The Data is Cooked!

By Mitchell Vexler, August 4, 2025

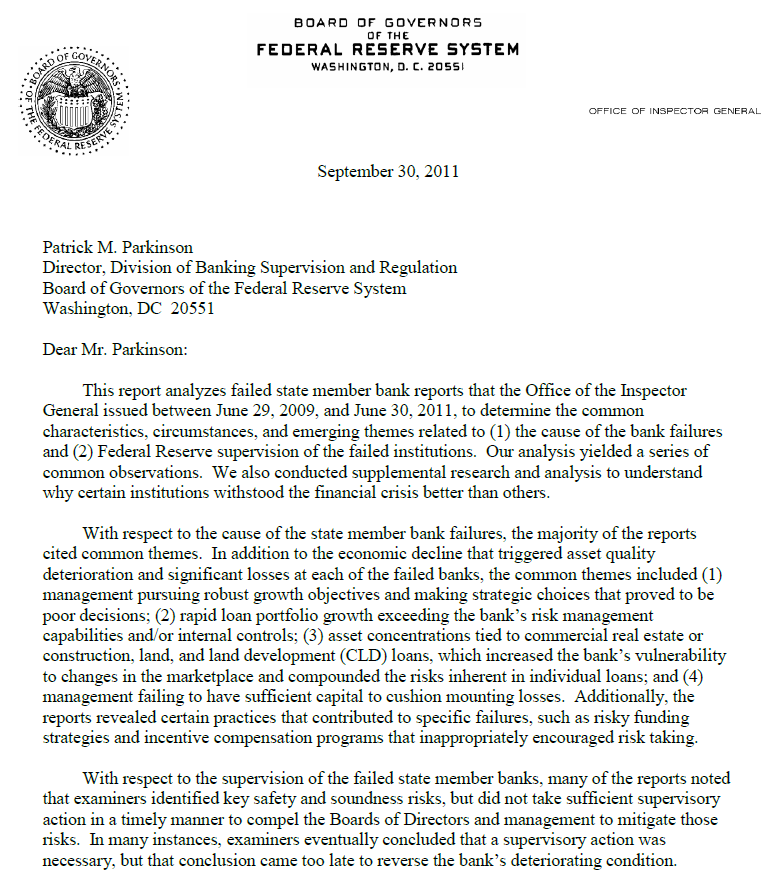

Through multiple articles including the Federal Reserve is a Failure & CPI The Big Lie, both at www.mockingbirdproperties.com/dcad , I made the case that most often, at the hands of government officials, the data is abused, made up, ill-timed (lag), ill-conceived and simply wrong, and quite often wrong for political reasons.

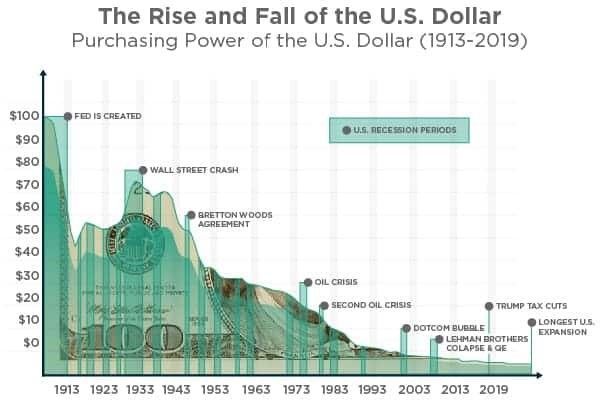

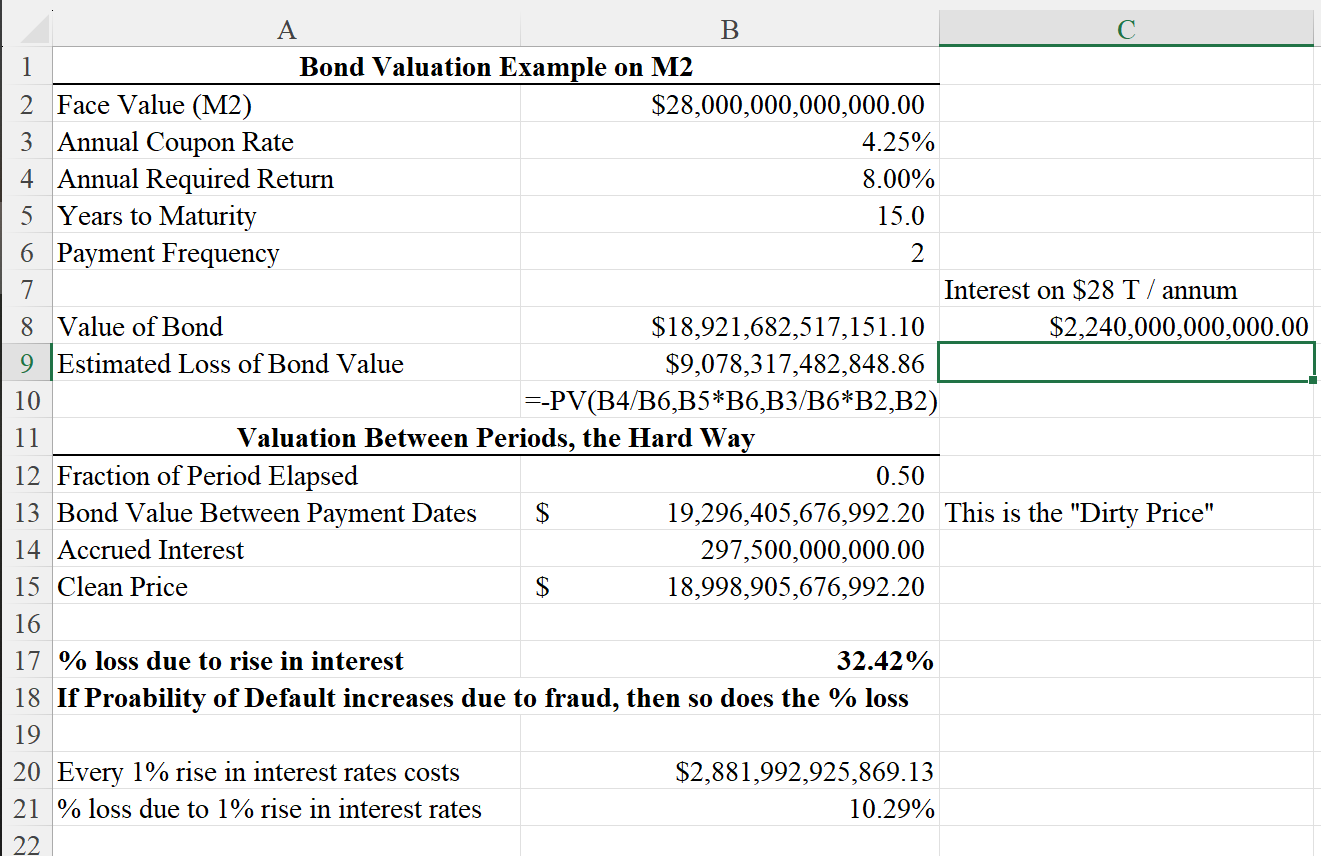

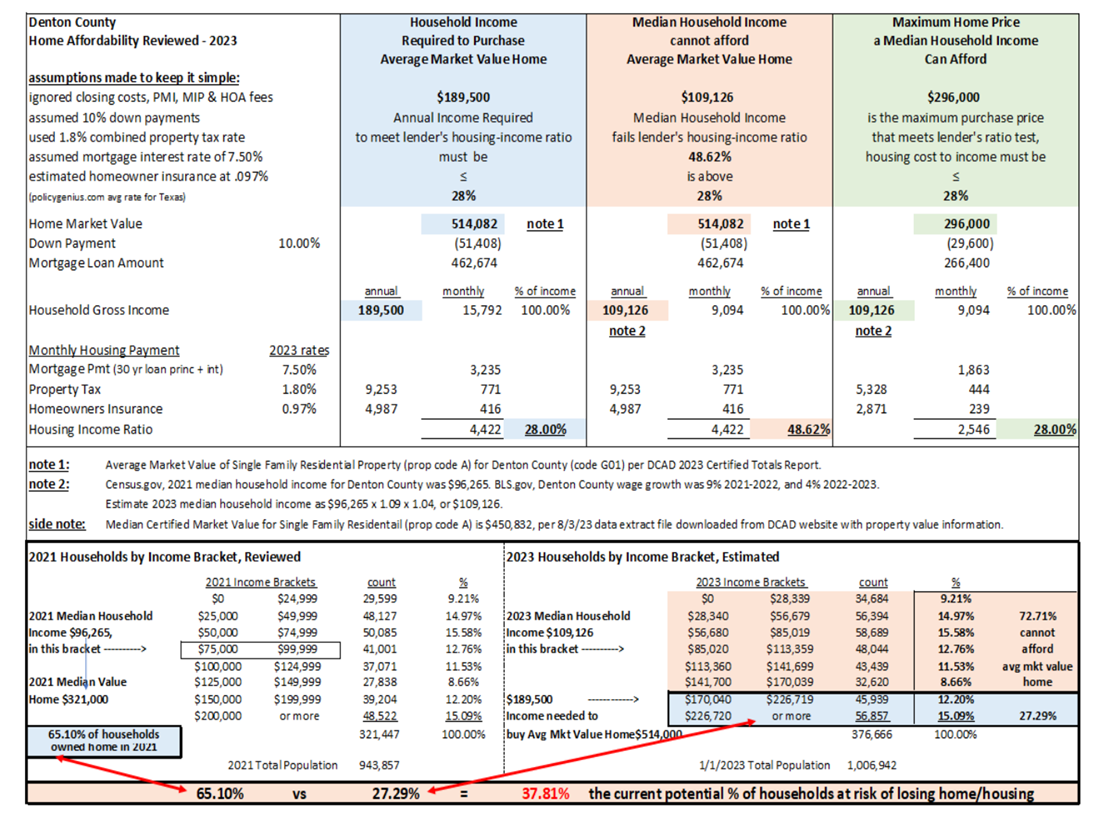

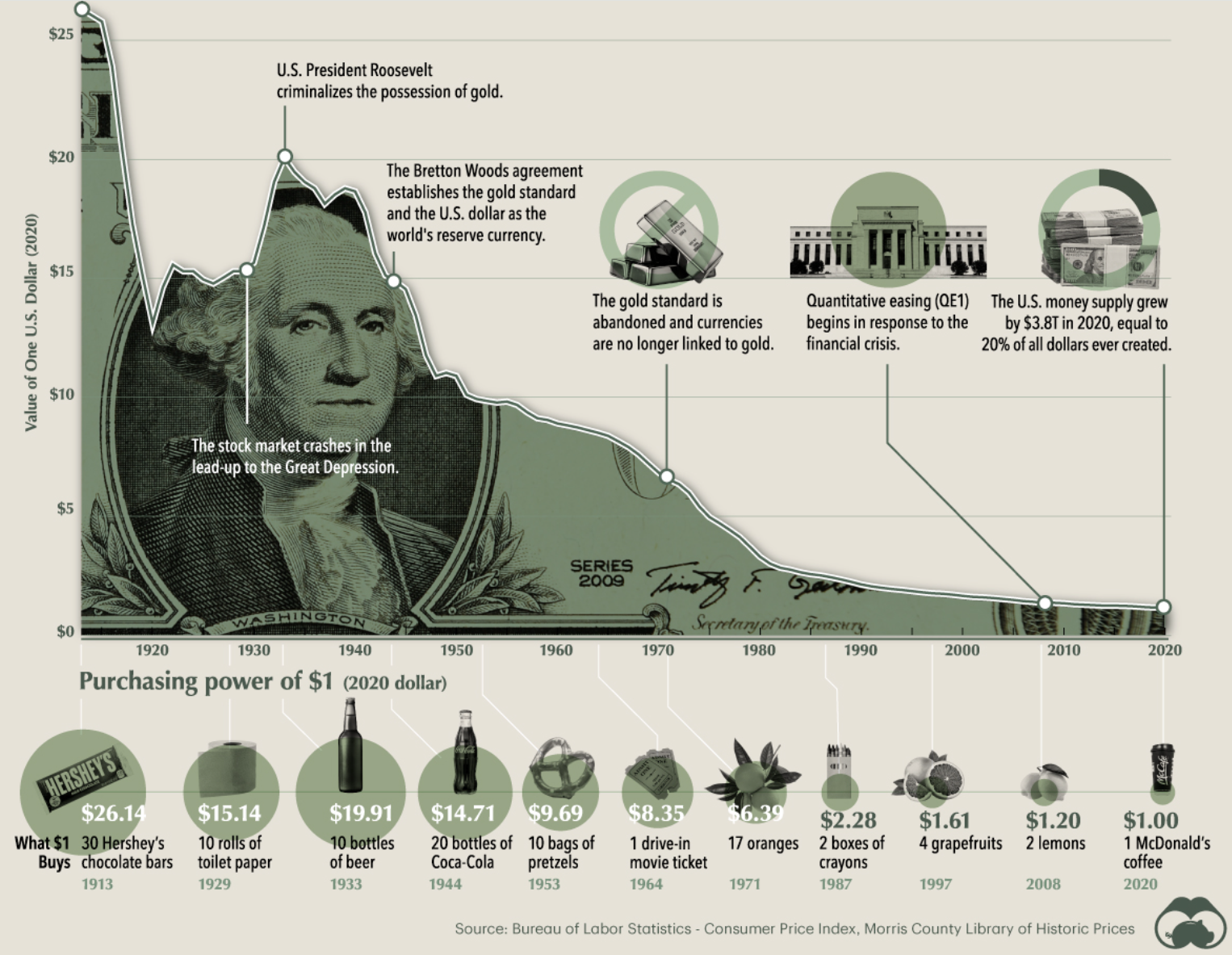

No amount of manipulated data is going to cover off what all property owners and grocery buyers are experiencing, which is inflation caused by the Federal Reserve and the Central Appraisal Districts both as a result of fraud.

The ramifications of the tenacles of fraud run deep in that insurance companies use the fraudulent data created at the CADs from which to determine the values upon which they write insurance policies thus creating the circular effect of compound inflation, that being fraud upon fraud.

There are multiple problems including but not limited to:

The data collection process is flawed: subjective, biased, or incomplete.

Software programs are written to allow no uniformity of application of the law, and no uniformity of application within the CADs themselves.

Data review is absent or questionable, with no checks and balances to ensure correct data input.

Hand overwriting of values exists, based on curve fitting to a pre-defined budget which has zero to do with real estate appraisal law or

USPAP – Uniform Standards of Professional Appraisal Practice. See Violations.pdf (10 pages of broken laws by the CADs & Co-Conspirators)

https://irp.cdn-website.com/39439f83/files/uploaded/Partial_List_of_Violations_Reviewed-052224.pdf

Real Estate Appraisers, outside the CADs, are afraid to do their job for fear of retaliation.

Survey Response Rates are between 25% and 35% for the past year.

The complexity of the laws prohibit property owners from being able to defend their values all of which violates the Rule of Law meaning the setup to defraud includes the intentional complexity.

Chief Appraisers go on retreats to teach each other their methods to de-fraud. “We took 60,000 properties outside the database, put them in excel, manipulated them and put them back.”

Data demanded by the CADs from the property owners is never utilized, in violation of Texas Property Tax Code and the Texas Constitution, such that the CAD literally makes up the income, expenses, NOI, and Cap Rate to the point of bankrupting commercial properties and homes.

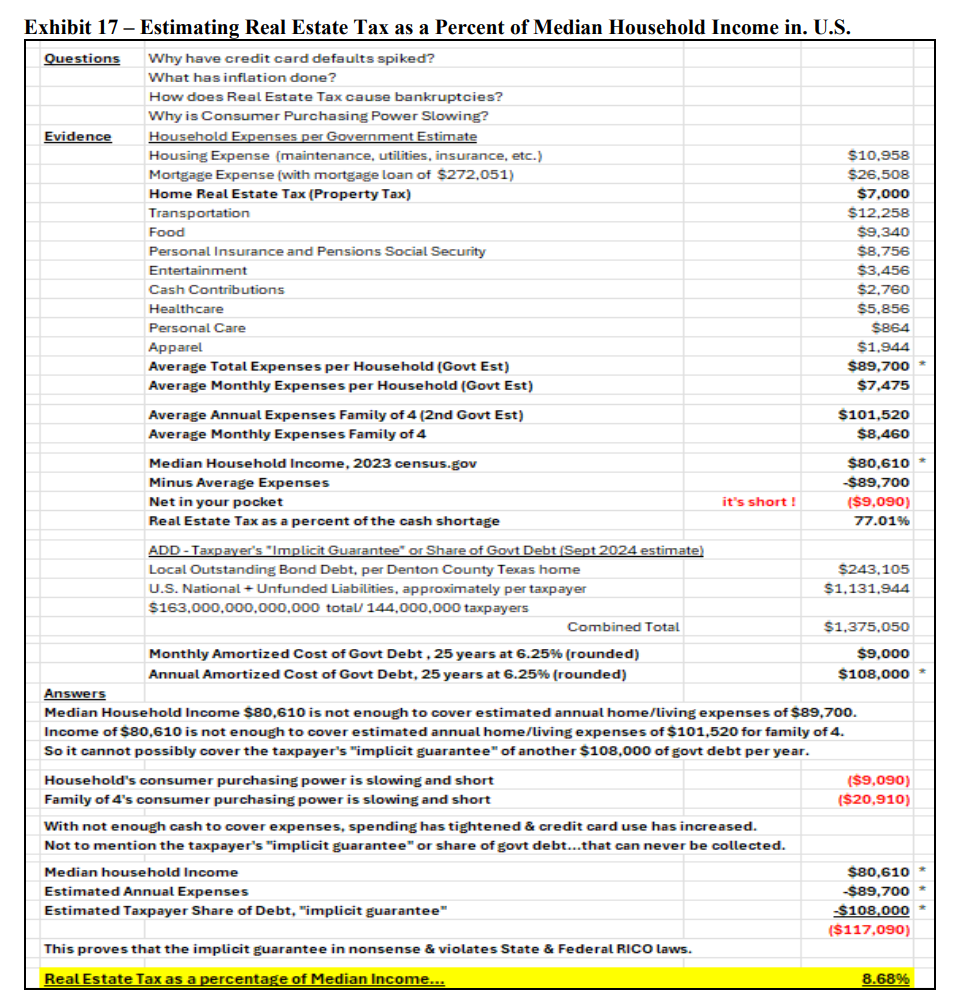

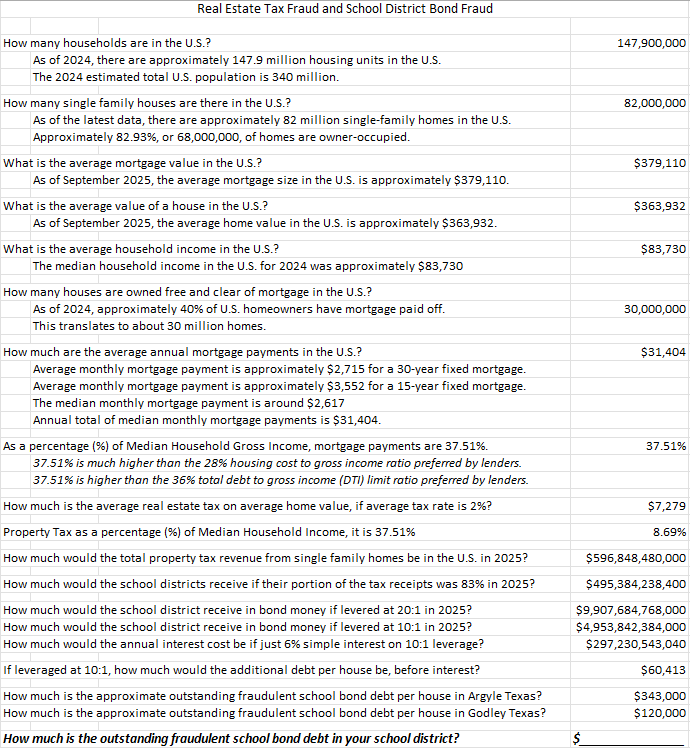

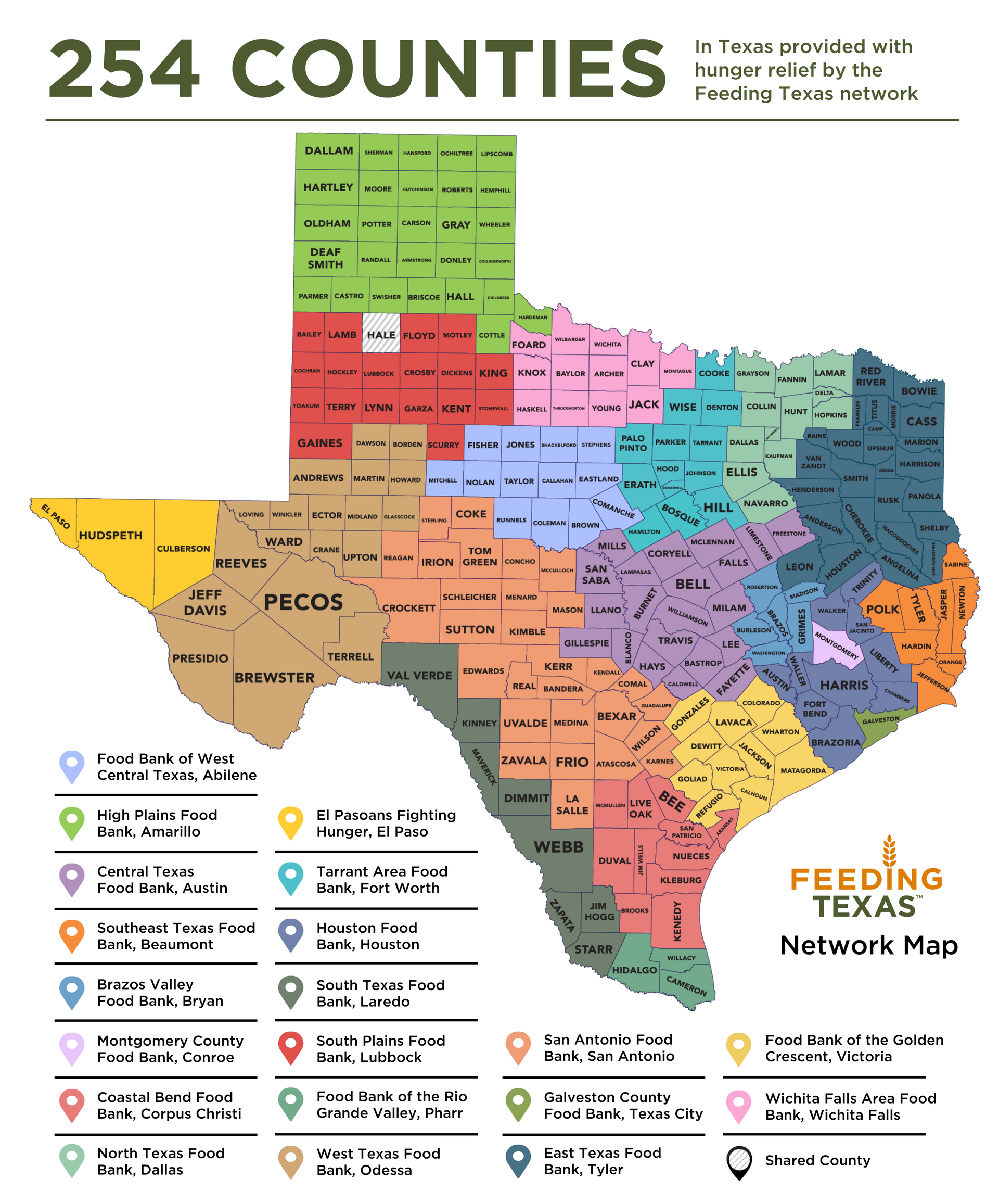

This is the Compound Interest Calculator using Godley Texas as an example, but the math is applicable to your school district and how the compound cumulative interest has stolen your equity and ends in the bankruptcy of not just the school districts which are bankrupt today, but also, bankrupts over 42,000,000 households simultaneously.

https://irp.cdn-website.com/39439f83/files/uploaded/Compound+Interest+Calculator+-+Godley+Texas.pdf

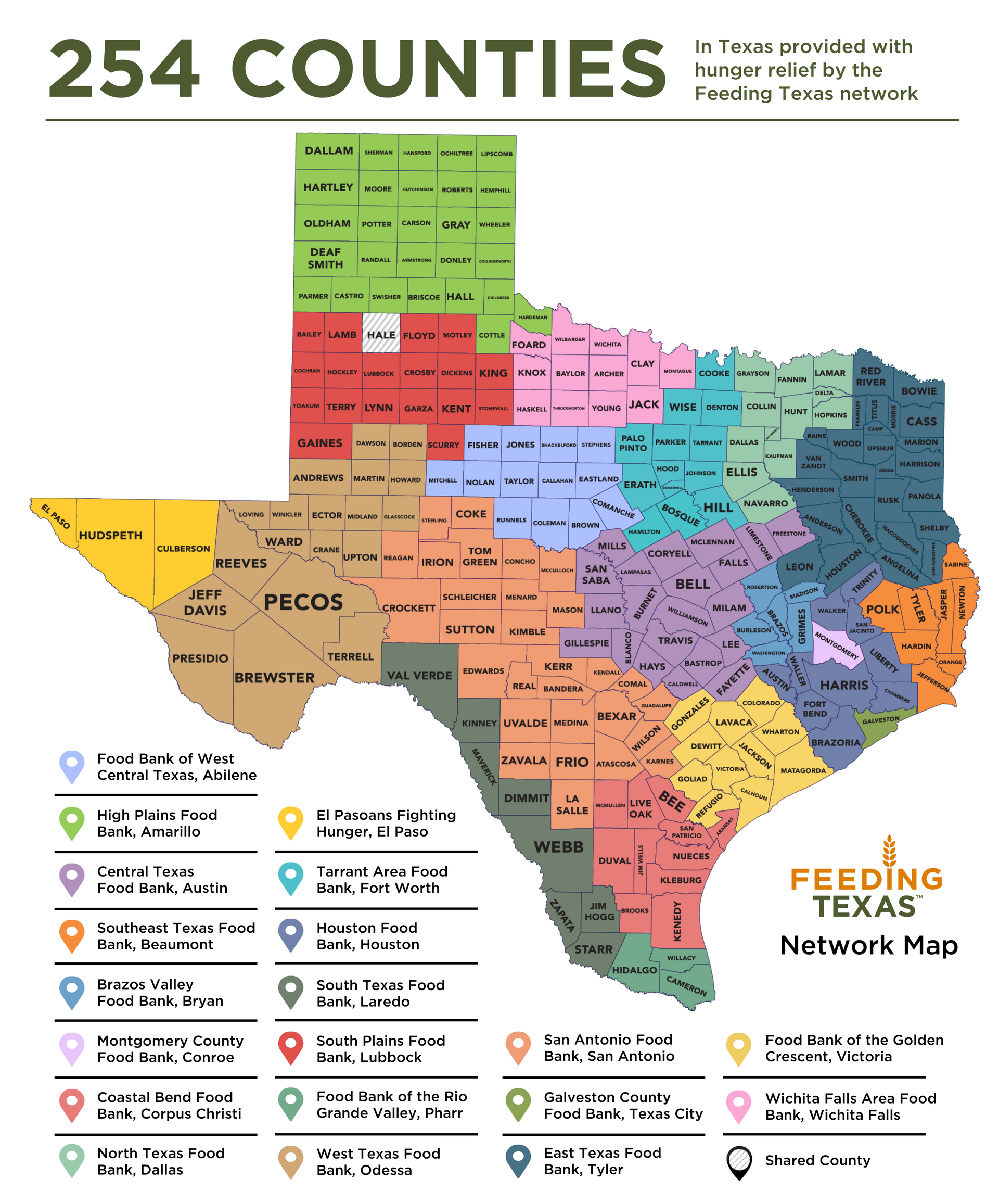

There are a collection of problems, including lies, manipulation, violations of State and Federal Law, with the net result being compound cumulative annual fraud upon fraud ending with the CAD databases being roughly 92% corrupted, school district being bankrupt, and 37%+ of the household in harms way of bankruptcy or losing the roof over their head.

How do we fix these problems?

Repeal all property tax in favor of the Uniform States Sales Tax.

There is no other solution.

The “system” is broken. A “system” that is designed to defraud is not a “system”, it is a crime scene.

The criminals must be fired in mass, the CADS shut down, school districts forced into involuntary bankruptcy if necessary, criminals (Chief Appraisers and School District Superintendents and their Boards) prosecuted and the vast majority of school district bond fraud which cannot be paid down to zero in 3 years must be vacated. This combination is stated in the Bill which restores the balance sheet to all property owners such that they own the land beneath their feet and from which via the amortization schedule, they will have a paid for asset from which they can retire from. This Bill fixes the housing problem and restores the American Dream of home ownership.

It is crucial that every property owner understand what is happening, and push for the fix which is the Bill and that there is nothing more important for any local politician to do then ensure their constituents don’t go bankrupt as a result of the School District Bond Fraud and Property Tax Fraud.