How to Audit Your School District & Central Appraisal District

By Mitchell Vexler, December 26, 2025

1. Find a local active Facebook group you can work with to expose the data / evidence and have a place you can communicate with other active members of society. Be active and let everyone know in your community about this group and your efforts. Once the team is set up, issue a Preservation of Records to each person who has knowledge including School District Accounting Firm, SD Supervisors, SD Board, State Comptroller, State Attorney General, State Auditor. Post every document and communication on the Facebook page. Create a website and post every document there. Find a local reporter who has an interest in the story and evidence.

2. Find a local accountant, Certified Fraud Examiner, or a person who for the prior 3 years can chase down:

A. Revenue

B. Expenses – Who received the checks / money?

C. % of line item expenses as compared to revenue- Review largest expense items.

D. Detailed balance sheet analysis including investment pools where details are not provided (hidden investment pools), who participated, are they tenured, where are the investments, where did the money for the investments come from, who received benefit, etc., etc.

E. Review internal emails between School District Superintendent, Chief Appraiser, and SD Board Members. Chase down gaps in correspondence where emails may be missing.

F. Detailed kickback analysis. Who paid for the bond raise advertising? Who received the contract to build the school? Where are the conflicts of interest?

3. Send a Certified Mail or FedEx containing a Freedom of Information Act request outlining exactly what you and or your group is looking for from the SD Superintendent.

By law, they must respond. Keep the FOIA request as short as possible. Use the FOIA request found on www.mockingbirdproperties.com/dcad as a possible template. If they don’t respond, that speaks volumes. Each Board Member and SD Superintendent can be held joint and severally liable, and a Judge will make them turn over the evidence and the defendants will end up paying the cost of legal fees.

4. The audit process is a crucial component of any business. Make no mistake, your school district is in the extortion business. An extortion business designed to transfer your money into their pocket without providing the service for your children that you demand, and if you don’t pay, they will take your property. The audit provides assurance that financial statements are accurate and reliable.

Understanding the Audit Process

Before delving into the specific phases of the audit process, it's essential to understand the overall concept of auditing. Auditing is a systematic examination of an organization's financial statements and records, conducted by independent professionals known as auditors, and yes, an auditor does not need to be licensed and neither does an investigative journalist. This process involves assessing the fairness and accuracy of financial information, identifying any potential fraud or errors, and ensuring compliance with applicable laws and regulations.

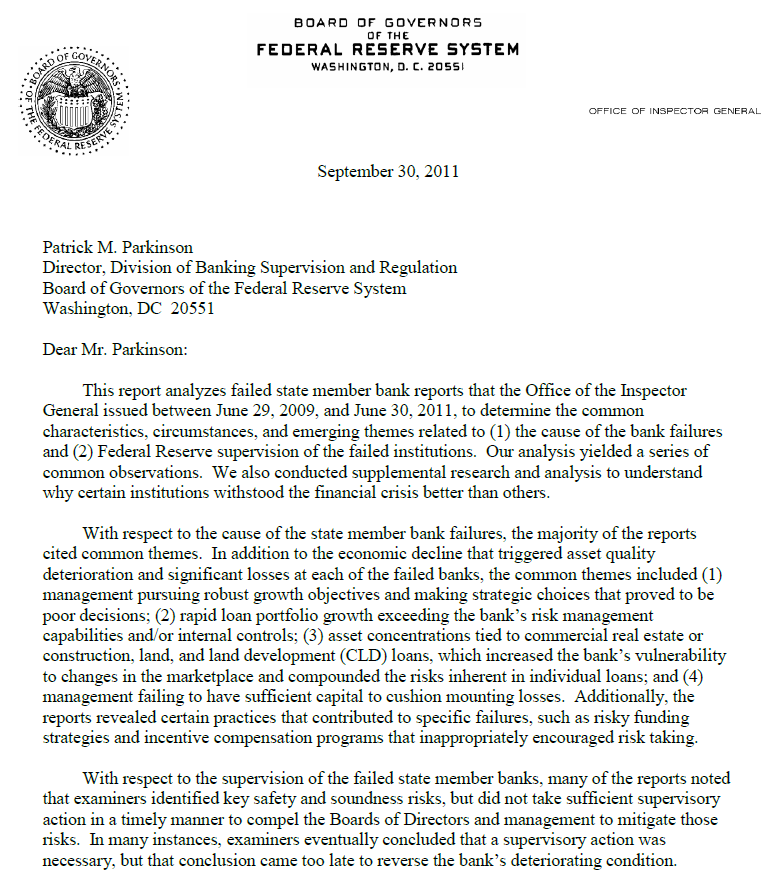

Auditing serves as a critical function, providing credibility to financial information and enhancing the accountability of corporate and or governmental entities. It involves a comprehensive review of financial records, internal controls, and management practices, with the aim of providing an opinion on the accuracy of financial reporting. The audit process follows a systematic approach and is governed by a set of generally accepted auditing standards (GAAS), or in the case of the government itself the Yellow Book of auditing standards, ensuring consistency and reliability.

When conducting an audit, auditors perform several key procedures to gain a thorough understanding of the organization's financial health. These procedures include analyzing financial statements, testing internal controls, sampling transactions, and verifying the existence and valuation of assets and liabilities. By conducting these procedures, auditors are able to assess the organization's financial position and provide an independent opinion on the fairness of the financial statements.

Importance of Auditing

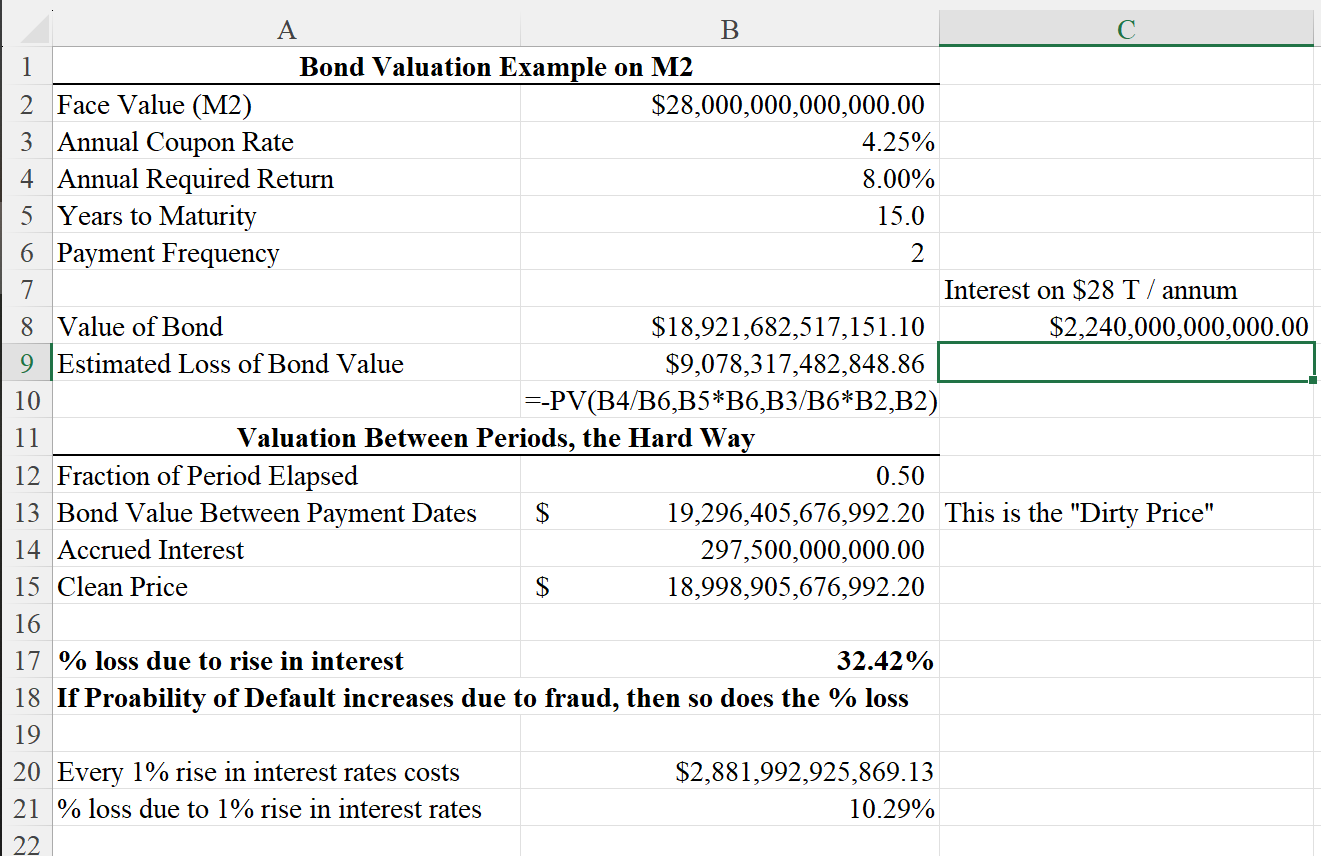

Auditing plays a vital role in business by providing numerous benefits. Firstly, it enhances the confidence of the taxpayers, bond investors, creditors, and regulators, by providing an independent assessment of financial statements. This, in turn, facilitates proper investment decisions and efficiency.

Furthermore, audits help in identifying areas of improvement, enabling organizations to address weaknesses in their financial reporting processes and internal controls. By highlighting areas for improvement, audits contribute to the overall efficiency and effectiveness of an organization's operations.

Audits also serve as a deterrent to fraud and misconduct. The presence of auditors reviewing financial records and internal controls acts as a strong deterrent to fraudulent activities, promoting ethical behavior and protecting the interests of shareholders.

In addition to these benefits, audits also provide valuable feedback to management. Through the audit process, management receives insights into the organization's financial health, internal controls, and compliance with laws and regulations. This feedback helps management make informed decisions and improve the overall governance and risk management of the organization.

The Initial Phase: Audit Planning

The audit process begins with detailed planning. During this phase, auditors gather relevant information, set objectives, and develop an audit strategy to guide their work. It involves a careful assessment of the organization's operations, risks, and controls, ensuring that the audit is conducted efficiently and effectively.

Identifying the Scope of Audit

One of the key tasks in audit planning is to determine the scope of the audit. This involves identifying the specific areas to be audited, such as financial statements, internal controls, or compliance with laws and regulations.

Risk Assessment in Audit Planning

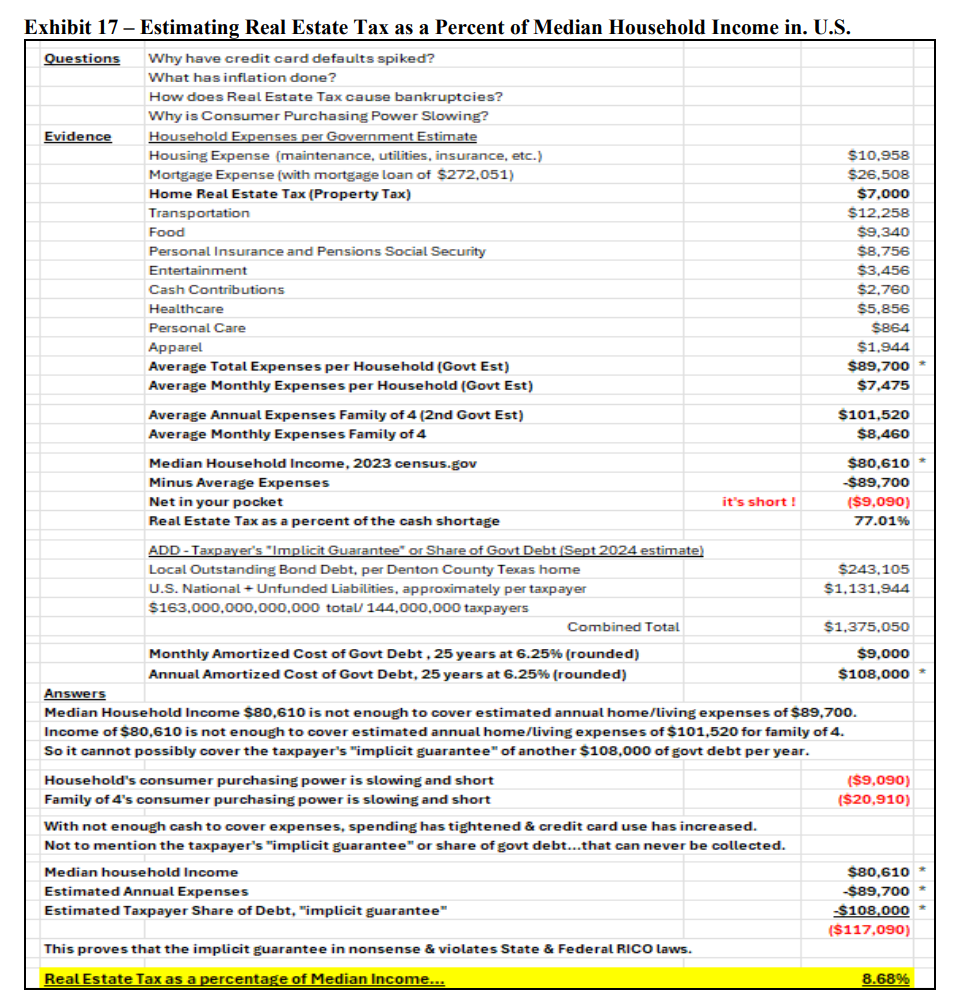

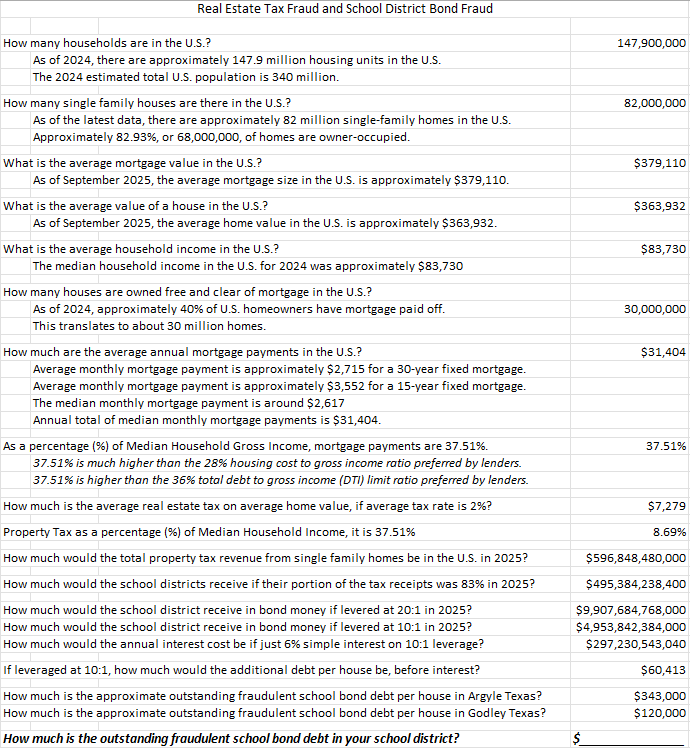

What is the source of revenue? Taxpayers

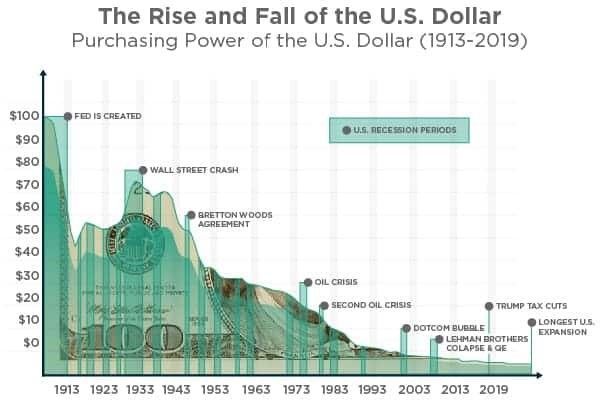

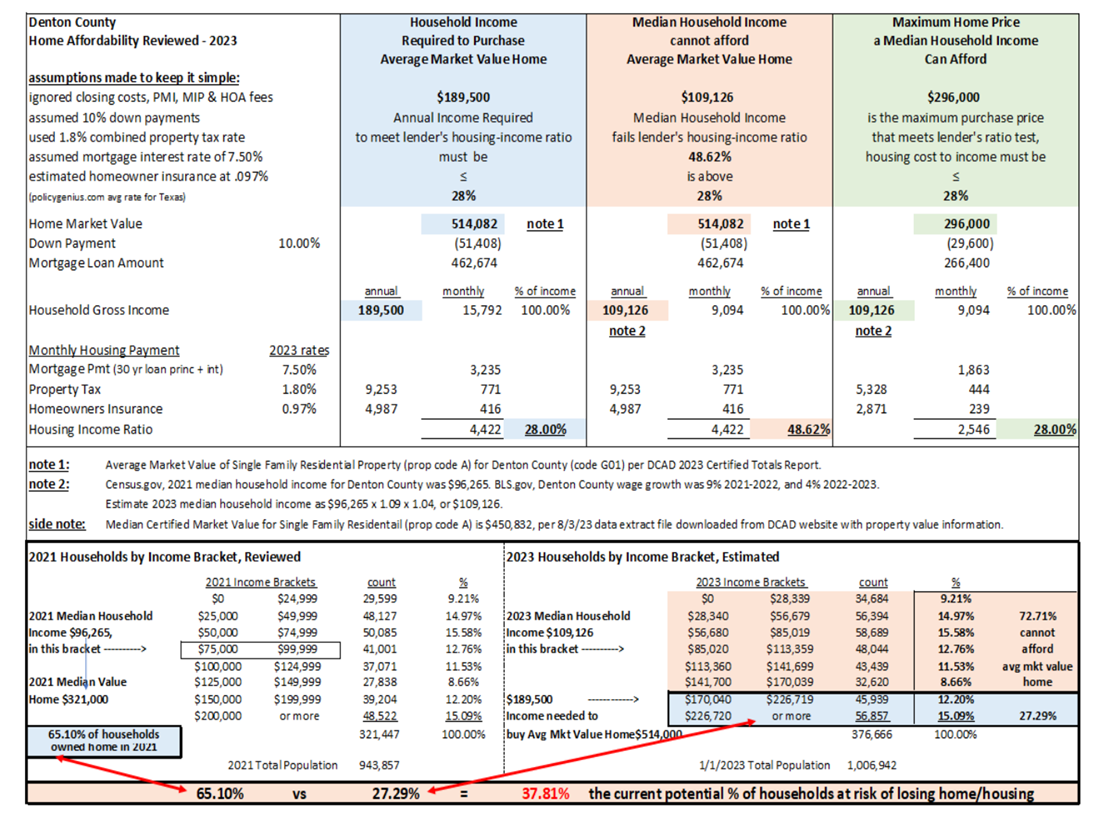

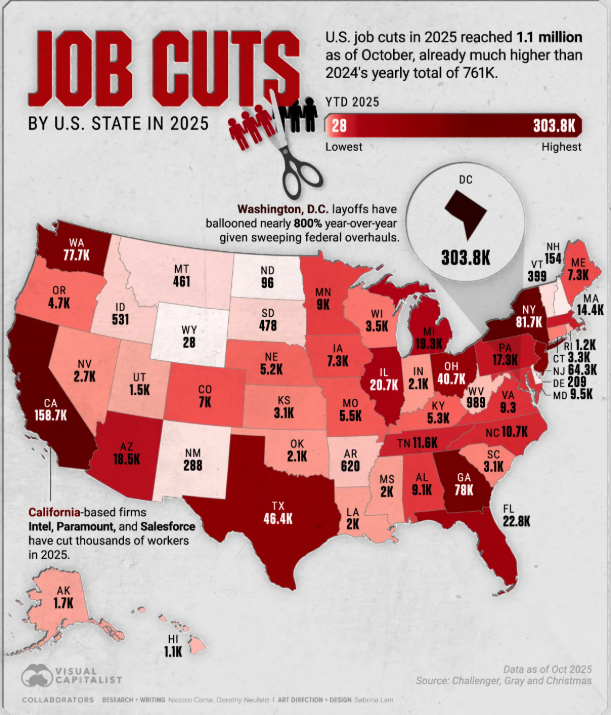

What is the source of over taxation? The Central Appraisal Districts and the Chief Appraiser’s property over-valuations for ad valorem taxation due to School District or Municipality bloated budgets and large debt service requirements. (Property values have been increased to cover off the fraudulent spending.)

Who colludes with the Chief Appraiser to create higher property values than established in law (and USPAP)? The School District Superintendent.

Who is at risk? You!

Risk assessment is a critical component of audit planning. It involves identifying and evaluating the risks that may impact the organization's financial statements. Auditors use various techniques, such as interviews, inquiries, and analytical procedures, to gain an understanding of the entity's risk profile. This information helps them to plan the audit procedures and allocate your team resources effectively.

Developing an Audit Strategy

Based on the scope and risk assessment, auditors develop an audit strategy tailored to the organization's specific needs. The strategy outlines the approach to be taken, the audit procedures to be performed, and the resources required. It serves as a roadmap for the audit, ensuring that the work is conducted in a systematic and efficient manner.

Use www.mockingbirdproperties.com/dcad and www.realestatemindset.org as the roadmap for your investigation.

The Execution Phase: Conducting the Audit

Once the planning phase is complete, auditors move on to the execution phase, where they gather evidence, test internal controls, and perform substantive procedures to validate the accuracy of the financial statements.

Gathering and Analyzing Evidence

The gathering and analysis of evidence are crucial steps in the audit process. Auditors use various techniques, such as examination of documents, observation, and confirmation with third parties, to obtain the necessary evidence to support their conclusions. The evidence is then analyzed to determine whether the financial statements are free from material misstatements.

Testing Internal Controls

A significant aspect of the audit process is testing the effectiveness of internal controls. Internal controls are the policies and procedures established by management to ensure the reliability of financial reporting. Auditors evaluate the design and implementation of these controls to determine their effectiveness in preventing or detecting errors or fraud. This analysis helps auditors assess the level of risk associated with the financial statements and guides the selection of appropriate audit procedures.

Audit Sampling Techniques

Due to the volume of transactions and the limited resources available, auditors often use sampling techniques to gather evidence. Sampling involves selecting a representative portion of the population for examination. Various sampling methods, such as statistical sampling or judgmental sampling, can be employed depending on the circumstances. Auditors carefully design their sampling plans to ensure that they obtain reliable and meaningful results.

The Final Phase: Audit Reporting

The last phase of the audit process involves finalizing the audit report and communicating the findings to the organization's management and if necessary a Judge and Jury. Keep the public informed all the way along.

Preparing the Audit Report

The audit report is perhaps the most critical deliverable of the audit process. Consider the Report a portion of a Trial Brief. It provides an independent opinion on the fairness and accuracy of the financial statements. The report typically includes an introductory paragraph, a description of the scope and objectives of the audit, a summary of findings, and the auditor's opinion. The format and content of the report are governed by auditing standards and must adhere to certain reporting requirements.

Communicating Audit Findings

Once the audit report is finalized, auditors communicate their findings to the organization's management and relevant stakeholders. The communication may include a discussion of significant issues identified, recommendations for improvement, and any other matters of importance. This step ensures that the impact of the audit is fully understood and that appropriate actions are taken to address any identified deficiencies.

Conclusion

In conclusion, the audit process is a comprehensive and systematic examination of an organization's financial statements, as well as statements made in public by the Boards and SD Superintendent, and related records. From the initial planning phase to the final reporting phase, auditors follow a structured approach to ensure the accuracy, reliability, and compliance of financial information. Understanding the different phases of the audit process helps organizations and stakeholders appreciate the importance of auditing in building trust, enhancing transparency, and promoting sound practices. If your school district and appraisal district are participating in a criminal conspiracy to defraud, you have the civic duty to expose them because it is your money they are stealing.