When Confidence Crashes... Opportunities Rise!

By Mitchell Vexler, November 17, 2025

What makes confidence crash?

- Manipulated Data

- Systemic Institutionalized Moral Hazard

- Fraud

- Propaganda

- Willing suspension of disbelief

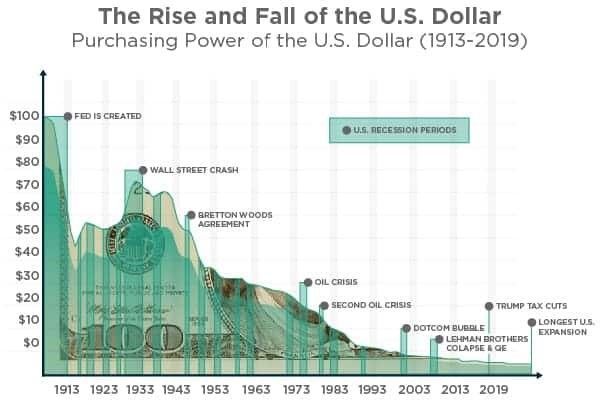

- Inflation

- Working and having no money to show for your efforts

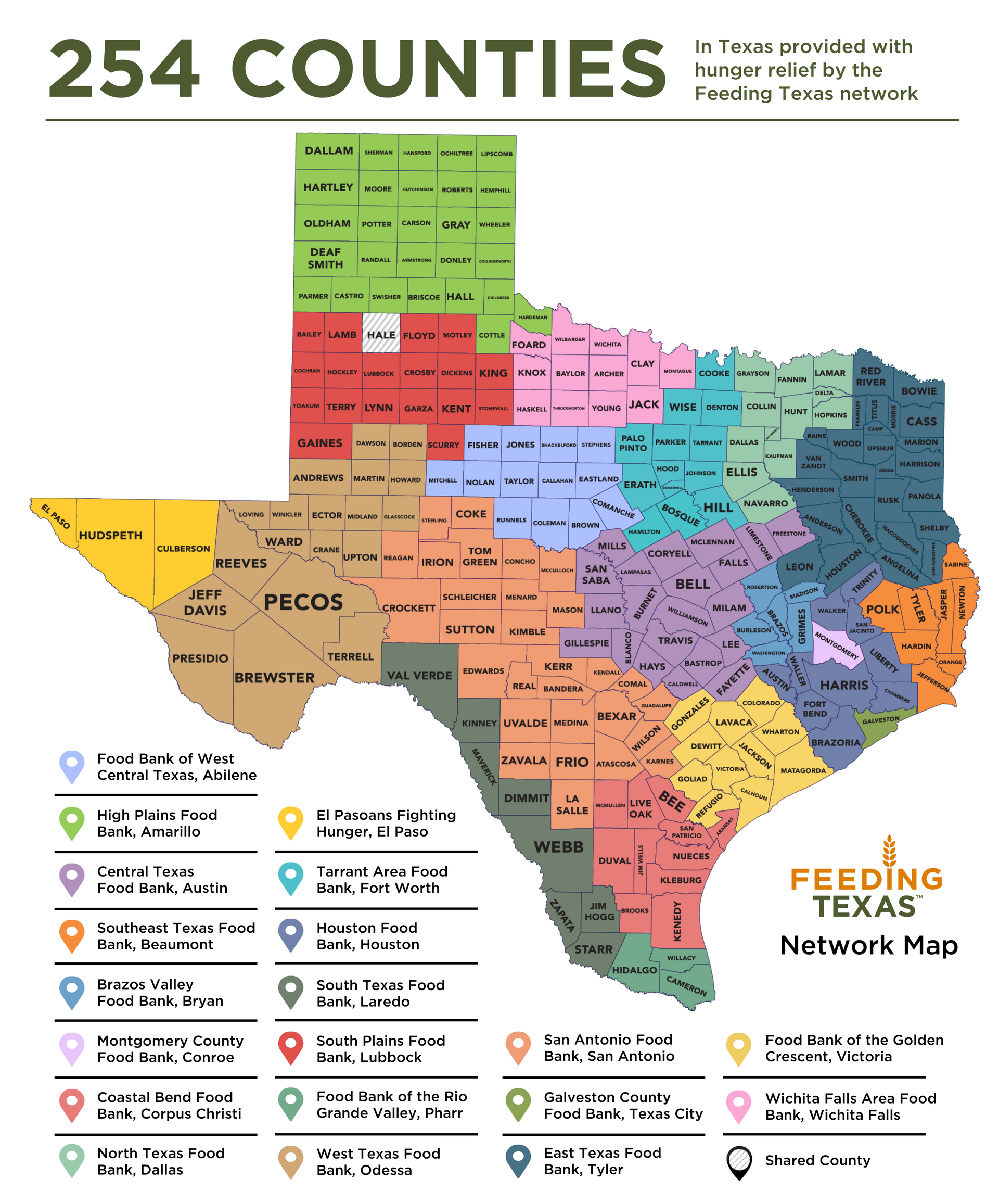

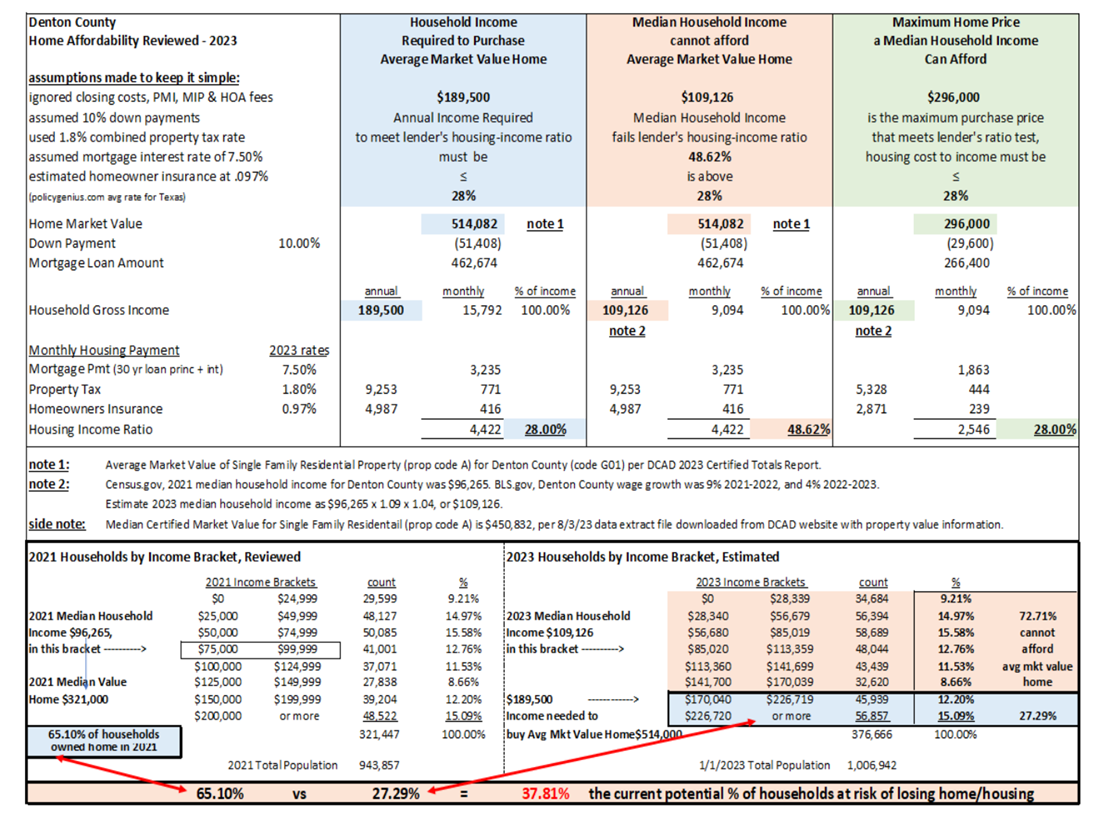

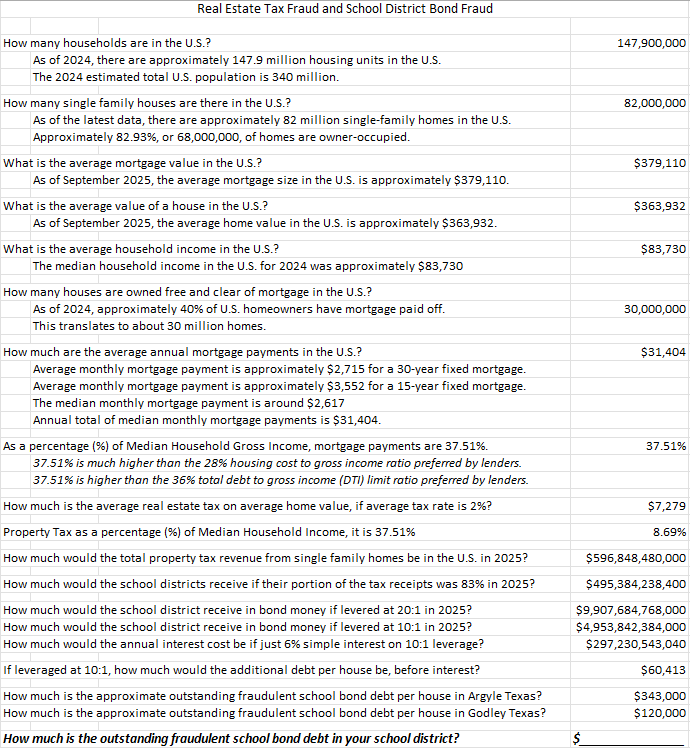

- School District Equity Stripping, the principal reduction from your mortgage and flipping it into property tax of which roughly 83% of that property tax goes to a fiscally, morally, bankrupt, criminal school systems, that levered the tax receipts into bonds for up to 40 years while deeming that you the property owner will pay for their crimes

- Ignorance of what is missing in the data. (see all of the above)

- Not spending quality time with family.

Decreasing confidence is the warning sign.

When markets crash, opportunities rise!

The stock market is its own ecosystem / economy; it can go up, down and sideways. Just like people’s confidence, being irrational exuberance, depression, and it will be ok. The question is over what time frame? 5 minutes, 1 day, 1 month, 1 year?

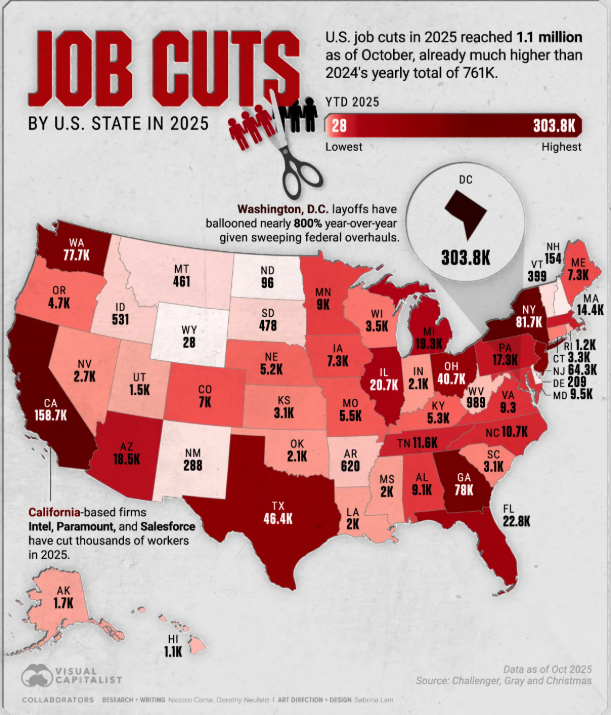

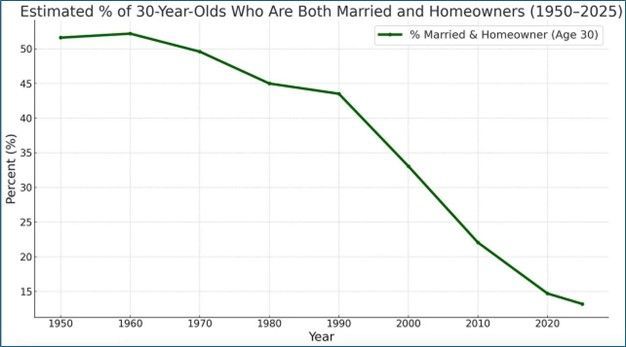

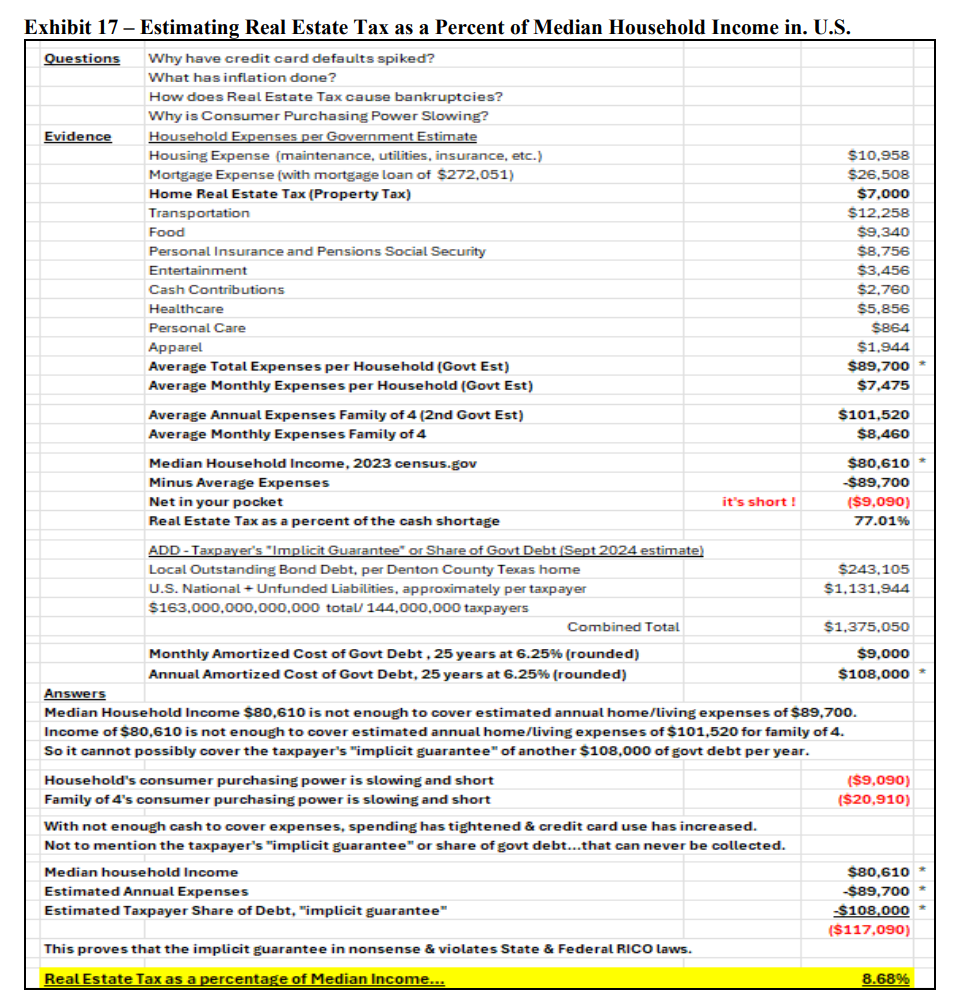

What is missing from the press and government modified data is the Personal Household Finance showing that roughly 37.8% of households being roughly 42,000,000 homes where the Median Household Income does not exist to pay property taxes which have gone up fraudulently by approximately 100% in last 5 years which still cannot pay off and retire the fraudulent school district bond debt. Today on average over 8.6% of a family’s gross income goes to property tax and the difference between going bankrupt for the majority of households is $9,000 of which $7,000 is property tax.

What are the options with regard to the property tax and fraudulent school district bonds?

The government could do nothing being the equivalent of hear no evil, see no evil, & do evil.

The government could create a Debt Jubilee.

The government (State and Federal) could repeal all property tax in favor of the Uniform States Sales Tax, thereby restoring the balance sheet to all property owners, and let the sellers and buyers of the fraudulent bonds suffer the consequences of their lack of due diligence.

The government could claw back the fraudulently paid interest with the goal to save as much of the invested principle as possible. Let the bondholders file suit against the companies that promoted the sub junk bonds.

The government could let the bonds fail.

The government and the courts must allow Ultra Vires to be adjudicated in a court of law.

The government and the courts must remove sovereign immunity in cases involving fraud.

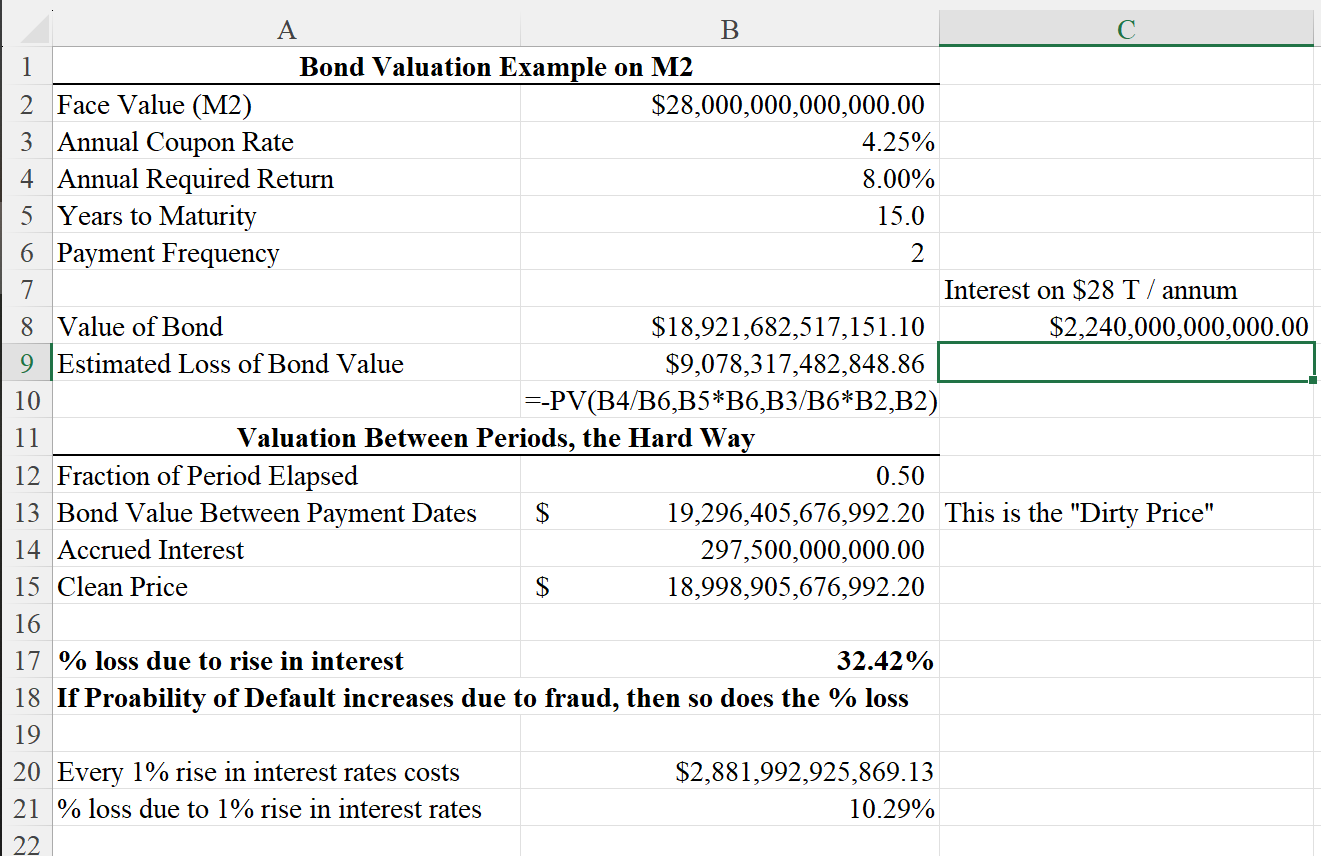

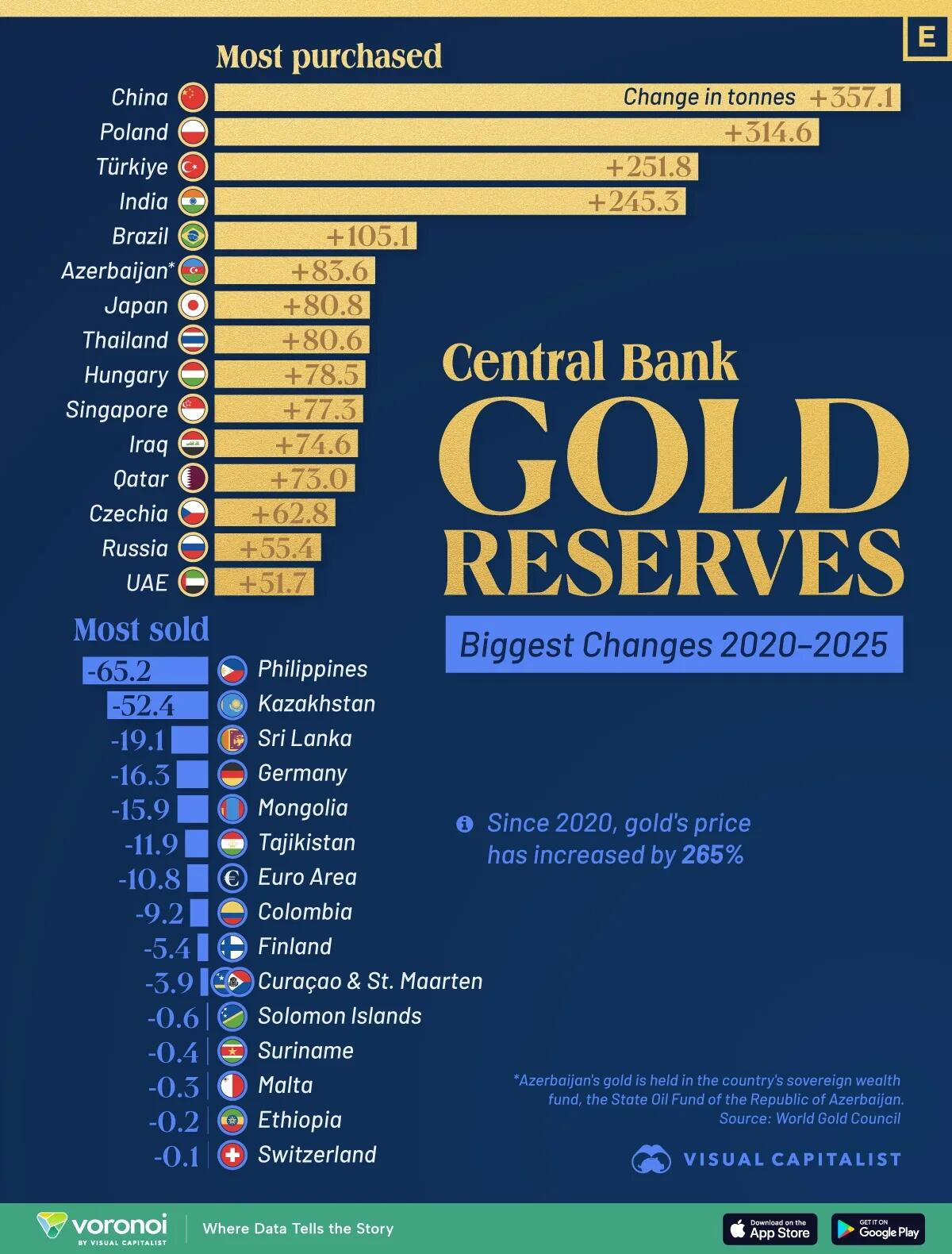

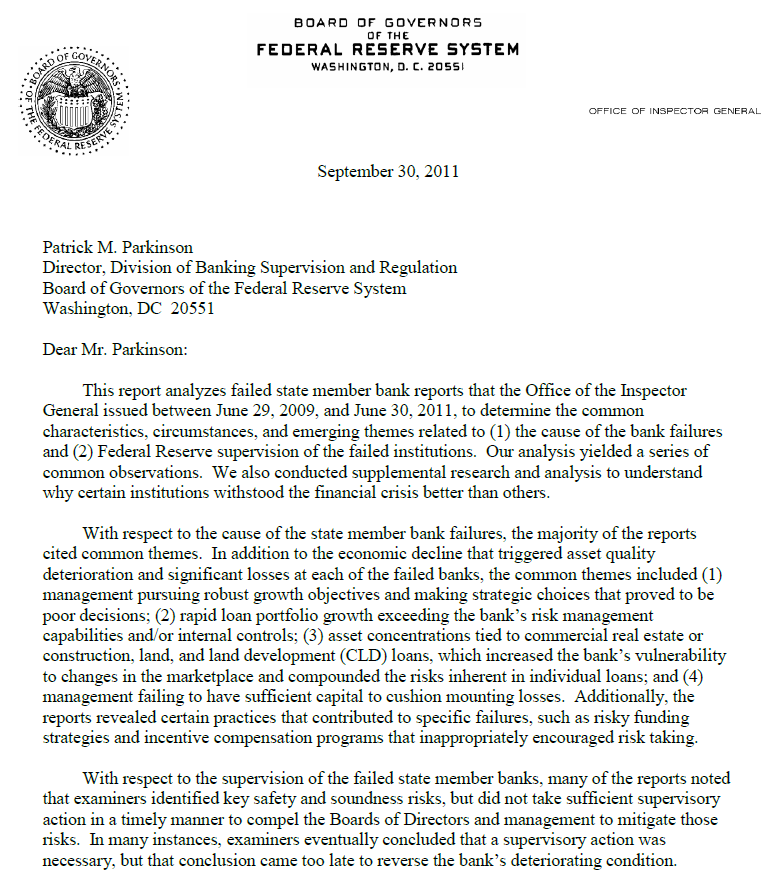

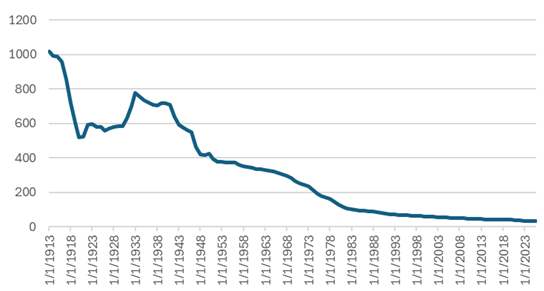

The government could ignore the debt that cannot mathematically be paid off and thus intentionally crash multiple systems possibly simultaneously. The U.S. Government has defaulted on its debt several times in its history. The press will state that this is a better record than most other countries over time. Maybe. However, printing of money by the U.S. Treasury at the behest of the Federal Reserve, which exists to protect the banks, from which assets are not backed, is by any definition is fraud. Printing money to cover the losses from bad debt and to cover stupid decisions to severely curtail the global economy (Covid), causes inflation, which is a hidden tax, which is a fraud on the public. Interesting article discussing the printing of money over a short period of time. https://mises.org/power-market/how-much-did-they-print . Identical to printing money by the U.S. Treasury is the overvaluation and over taxation as a result of the fraud created by the Central Appraisal Districts on behalf of their owners the School Districts. In both cases, what no one talks about is the cumulative effect of the interest on the debt, which was known before the most recent and larges round of money printing was even printed and before the fraud at the CADs started to ramp up in 2016. It is the compound interest on debt that should not exist which in combination cannot be paid off which creates U.S. National Debt deficits and similarly School District Bonds which also cannot be paid off and retired permanently. The compound interest is now magnified, many times larger than the original principal.

If you took the attitude that it is just 37.8% of the households that can’t afford their property taxes and everybody else being the remaining 62% (88,000,000) of the households, will pick up the slack ask yourself how would that be possible as the increase per household would be $2.9 Trillion divided by 88,000,000 being a quick $32,950 added to the forced liability of each household, plus the ongoing school district bond raises, plus the ever increasing outstanding compound cumulative interest? Obviously, that can’t be done and is illegal, then what is the solution? Repeal all property tax in favor of the Uniform States Sales Tax.

Who are the winners? The Banks, because they collect the interest on the money loaned. Also, let’s not forget the attorneys, accountants, real estate appraisers, economists and bureaucrats who protect and preach for their masters, all while being intentionally oblivious to an amortization schedule.

Who are the losers? Society.

No one knows the exact timing of a crash and how deep the crash will be or how short lived.

When a crash occurs, this is where the opportunity exists.

In the meantime, think about what you are not being told about the compound cumulative effect of interest and why you should be involved in the decisions that are forced upon you by those you wish to trust, but have shown a propensity not to be trustworthy.