Hunger, Assault, Repeal the Real Estate Tax

By Mitchell Vexler, July, 19, 2025

Are you prepared to go bankrupt to support your school district which is failing in education, equity stripping your money and your future via the outstanding fraudulent school district bond debt?

If you knew that a child is going hungry and the difference between whether that child goes hungry or not is real estate tax, what would you do to help that child from not going hungry?

Food Banks in Texas:

The Feeding Texas network is made up of 20 food banks and over 4,000 local partners. Together, the network fees more than 4 million Texans annually and is the largest hunger relief network in Texas.

How many people received assistance to buy food? 4,000,000 per year.

Population of Texas is 31,853,800.

How many are hungry and or can’t afford a meal = >12.6%.

Feeding Texas provided over 545,000,000 meals in 2023.

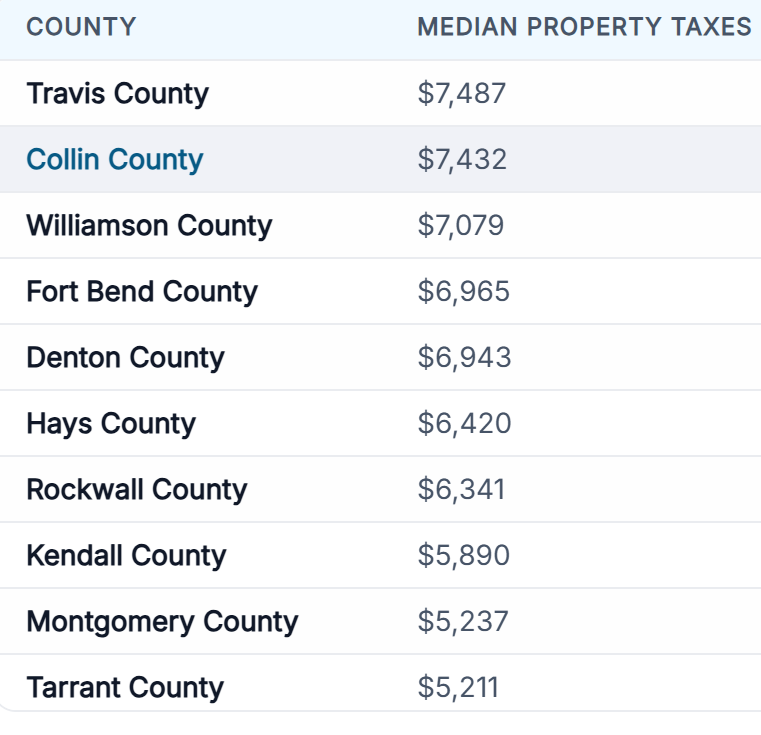

How much are the Median Property Taxes per home?

(sample list)

Feeding Texas provided SNAP application assistance to over 57,000 households in 2023.

Texas has the highest rate of senior food insecurity in the nation with 13.6% of Texas seniors at risk for hunger. Seniors face unique challenges in the fight against hunger, such as health conditions, transportation problems, fixed income and social isolation. Food insecurity for seniors can also have drastic impacts on their health and result in high medical costs for them and our medical system. After a lifetime of hard work, many seniors find themselves facing an impossible choice — to buy groceries or afford medical care.

In Texas, 1 in 4 Latinos are experiencing food insecurity. The overall food insecurity rate for Latinos in Texas is 24%.

According to the Texas State Comptroller Glenn Hegar’s report:

In fiscal year 2022—from September 1, 2021, to August 31, 2022—property tax revenues reached $80.8 billion, accounting for 47.5 percent of total state-local tax revenue.

The following fiscal year—September 1, 2022, to August 31, 2023—saw property tax revenues increase to $81.4 billion.

State sales tax generated the next largest state-local tax revenue, totaling $43 billion (25.2 percent of the total) in 2022 and $46.6 billion (26.3 percent) in 2023.

Local sales taxes, meanwhile, generated $12.2 billion in revenue, or 7.19 percent of total state-local tax revenue, in 2022. In the subsequent fiscal year, local sales taxes generated $13.3 billion, or 7.51 percent of all taxes.

Other state taxes, such as the franchise tax, gas tax, and business personal property tax, generated $34.2 billion in 2022, accounting for 20.1 percent of total state-local tax revenue. That number increased slightly to $35.6 billion in 2023, and the percentage remained the same.

Additional findings by the Comptroller show that single-family residential property comprised nearly half of all taxable value—a property’s assessed value subtracted by exemptions—in the 2022-2023 biennium.

The number of property-taxing units rose from 4,421 in 2021 to 4,549 in 2022 and 4,644 in 2023. Property-taxing units are local jurisdictions established by the Texas government to levy taxes.

School districts continue to collect the largest share of Texans’ property taxes. Of the $81.4 billion in property tax revenue collected in 2023, 48.5 percent was due to school district taxation, that being $39 Billion in property taxes against the households. Then, the levered school district bond debt accounts for roughly 81% of the bonds raised from the tax receipts which the criminals believe you will pay for over the next 30-40 years on a per annum taxed basis even though the current payment monthly grows 11X over 30 years. Mom and Pop do not have the money today to pay for their fraud, never mind tomorrow.

Utilizing the State Comptroller number of $39 Billion which is then levered up into School District bonds at roughly 20:1 and for terms up to 40 years under Texas law, you then end with an impossible amount of principle to pay off (today) and thus the circular argument of needing to increase real estate tax in perpetuity which is assured mutual destruction or simply face reality now, stop the hemorrhaging and repeal the real estate tax in favor of the Uniform States Sales Tax and put every school district that cannot pay off its bonds in 3 years into bankruptcy (see the attached Bill delivered to Helen Kerwin the Texas State Representative).

Summary (according to the Texas State Comptroller’s office):

$39,000,000,000 ($39 Billion) of real estate taxes charged against the houses

multiplied by

12.6% of the population that are hungry

equals

$4,914,000,000 of the tax $

divided by

4,000,000 (4 million) people that are hungry (12.6% of 31,853,800 population)

equals

$1,228.50 per hungry person, to feed them,

except for that the School District Taxes are being used to pay the interest on the fraudulent principle

Eliminate Hunger.

Repeal the real estate tax and generate $1,228.50 for 4,000,000 people to make sure no one in the State of Texas goes hungry.

Mom and Pop have been equity stripped. (See the Godley Texas Bond Debt example for cumulative interest calculator that was also delivered to Helen Kerwin.) Mom and Pop are paying 50, 60, 80% of the value of their home mortgage, in excess of their mortgage, in real estate tax to cover off the interest on the outstanding fraudulent principle debt created by the school districts, and then being expected to pay for the compound cumulative interest added to new fraudulent principle plus interest in perpetuity. To pay this off, is impossible as the Median Household Income does not exist.

As if 4,000,000 people being hungry in Texas is not enough to make blood boil, then how would you like to be a property owner, who goes to protest your property value only to be assaulted by the Appraisal Review Board Chairman?

On Monday, July 15th, 2025 Travis Spencer as property owner in Montgomery County Texas, was invited by the MCAD to present his case on his property value.

The hearing is a public hearing.

Mr. Spencer was not allowed to finish the presentation.

Mr. Spencer was asked to leave the hearing, and he did so.

Mr. Spencer was escorted out by the Chairman of the ARB panels who then put his hands on Mr. Spencer to knock the camera from Mr. Spencer’s hands and obviously in an attempt to pick a fight.

Mr. Spencer was wearing a body camera and the events of the crimes committed against Mr. Spencer are seen here:

July 15 https://www.youtube.com/watch?v=9VwoWlQgfsc (Assault)

The following videos are a result of that assault and violations of rights:

July 16 https://www.youtube.com/watch?v=EkUe_V31s7c

July 17 https://www.youtube.com/watch?v=TOnsn2cI498

July 18 https://www.youtube.com/watch?v=2T54AroQmU0

There was no trespass or criminal trespass by Mr. Spencer as claimed by the police, and the result of such a false charge is violating the 1st Amendment (freedom of speech), and the CAD and its employees including the ARB members have violated the 5th and 14th Amendment with regard to due process as well as their Oath.

Civil Rights Violations against Mr. Spencer include:

1st Amendment to the U.S Constitution - Freedom of Speech

5th and 14th Amendments Due Process

Title 42 U.S. Code Section 1986, Knowledge of Wrongful Act & Power to Prevent

Title 18 of Criminal Code, U.S. Code Section 1621, Perjury Defined

Title 18 U.S. Code Section 1512 c 1 2, who corruptly alters. Destroys or conceals a record

42 U.S.C Section 1983

42 U.S.C. Section 1987

Title 18, U.S.C., Section 241 - Conspiracy Against Rights

This statute makes it unlawful for two or more persons to conspire to injure, oppress, threaten, or intimidate any person of any state, territory or district in the free exercise or enjoyment of any right or privilege secured to him/her by the Constitution or the laws of the United States, (or because of his/her having exercised the same).

Title 18, U.S.C., Section 242 - Deprivation of Rights Under Color of Law

This statute makes it a crime for any person acting under color of law, statute, ordinance, regulation, or custom to willfully deprive or cause to be deprived from any person those rights, privileges, or immunities secured or protected by the Constitution and laws of the U.S.

This law further prohibits a person acting under color of law, statute, ordinance, regulation or custom to willfully subject or cause to be subjected any person to different punishments, pains, or penalties, than those prescribed for punishment of citizens on account of such person being an alien or by reason of his/her color or race.

Acts under "color of any law" include acts not only done by federal, state, or local officials within the bounds or limits of their lawful authority, but also acts done without and beyond the bounds of their lawful authority; provided that, in order for unlawful acts of any official to be done under "color of any law," the unlawful acts must be done while such official is purporting or pretending to act in the performance of his/her official duties. This definition includes, in addition to law enforcement officials, individuals such as Mayors, Council persons, Judges, Nursing Home Proprietors, Security Guards, etc., persons who are bound by laws, statutes ordinances, or customs.

It is important to point out that the members of the ARB panel including the Chair of the ARB signed an Oath to protect and defend the Constitution of the State of Texas and the United States of America. The Oath of Office clearly appears to have been violated which is a 3rd degree felony.

Texas State Penal Chapter 22 Assault appears to have occurred.

Texas Penal Code 42-072 – Stalking. The Chairman of the ARB Panels did not just appear out of thin air. Under the FOIA act, demand for additional hallway video has been made.

To be crystal clear, Mr. Spencer is you. You as a property owner. You as a person who has the right to protest your property value and You as a person with inalienable rights which are fundamental rights that cannot be taken away or transferred, considered inherent to all individuals. Examples include the rights to life, liberty, and the pursuit of happiness, as stated in the Declaration of Independence. Many of you reading this article across Texas and the U.S. have suffered the lies, ignorance, aggravated perjury and harassment by the Registered Professional Appraisers and the Appraisal Review Board Panels. Mr. Spencer is you!

To the Investigators (DA, Internal Affairs, Sheriff, Police Chief, DOJ, FBI etc.):

- Look at the evidence, audio, video, depositions, black letter of the law, and if you can disprove any of the evidence on the websites below and videos above, then simply say so. We are prepared and welcome any debate publicly with regard to the evidence or actions of those who violated the law. If you can’t disprove it, (which you can’t), then your job is to prosecute the crimes and those involved. If you refuse to do your job, then you are reinforcing the crime, violating the black letter of the law that governs ALL Citizens, and further perpetrating the fraud and violations of civil rights against all Citizens, not just the property owners. Any idea of self-preservation by the government is 100% misplaced because if 37% of the household go bankrupt you will have much more to worry about. We are at the tipping point.

- There is no bigger issue that you as an investigator face than the real estate taxes because stealing of money via overvaluation, over taxation, and the resulting equity stripping of Mom and Pop is directly correlated to the increase in crime, increase in hunger and the rise of communism in such states as NY and CA.

To the Legislators:

- This problem of the real estate tax fraud, school district bond fraud and the resulting equity stripping that has occurred and will continue to occur for the next 30 years or until the system implodes, is large enough to bring the U.S. economy to a halt shortly. 37.8%+ of the households today are in harms way of bankruptcy or losing the roof over their head. Look at the math. That is roughly 42,000,000 households across the U.S. and over 4,000,000 in Texas. If that happens, the system will implode, if not worse, because the law and application of the law would have proven to be meaningless and that has a high probability of leading to civil strife.

- How hard is it for a Legislator to simply state that a system was created over decades that was not just from inception, we realize the problem, the deck has been stacked against the property owners and the solution is to REPEAL THE REAL ESTATE TAX IN FAVOR OF THE UNIFORM STATES SALES TAX AND RESTORE THE BALANCE SHEET TO ALL PROPERTY OWNERS FROM WHICH THEY WILL OWN THE LAND BENEATH THEIR FEET AND WILL HAVE SOMETHING TO RETIRE FROM. (see – Benefits of Repealing the Real Estate Tax, and all the evidence at www.mockingbirdproperties.com/dcad, www.commonsenselaw.org, www.realestatemindset.org.

The Constitution of the United States of America and the laws thereunder exist for the protection of all Citizens including the Investigators, Legislators, & Judges. Where are the protectors of the property owners, and the protectors for those who are hungry? We the People, must make demand now for the repeal of all real estate taxes in favor of the Uniform States Sales Tax per the Bill submitted to Helen Kerwin which then goes a long way to eliminate hunger in the State of Texas and across the United States.

M.