Executive Branch, Legislators all collude in promoting propaganda with your taxpayer funds, to make you to believe “it is for the children” and that there is nothing you can do about it, while they commit crimes against you.

Our Goal and mission - To guide property owners and real estate taxpayers (aka Mom and Pop being owners and renters) through development of knowledge, skills, values, and motivation, so they can meaningfully engage in their School Districts and Central Appraisal Districts to restore fairness in taxation until such time as all property tax is repealed in favor of the Uniform States Sales Tax. Instill respect for life, liberty, family, and fiscal responsibility.

The information we present is applicable not just in Texas but throughout the U.S. in any county where the school districts raise bonds based on the tax receipts generated by the Central Appraisal Districts. We have the evidence of the pattern and practice as seen at www.mockingbirdproperties.com/dcad.

In addition, two other sites have been established to help: www.commonsenselaw.org & www.realestatemindset.org.

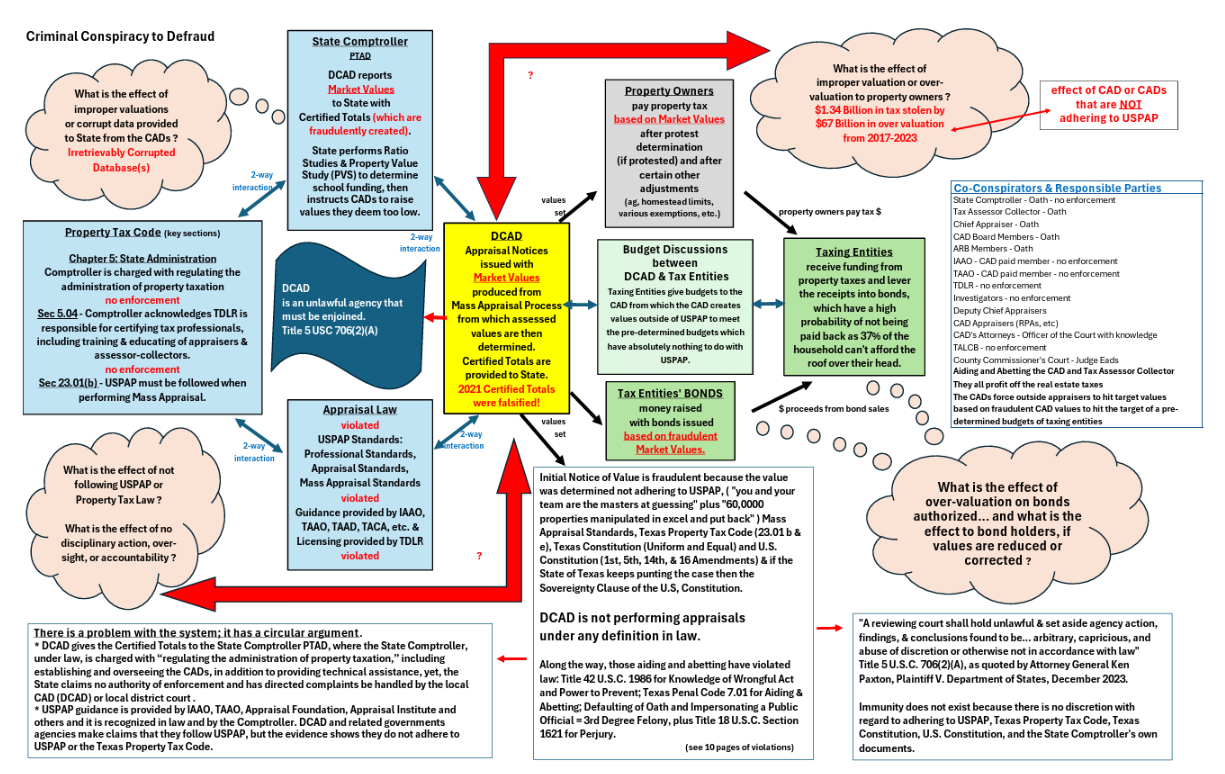

Below is the map of the criminal conspiracy which is currently being protected by the belief that the process stops at the ARB (Appraisal Review Board) which in law it cannot, as the ARB does not have the authority under law to detect fraud, or the knowledge to detect fraud or any knowledge about Uniform Standards of Professional Appraisal Practice. Ultra Vires and Sovereign Immunity cannot in law protect against fraud, otherwise for what purpose do they exist?

THE PROBLEM

Everything has become so expensive:

- Your Home, whether owned or rented

- Your Home Mortgage

- Your Commercial Property Mortgage

- Property Tax – approximately 9% of your Median Household Gross Income

- Fraud at every level of the School District bonds – Superintendents, Boards, bond ratings, and underwriters

- Credit Card Debt, 24 – 30% interest

- Student Loans

- Auto Loans

- Health Care – Fraud in the system – 70% of bankruptcies are health care related

- Private Loans – high interest

- Buy Now Pay Later – 30% interest

- Food

= Increase in Hunger +

= Increase in Crime

Inflation is a hidden tax and is fraud as printing money not backed by assets creates inflation. Inflated property values by overvaluation and over taxation to meet pre-determined budgets of the school districts is fraud that adds to the inflation and equity strips what would be your amortization of principle reduction and flips it into their revenue to further commit crimes by then placing the liability of the school districts debt onto your back. Example: Godley Texas $120,000 in fraudulent outstanding school district bond debt where the median home value is $160,000. This is happening across the U.S.

Laws designed to hide fraud are a fraud in themselves. A contract that is designed to break the law is not a contract in the eyes of the law.

You are being forced to pay more than you should.

Therefor nothing else matters but the MHI (median household income) and the money does not exist to pay off the bankrupt school districts or the fraudulent school district bonds.

The assets of the School Districts are YOU and the collateral is your HOUSE.

Inflation is created via fraud which is printing money instead of letting the system clear itself.

When Liabilities > Assets = Bankruptcy. No one on this planet can get blood out of a stone. The money does not exist to pay the real estate tax based on fraud by the school districts and the money does not exist to pay for the fraud in other divisions of the government including healthcare costs. The point to the above list of household expenses is that individually or collectively they can’t be paid by over 42,000,000 household across the U.S. and it is those 42,000,000 households that are true U.S. economy.

Taxes must be fair and must be calculated fairly. What you don’t know can and will hurt you. It is not what you think you know, it is what you don’t know which is the inflated appraisals. Fraudulent overvaluations can put you in tens of thousands of dollars of debt that you can’t reverse and payoff.

Property taxes cannot currently be fair because the cost of the taxes related to housing are beyond the Median Household Income. Your income, not the Median Household Income is worth $X and should only be taxed to the degree it is legal, and for appraisals to be fair they must be based on uniform and equal.

According to the 16th Amendment of the U.S. Constitution, there should be no taxes on property, just on income. No government within the borders of the U.S. can tax unrealized gains. Market Value and or Assessed Value are both based on unrealized gains.

People want to understand what is easier for them to understand and there is no doubt that delving into the analysis requires time to realize the interconnectivity of the entities involved and the complexity of the documents all designed to steal your money.

The investigative bodies themselves are comprised of humans and as such they want to believe in what is easier for them to understand. This is where and how financial crimes are allowed to fester, costing millions per day in un-justified interest payments. It is this willing suspension of disbelief of both the Citizens and the investigative bodies themselves that provide cover for the criminals until one day the system self-destructs.

Bernie Madoff was a successful con man because he gave the appearance that his return was so successful that the investors did not need to know how. The investors accepted it at face value. Madoff was an American financial criminal and financier who was the admitted mastermind of the largest known Ponzi scheme in history, worth an estimated $65 billion. He was at one time chairman of the Nasdaq stock exchange. Harry Markopolos is credited with discovering Bernie Madoff's Ponzi scheme. He alerted the U.S. Securities and Exchange Commission multiple times about his suspicions from 1999 to 2008, but his warnings were largely ignored until Madoff's arrest in December 2008. Why did this take so long? Willing suspension of disbelief! The SEC themselves refused to believe that a former Chairman of the Nasdaq would be involved in a Ponzi Scheme. It is the willing suspension of disbelief of both the Investors and the investigative bodies that provided cover for Madoff until one day the drum beat of fraud became crystal clear and he was arrested. Now consider the financial damage done during the timeframe that Madoff was allowed to continue to operate for 9 years before his arrest.

Irving H. Picard was the American lawyer known for his recovery of funds from the Madoff investment scandal from investors, Bernie Madoff and his family, and their spouses and estates. Mr. Picard’s firm was handsomely paid but that is not what is important. What is important is the power of the claw-back.

The term claw-back or claw back refers to any money or benefits that have been given out but are required to be returned due to special circumstances or events, such as the money having been received as the result of a financial crime, or where there is a claw-back provision in the executive compensation contract. In law, claw-back is most known as restitution. Keep the thought of restitution in mind. Where do you go to get what was your equity which was stripped from your amortization schedule back? Where do you go to get the fraudulent property overvaluation and subsequent over taxation back? Who is financially responsible? Who should be jailed? Another interesting term to keep in mind is disgorgement. Disgorgement is not an independent cause of action; rather, it is a remedy that requires a party to give up profits gained from illegal or wrongful acts. It aims to prevent unjust enrichment and is typically sought in cases involving breaches of fiduciary duty or other wrongful conduct.

The mission is fairness, not being the victims of bureaucracies.

All property owners and taxpayers bear the responsibility to ensure that the School Districts and Central Appraisal Districts are adhering to the law.

The law is to be applied with accuracy and fairness.

The mission is fairness, not being the victims of bureaucracies.

For reasons of posterity, we are documenting the history of the evidence to ideally ensure that such malice, arbitrary and capricious, financial crimes against humanity, with the backstop of the court system being sovereign immunity, never happens again. In order to move forward, one must understand history so as not to repeat it.

The issues raised herein, are not just applicable to Denton Central Appraisal District, but are applicable across Texas and the United States.

There is a beginning, a middle, and an end. To this point the beginning is the history which is outlined above and via the documentation below. The middle is the process and means to achieve the end. Your involvement is to help through the process to make history and repeal all property taxes in favor of the Uniform States Sales Tax.

Let’s examine what is necessary to turn the tide toward the end. The following Petition is the summary of a massive amount of time, money and effort to distill the case down to its constitutional foundation.

The key phrase in the below Petition for Review is “If left undisturbed, the decision below would permit executive branch agencies to implement systematic constitutional violations immune from judicial review, so long as the Legislature has created an administrative process—however inadequate—to address individual disputes. This places executive action beyond constitutional scrutiny and requires this Court's correction.

In other words, if not addressed, the courts have created no law for the protection of the property owners.

Here are excerpts from the Petition for Review:

II. ISSUE PRESENTED

Whether Tax Code administrative exclusivity violates the Open Courts Guarantee (Tex. Const. art. I, § 13) when applied to bar district court jurisdiction over constitutional claims that the Appraisal Review Board lacks statutory authority to remedy.

III. STATEMENT OF JURISDICTION

The Court has jurisdiction under Tex. Gov't Code § 22.001(a). This case presents a constitutional question of first impression affecting millions of Texas property owners: Whether administrative exclusivity can constitutionally foreclose all judicial review of systematic constitutional violations when the administrative body lacks remedial authority to address such violations.

The decision below conflicts with this Court's precedent:

- LeCroy v. Hanlon, 713 S.W.2d 335, 341 (Tex. 1986), holds that the Open Courts Clause requires a remedy for every recognized legal injury. The Court of Appeals' holding eliminates any remedy—administrative or judicial—for systematic constitutional violations.

- City of El Paso v. Heinrich, 284 S.W.3d 366, 372 (Tex. 2009), holds that "suits to require state officials to comply with statutory or constitutional provisions are not prohibited by sovereign immunity." The decision below forecloses such suits through application of administrative exclusivity.

- Hensley v. State Comm'n on Judicial Conduct, 692 S.W.3d 184, 194 (Tex. 2024), holds that administrative exhaustion is not required when the administrative body cannot grant the requested relief, as exhaustion would be "a pointless waste of time and resources."

This issue affects all 254 appraisal districts statewide and the constitutional rights of Texas's 30 million property taxpayers. Resolution by this Court is necessary to clarify the relationship between administrative exclusivity provisions and constitutional guarantees of judicial review.

IV. STANDARD OF REVIEW

This Court reviews constitutional questions de novo. Patel v. Tex. Dep't of Licensing & Regulation, 469 S.W.3d 69, 75 (Tex. 2015).

Whether administrative exclusivity violates the Open Courts Guarantee is a pure question of law subject to de novo review. LeCroy v. Hanlon, 713 S.W.2d 335, 341 (Tex. 1986).

Whether a plea to the jurisdiction should be granted is likewise reviewed de novo. Tex. Dep't of Parks & Wildlife v. Miranda, 133 S.W.3d 217, 226 (Tex. 2004).

Because this case was dismissed at the pleading stage, all well-pleaded facts are taken as true. Tex. Ass'n of Bus. v. Tex. Air Control Bd., 852 S.W.2d 440, 446 (Tex. 1993).

V. STATEMENT OF FACTS

Petitioners allege that the Denton Central Appraisal District (DCAD) implemented a systematic mass appraisal methodology that violates Article VIII, Section 1(a)'s equal and uniform taxation mandate across all 455,000 properties in Denton County.

Petitioners do not challenge individual property valuations. Rather, they challenge the constitutional validity of DCAD's countywide methodology and seek declaratory and injunctive relief requiring DCAD to comply with constitutional requirements in all future appraisals.

The Appraisal Review Board's Authority Is Limited

The Appraisal Review Board's statutory authority is strictly limited to adjusting individual property valuations for single tax years. Tex. Tax Code § 41.02.

The ARB has no statutory authority to:

- Declare a mass appraisal methodology unconstitutional;

- Enjoin future use of unconstitutional methodologies;

- Order systematic changes to appraisal practices; or

- Provide relief affecting properties countywide.

See Tex. Tax Code §§ 41.01-41.47 (defining scope of ARB authority).

Procedural History

The trial court dismissed Petitioners' claims on sovereign immunity grounds, holding that the Tax Code's administrative remedies are exclusive.

The Court of Appeals affirmed, holding that Tax Code administrative remedies are exclusive regardless of the constitutional nature of the claims or the ARB's inability to grant the requested relief.

The Court of Appeals acknowledged that its holding forecloses Petitioners' access to any forum—administrative or judicial—capable of granting the prospective, systematic relief they seek.

VI. SUMMARY OF THE ARGUMENT

This Court should grant review to resolve a fundamental conflict between administrative exclusivity and constitutional guarantees of judicial review.

The Court of Appeals created an unconstitutional remedial gap. It acknowledged that Petitioners allege systematic constitutional violations affecting 455,000 properties yet held that the only available forum is an administrative body (the ARB) that lacks statutory authority to remedy systematic violations or grant prospective injunctive relief.

This holding violates the Open Courts Clause (Tex. Const. art. I, § 13), which guarantees that "every person for an injury done him...shall have remedy by due course of law." When an administrative body is statutorily prohibited from granting the relief necessary to remedy a constitutional injury, that body cannot provide an adequate—much less exclusive—remedy.

The decision also conflicts with this Court's precedent:

- Heinrich establishes that constitutional compliance claims are not barred by immunity. Administrative exclusivity cannot accomplish indirectly (foreclosing constitutional claims) what immunity cannot accomplish directly.

- Hensley holds that exhaustion is not required when the administrative body lacks authority to grant requested relief. The ARB cannot grant systematic, prospective relief.

- LeCroy requires a remedy for every legal injury. The decision below provides no remedy for systematic constitutional violations.

VII. ARGUMENT

A. The Decision Below Violates the Open Courts Guarantee (Tex. Const. Art. I, § 13)

The Open Courts Clause provides: "All courts shall be open, and every person for an injury done him, in his lands, goods, person or reputation, shall have remedy by due course of law." Tex. Const. art. I, § 13.

This constitutional guarantee prohibits the Legislature from abolishing a remedy for a recognized legal wrong unless a reasonable substitute is provided or the abolition serves a legitimate state interest. LeCroy v. Hanlon, 713 S.W.2d 335, 341 (Tex. 1986).

The ARB Cannot Provide the Remedy Required for Systematic Constitutional Violations

Petitioners allege a systematic, countywide constitutional violation: that DCAD's mass appraisal methodology violates Article VIII, Section 1(a)'s mandate for equal and uniform taxation.

The relief necessary to remedy this systematic violation is: (1) A declaration that DCAD's methodology is unconstitutional; and (2) A prospective injunction requiring DCAD to implement constitutionally compliant appraisal methods in future years.

The ARB cannot provide this relief. The ARB's statutory authority is strictly limited to "direct[ing] the chief appraiser to correct or change the appraisal records or the appraisal roll" for individual properties. Tex. Tax Code § 41.02(a). The ARB has no authority to declare governmental conduct unconstitutional or issue injunctions against government officials.

A Remedy That Cannot Reach the Scope of the Injury Is No Remedy at All

The Open Courts Clause requires a remedy adequate to address the injury alleged. When a constitutional injury is systematic and prospective, and the administrative body lacks authority to grant systematic, prospective relief, the administrative process cannot provide an adequate remedy.

This Court has consistently held that a purported remedy is inadequate if it cannot address the nature of the injury:

- In Mellard v. Hammer, this Court emphasized that the Open Courts Clause requires "a remedy adequate to redress injury." 477 S.W.3d 125, 129 (Tex. 2015).

- In Hensley, this Court held that requiring exhaustion of an administrative remedy that cannot grant requested relief would be "a pointless waste of time and resources." 692 S.W.3d at 194.

Applying administrative exclusivity to bar district court jurisdiction when the administrative body cannot remedy the alleged constitutional injury violates the Open Courts guarantee by eliminating any adequate remedy.

B. The Decision Conflicts With This Court's Holding in Heinrich

In City of El Paso v. Heinrich, this Court unambiguously held that "suits to require state officials to comply with statutory or constitutional provisions are not prohibited by sovereign immunity." 284 S.W.3d 366, 372 (Tex. 2009) (emphasis added).

The decision below conflicts with Heinrich by holding that administrative exclusivity—a statutory creation—can bar constitutional compliance claims seeking to compel governmental adherence to constitutional mandates.

Administrative exclusivity cannot accomplish indirectly what sovereign immunity cannot accomplish directly: the foreclosure of constitutional compliance claims. If a legislature can eliminate judicial review of constitutional claims simply by creating an administrative process—even an inadequate one—Heinrich's guarantee becomes meaningless. This conflict requires this Court's resolution.

C. Administrative Exhaustion Cannot Be Required When the Administrative Body Lacks Authority to Grant Constitutional Relief

This Court has recognized that administrative exhaustion is not required when the administrative body lacks authority to grant the requested relief, when exhaustion would be "a pointless waste of time and resources," or when constitutional rights are at stake. Hensley v. State Comm'n on Judicial Conduct, 692 S.W.3d 184, 194 (Tex. 2024); Patel v. Tex. Dep't of Licensing & Regulation, 469 S.W.3d 69, 87-88 (Tex. 2015).

All these exceptions apply here. Requiring Petitioners to exhaust ARB remedies would be pointless because the ARB cannot declare DCAD's methodology unconstitutional, cannot enjoin future constitutional violations, and can only adjust individual valuations annually. Requiring exhaustion of a remedy that cannot provide constitutional relief violates due process and the Open Courts guarantee.

D. This Case Presents a Constitutional Question Distinct From Routine Tax Valuation Disputes

The Court of Appeals treated this case as a routine tax dispute subject to administrative exclusivity. But Petitioners do not challenge individual property valuations—they challenge the constitutional validity of DCAD's systematic methodology applied countywide.

This distinction is critical:

ROUTINE TAX DISPUTE (ARB Jurisdiction)

- Individual property owner challenges appraisal of his property

- Seeks adjustment of that specific property's value

- Relief sought is retrospective (correction of current year)

- ARB has statutory authority to grant relief (Tex. Tax Code § 41.02)

SYSTEMATIC CONSTITUTIONAL CHALLENGE (District Court Jurisdiction)

- Taxpayers challenge methodology affecting all 455,000 properties

- Seek declaration that methodology violates Art. VIII, § 1(a)

- Seek prospective injunction against future constitutional violations

- ARB lacks statutory authority to grant relief

Failing to recognize this distinction would eliminate judicial review for all systematic constitutional violations in tax administration. The Constitution does not permit executive branch agencies to implement systematic constitutional violations immune from judicial scrutiny.

E. Petitioners Challenge Administrative Exclusivity As Applied, Not Facially

Petitioners do not argue that Tex. Tax Code § 42.09 is facially unconstitutional. Administrative exclusivity is valid and serves important purposes when applied to disputes within the ARB's statutory competence—individual valuation challenges for specific tax years.

Petitioners argue that § 42.09, as applied to bar district court jurisdiction over systematic constitutional violations that the ARB cannot remedy, violates the Open Courts Guarantee.

This as-applied constitutional challenge preserves the Legislature's authority to channel routine tax disputes to administrative review while ensuring judicial protection of constitutional rights that exceed administrative authority.

F. The Decision Creates a Dangerous Precedent With Statewide Implications

If the decision below stands, it establishes that the Legislature can immunize executive branch agencies from judicial review of systematic constitutional violations simply by creating an administrative process—however inadequate—to address individual disputes.

The implications are staggering. Every executive branch agency with an administrative review process would be insulated from judicial review of its systematic practices, regardless of constitutional violations. This Court has never countenanced such a result. The Constitution requires judicial review of systematic governmental violations of constitutional rights, regardless of whether an administrative process exists to address individual grievances.

VIII. PRAYER FOR RELIEF

WHEREFORE, Petitioners respectfully pray that this Court:

- GRANT this Petition for Review;

- REVERSE the judgment of the Court of Appeals and HOLD that: a. Tax Code administrative exclusivity does not bar district court jurisdiction over claims of systematic constitutional violations when the Appraisal Review Board lacks statutory authority to remedy such violations; b. The Open Courts Guarantee (Tex. Const. art. I, § 13) requires judicial review of systematic constitutional violations that administrative bodies cannot remedy; c. Constitutional compliance claims, as recognized in City of El Paso v. Heinrich, 284 S.W.3d 366, 372 (Tex. 2009), are not subject to administrative exclusivity when the administrative body lacks authority to compel constitutional compliance; and d. Petitioners have stated viable constitutional claims not subject to dismissal on jurisdictional grounds;

- REMAND this cause to the trial court for proceedings on the merits consistent with this Court's opinion; and

- Grant such other and further relief, at law or in equity, to which Petitioners may be justly entitled.

(end of excerpt from Petition for Review)

As I have stated, either the law exists or it doesn’t. The ramifications of no law and institutionalized systemic moral hazard are frightening.

See these items to get up to speed quickly:

- Credit Analysis + Systemic Fraud = Moral Hazard, https://irp.cdn-website.com/39439f83/files/uploaded/Credit+Analysis+and+Systemic+Moral+Hazard.pdf

- https://www.youtube.com/watch?v=AZXDuHuW-aw, Dodd Frank failure

- https://www.youtube.com/watch?v=th6UAkba2bw, Video Testimony of School Board Member Kayla

- https://www.youtube.com/watch?v=TdYHbhT6524, interview with Daniela Cambone

- Amicus Brief to the SCOTX https://irp.cdn-website.com/39439f83/files/uploaded/Amicus+Brief-Case+25-0615+Supreme+Court+of+Texas-UN-SIGNED.pdf

- https://realestatemindset.org/p/how-to-do-a-market-analysis, free course by Travis Spencer on how to do a market analysis

- Violations of USPAP = Pattern and Practice across Texas and the U.S. https://irp.cdn-website.com/39439f83/files/uploaded/Partial_List_of_Violations_Reviewed-052224.pdf

With the above, you will end up knowing more than any employee at any CAD or School District across the U.S.

Take a witness and have them video record your meeting and hearing with a CAD or ARB.

Video is very powerful and important to expose the criminal behavior in action.

Activism

Why Activism and why your involvement in your community is crucial?

IF THE UNDERLYING REAL ESTATE IS NOT PROPERLY VALUED THEN NEITHER ARE THE BOND RATINGS.

IF MEDIAN HOUSEHOLD INCOME DOES NOT EXIST TO PAY FOR THE SCHOOL DISTRICT EXPENSES (I&S + M&O) THEN THERE IS NO POSSIBLE WAY TO HAVE CASH FLOW FOR THE SCHOOL DISTRICTS TO PAY FOR THEIR FRAUDULENT INCREASING BONDS + THE OUTSTANDING COMPOUND CUMULATIVE INTEREST ON THOSE BONDS. THUS, THE RATING AGENCIES ARE WRONG AND THE PROBABILTY OF DEFAULT INCREASES BY THE DAY VIA THE COMPOUND CUMULATIVE EFFECT ON THE DEBT.

What does Subprime housing loans, Subprime Auto Loans, Wachovia, Enron, Arthur Anderson, Worldcom, Bear Sterns, AIG, Washington Mutual, Madoff, Theranos, Silicon Valley Bank, Signature Bank, First Republic Bank, Tricolor Auto, First Brands, and Lehman all have in common?

In order to meet the bond funding systemic fraud is required along with increasing fraudulent valuations and fraudulent taxation regardless of the values of the homes.

BY IGNORING THE LAWS AND PROHIBITING THE ADJUDICATION OF FRAUD UNDER THE COLOR OF LAW BEING ULTRA VIRES AND SOVEREIGN IMMUNITY, THE COLLUSION TO DEFRAUD IS IRREFUTABLE AND THROUGH THAT CONTORTION, THE COLLUDERS MADE YOU RESPONSIBLE FOR THEIR CURRENT AND FUTURE LIABILITIES!

Taxes cannot come out of homeowner’s equity (Equity Stripping).

Find a local FaceBook Group and become active.

Use this Equity Stripping document as the starting point.

Questions to ask your school district board and school superintendent, https://www.mockingbirdproperties.com/questions-to-be-asked-by-all-concerned-citizens-property-taxpayers-at-their-school-district-board-meetings.

Start a local Facebook Chapter focused on fraudulent property tax.

For more Articles on related topics, go to… https://www.mockingbirdproperties.com/dcad#ArticlesLettersDiscussions.