You Can Make a Difference!

A Holiday Wish for All.

By Mitchell Vexler, December 17, 2025

Grocery store empty shelves, food shortages, emergency rail grain supplies, emergency boat grain supplies, food caravans, food banks, all have one thing in common which is failed socialism.

Socialism has never and will never work, as it never was an economic model. It was a con created by a drunk who dreamt up this nonsense to convince people at a bar to buy him more drinks. Without exception it has failed in every country that attempted it as evidenced by economic stagnation, shortages, and authoritarian regimes. Countries like the Soviet Union, Venezuela, Cuba, North Korea, China, and Canada are all examples where socialist policies led to widespread failure and hardship and now under the “globalist” ideology (just another word for socialist) and policies (the cancer of socialism) spread throughout Europe, Germany, Australia, United Kingdom, Canada, and we the United States came dangerously close as a Nation to succumbing to socialism had the past election gone the other way.

For more on the topic of socialism click here... https://www.mockingbirdproperties.com/dcad#ArticlesLettersDiscussions.

Socialism is guilty of fatal conceit as socialists believe the system they desire and those that run the system and their co-conspirators can make better decisions for the people than they can for themselves, and of course, because they the socialists believe the population is so dumb and they are so smart, we will transfer the populations earned wealth, by fraud and coercion, to our pockets.

Those who seek control of an organization or population, who produce no goods or services in exchange, are socialist organizations or people.

There is a major hurdle to the con…socialism only works until you run out of other people’s money, and then to cover up their crimes, society ends up in civil war and a war of nations because of the socialists.

The cancer of socialism and its incestuous cousin authoritarianism, which is a political system characterized by the rejection of political plurality, the use of strong central power to preserve the political status quo, and the reductions in democracy, separation of powers, civil liberties, and rule of law. Hmmm! Interesting, as this is exactly the case now at the Supreme Court of Texas (link to Motion filed) wherein the courts recognize that fraud was committed but so far have chosen not to allow the case to be adjudicated on its merits, relying on a body known as the ARB (Appraisal Review Board) to be the sole determiner of property value, yet that body has no authority in law to circumvent the fraud of the Chief Appraiser, the Central Appraisal District, and the Board of the CAD, all of which choose to hide behind Ultra Vires and Sovereign Immunity, which doctrines of law would not exist but for to prohibit such abuse of power creating the fraud under the color of law. Thus, a true legal dead zone exists for which the Supreme Courts are designed to prohibit, both at a State and Federal level.

So what we have in Texas and throughout the United States are thousands of mini-socialist-fiefdoms known as CADs and their related co-conspirators who choose to take your money in the form of property taxes, roughly 80% of which goes to school districts and portioned off into operations and then to pay for outstanding fraudulent school district bonds and interest thereon which grows compound cumulative as the bonds are just rolled out and interest rolled up with even more debt being added on an annual basis. The fees, ratings agencies, accounting firms, law firms, bond underwriters, ethically challenged licensed appraisers and employees of the CADs, plus kickbacks to construction companies, and politicians who promote this criminal activity, are all elements within the fraud being perpetrated against society from which the end result is a failed school system perpetrating bond fraud and equity stripping your money from your house and then telling you that you are responsible for their fraudulent debts for the next 40 years. Yet, there is a problem. The median household income does not exist to pay for their crimes. Thus, the irrefutable proof of fraud.

Holidays should be a happy time, but never forget the less fortunate who have a difficult time feeding their family because they, like all of us, are victims of socialism.

Are you or anyone prepared to go bankrupt to support your school district which is failing in education, equity stripping your home and your future via the outstanding fraudulent school district bond debt?

If you knew that a child is going hungry and the difference between whether that child goes hungry or not is real estate tax, what would you do to help that child from not going hungry?

Food Banks in Texas:

The Feeding Texas network is made up of 20 food banks and over 4,000 local partners. Together, the network fees more than 4 million Texans annually and is the largest hunger relief network in Texas.

How many people received assistance to buy food? 4,000,000 per year.

Population of Texas is 31,853,800.

How many are hungry and or can’t afford a meal = >12.6%.

Feeding Texas provided over 545,000,000 meals in 2023.

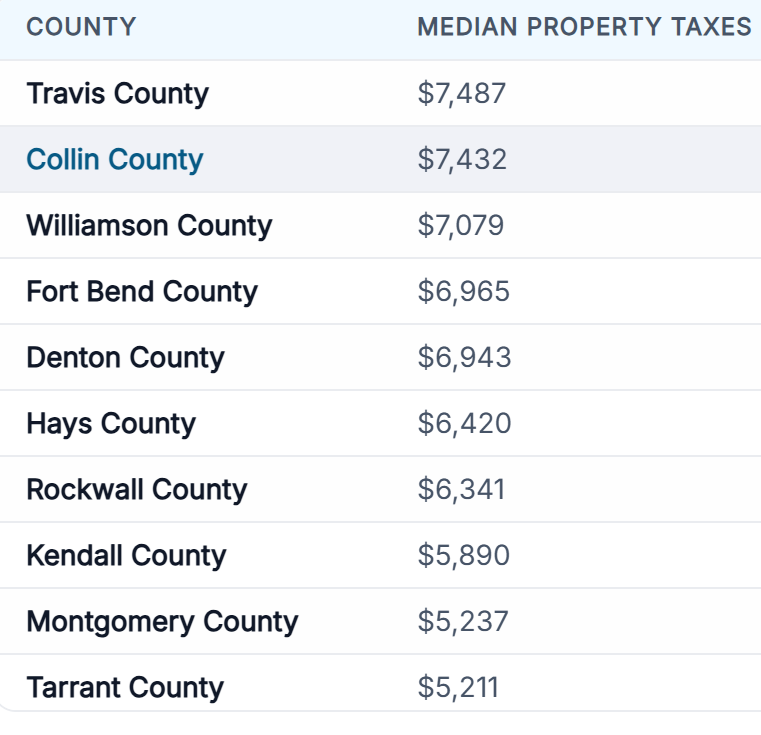

How much are the Median Property Taxes per home?

(sample list)

Feeding Texas provided SNAP application assistance to over 57,000 households in 2023.

Texas has the highest rate of senior food insecurity in the nation with 13.6% of Texas seniors at risk for hunger. Seniors face unique challenges in the fight against hunger, such as health conditions, transportation problems, fixed income and social isolation. Food insecurity for seniors can also have drastic impacts on their health and result in high medical costs for them and our medical system. After a lifetime of hard work, many seniors find themselves facing an impossible choice — to buy groceries or afford medical care.

In Texas, 1 in 4 Latinos are experiencing food insecurity. The overall food insecurity rate for Latinos in Texas is 24%.

According to the Texas State Comptroller office under Glenn Hegar’s term:

In fiscal year 2022—from September 1, 2021, to August 31, 2022—property tax revenues reached $80.8 billion, accounting for 47.5 percent of total state-local tax revenue.

The following fiscal year—September 1, 2022, to August 31, 2023—saw property tax revenues increase to $81.4 billion.

State sales tax generated the next largest state-local tax revenue, totaling $43 billion (25.2 percent of the total) in 2022 and $46.6 billion (26.3 percent) in 2023.

Local sales taxes, meanwhile, generated $12.2 billion in revenue, or 7.19 percent of total state-local tax revenue, in 2022. In the subsequent fiscal year, local sales taxes generated $13.3 billion, or 7.51 percent of all taxes.

Other state taxes, such as the franchise tax, gas tax, and business personal property tax, generated $34.2 billion in 2022, accounting for 20.1 percent of total state-local tax revenue. That number increased slightly to $35.6 billion in 2023, and the percentage remained the same.

Additional findings by the Comptroller show that single-family residential property comprised nearly half of all taxable value—a property’s assessed value subtracted by exemptions—in the 2022-2023 biennium.

The number of property-taxing units rose from 4,421 in 2021 to 4,549 in 2022 and 4,644 in 2023. Property-taxing units are local jurisdictions established by the Texas government to levy taxes.

School districts continue to collect the largest share of Texans’ property taxes. Of the $81.4 billion in property tax revenue collected in 2023, 48.5 percent was due to school district taxation, that being $39 Billion in property taxes against the households. Then, the levered school district bond debt accounts for roughly 81% of the bonds raised from the tax receipts which the criminals believe you will pay for over the next 30-40 years on a per annum taxed basis even though the current payment monthly grows 11X over 30 years. Mom and Pop do not have the money today to pay for their fraud, never mind tomorrow.

Utilizing the State Comptroller number of $39 Billion which is then levered up into School District bonds at roughly 20:1 and for terms up to 40 years under Texas law, you then end with an impossible amount of principle to pay off (today) and thus the circular argument of needing to increase real estate tax in perpetuity which is assured mutual destruction or simply face reality now, stop the hemorrhaging and repeal the real estate tax in favor of the Uniform States Sales Tax and put every school district that cannot pay off its bonds in 3 years into bankruptcy (see the Bill delivered to Helen Kerwin the Texas State Representative).

Summary (according to the Texas State Comptroller’s office):

$39,000,000,000 ($39 Billion) of real estate taxes charged against the houses

multiplied by

12.6% of the population that are hungry

equals

$4,914,000,000 of the tax $

divided by

4,000,000 (4 million) people that are hungry (12.6% of 31,853,800 population)

equals

$1,228.50 per hungry person, to feed them,

except for that the School District Taxes are being used to pay the interest on the fraudulent principle

Eliminate Hunger.

Repeal the real estate tax and generate $1,228.50 for 4,000,000 people to make sure no one in the State of Texas goes hungry.

Mom and Pop have been equity stripped. (See the Amicus Brief.) Mom and Pop are paying 50, 60, 80% of the value of their home mortgage, in excess of their mortgage, in real estate tax to cover off the interest on the outstanding fraudulent principle debt created by the school districts, and then being expected to pay for the compound cumulative interest added to new fraudulent principle plus interest in perpetuity. To pay this off, is impossible, as the Median Household Income does not exist.

As if 4,000,000 people being hungry in Texas is not enough to make blood boil, then how do feel being financially abused by a socialist organization comprised of your school district and central appraisal district?

You can make a difference. All real estate is local. Make others aware of the crimes being perpetrated against them using social media especially Facebook local boards. See Violations.pdf at www.mockingbirdproperties.com/dcad (the website is word searchable). File criminal complaints against those where the evidence is crystal clear. File lawsuits against the individuals and organizations responsible, joint and severally liable. Join forces with others to share the legal expenses. Run for district boards and municipal councils. Protest in mass. Question those responsible directly in social media and press. No one can sit back anymore and not get involved. We know the above works because we have done it as recently seen in Johnson County with a 100% success rate in stopping the bonds by a handful of people, with no out of pocket money, where the opposition spent roughly $130,000 of taxpayer money to promote their crimes.

A Holiday Wish for All:

Repeal all property tax in favor of the Uniform States Sales Tax.

End the socialist nightmare.

Feed those who have been strangled by the socialists.

We look forward to a better future.

Happy Holidays.