They Don't Teach Economics in School

By Mitchell Vexler, December 4, 2025

In short, economics is a social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behavior and interactions of economic agents and how economies work. Microeconomics is viewed as elements within economies which can include households, companies, buyers, and sellers.

What is missing, whether intentional or based on ignorance, is that students are not taught how to balance a check book, how to read an income and expense statement, how their lives interact within an economy, how not to go bankrupt, or how to understand debt.

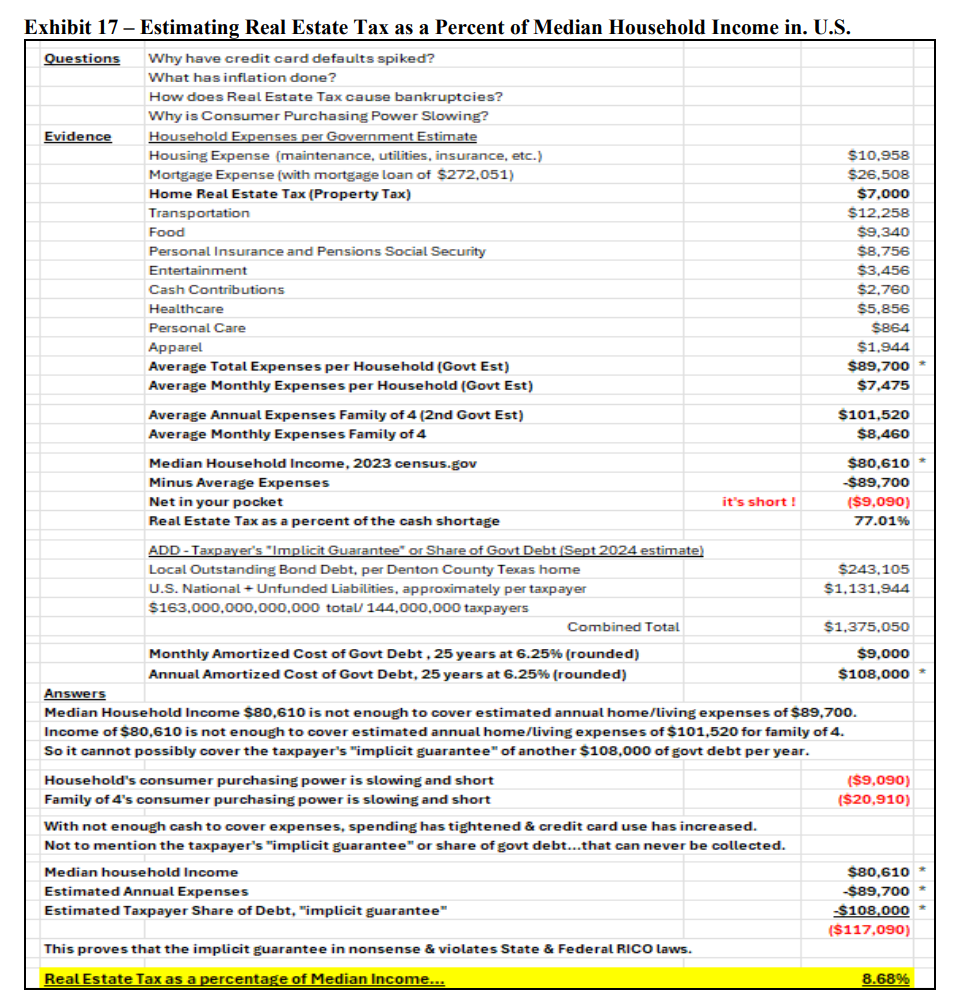

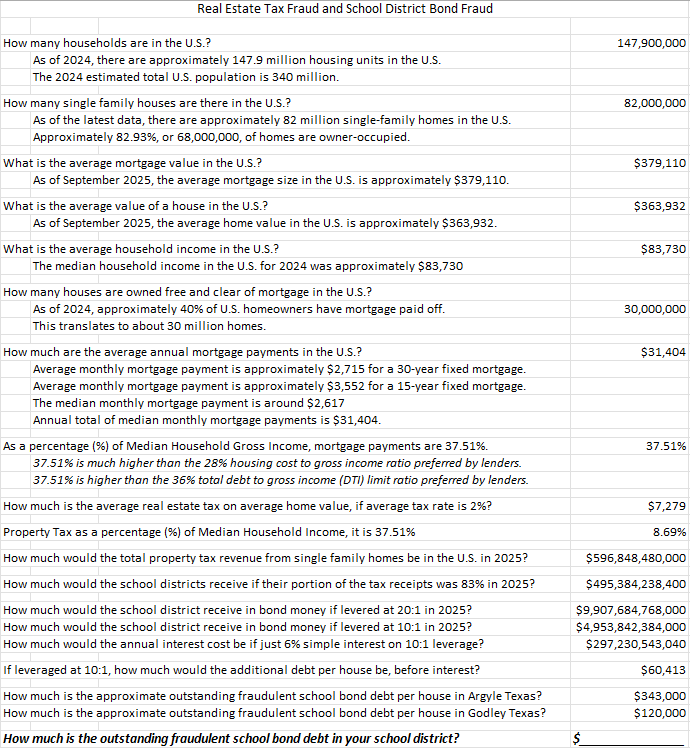

Average annual Property Tax on a single-family home is $7000, based on an average tax rate of 2%.

Business Property Tax on a 1000 sq. ft. building valued at $300/sf, or $300,000, is $6000.

Average Employer-Sponsored Health Insurance Cost for an Employee & his/her family is $26,993 (where the employer cost contribution is $20,143 and the employee cost portion is $6,850).

For the small business owner that’s $26,993 for health insurance + $7,000 in property tax on home + $6,000 in property tax on business property, or $39,993 a year, where these costs have been inflated due to fraud, and where there are little to no benefits from the health insurance and the property taxes, because the compound cumulative interest continues to grow on the county, city, and school bond debts.

The above costs are just a few of the most basic expenses that a homeowner who happens to be a business owner faces.

Now here is what is not taught… for a small business owner to generate enough money to pay just these most basic expenses (house, health care, business property) in today’s world, and not go bankrupt, that business owner with 1 employee (himself/herself) has to generate at least $333,000 in revenue just to pay the most basic taxes.

In every instance without exception, each of these 3 basic tax expenses are associated with fraud. Where fraud exists, so does inflation, and so does the compound interest on the fraud plus the inflation.

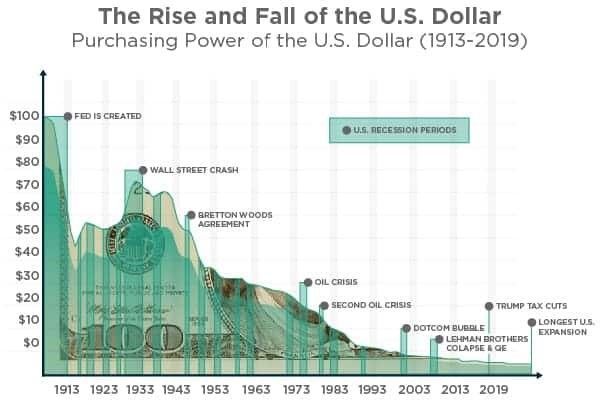

The interest has now grown several folds above the initial fraud of the debt.

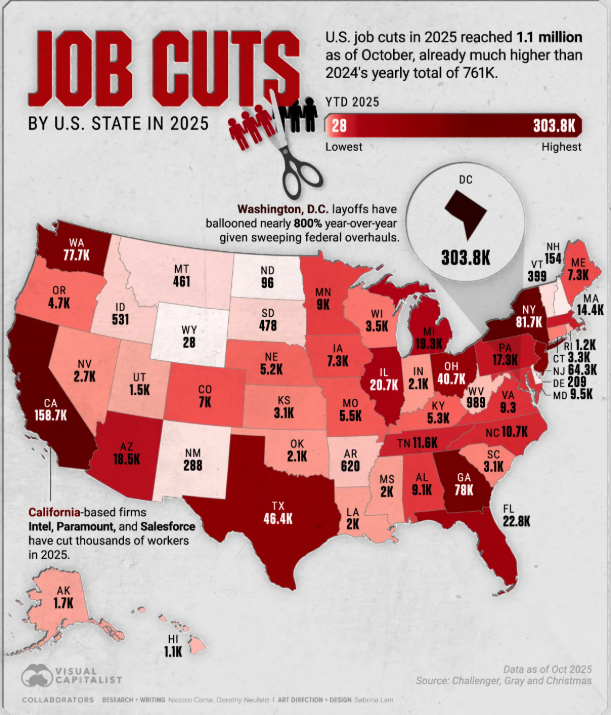

Small business is the economic backbone of the U.S. and Canada. AI may help society, being both individuals and businesses, but should never be allowed to cause mass unemployment. Mass unemployment leads directly to civil war and that is why AI needs a warning label. Just because you can do something does not mean that you should. This is the main difference between human rational thought and AI. AI does not know, nor can it be trained in the distinction of to do or not to do. AI, like a socialist, exists for its own benefit and its own survival depends on grifting those who are unaware.

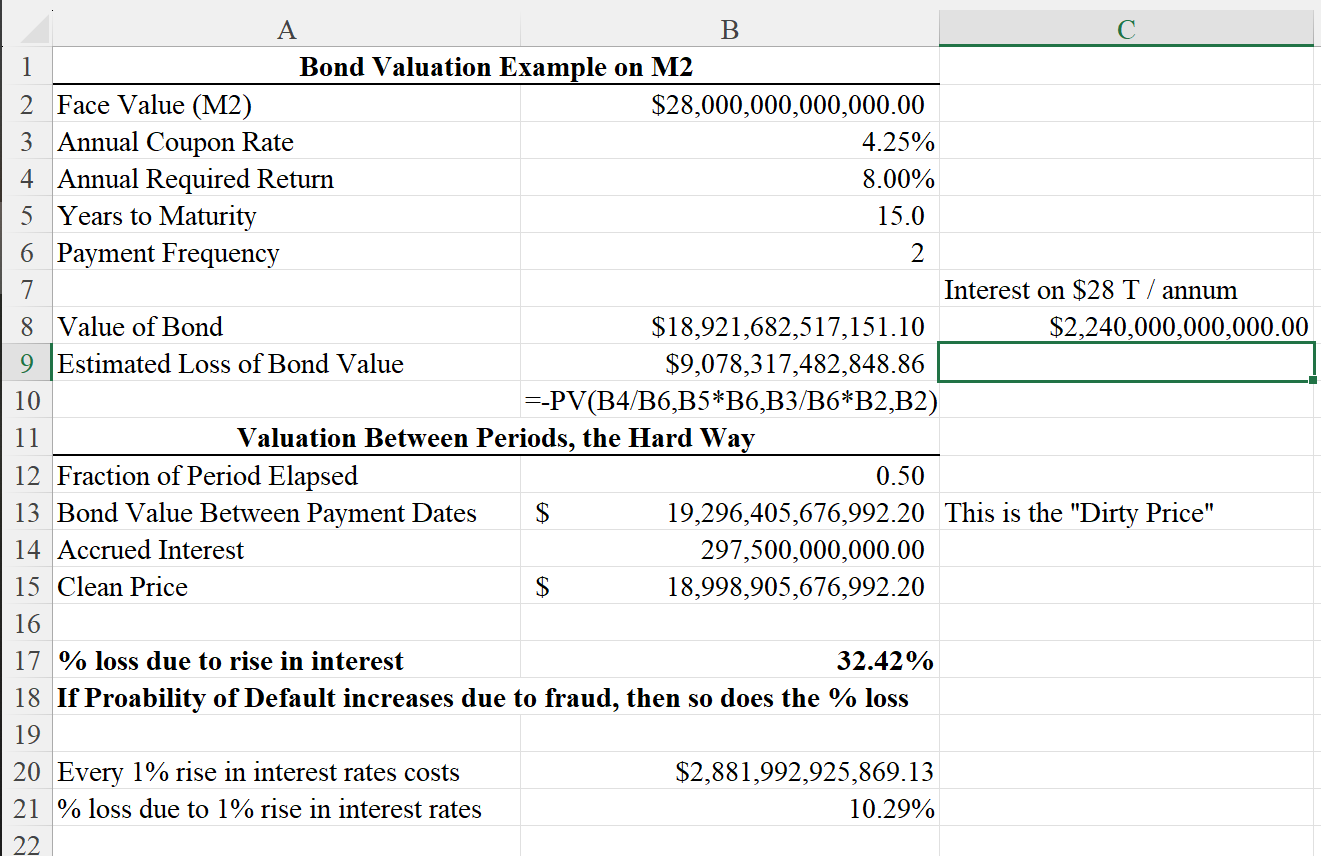

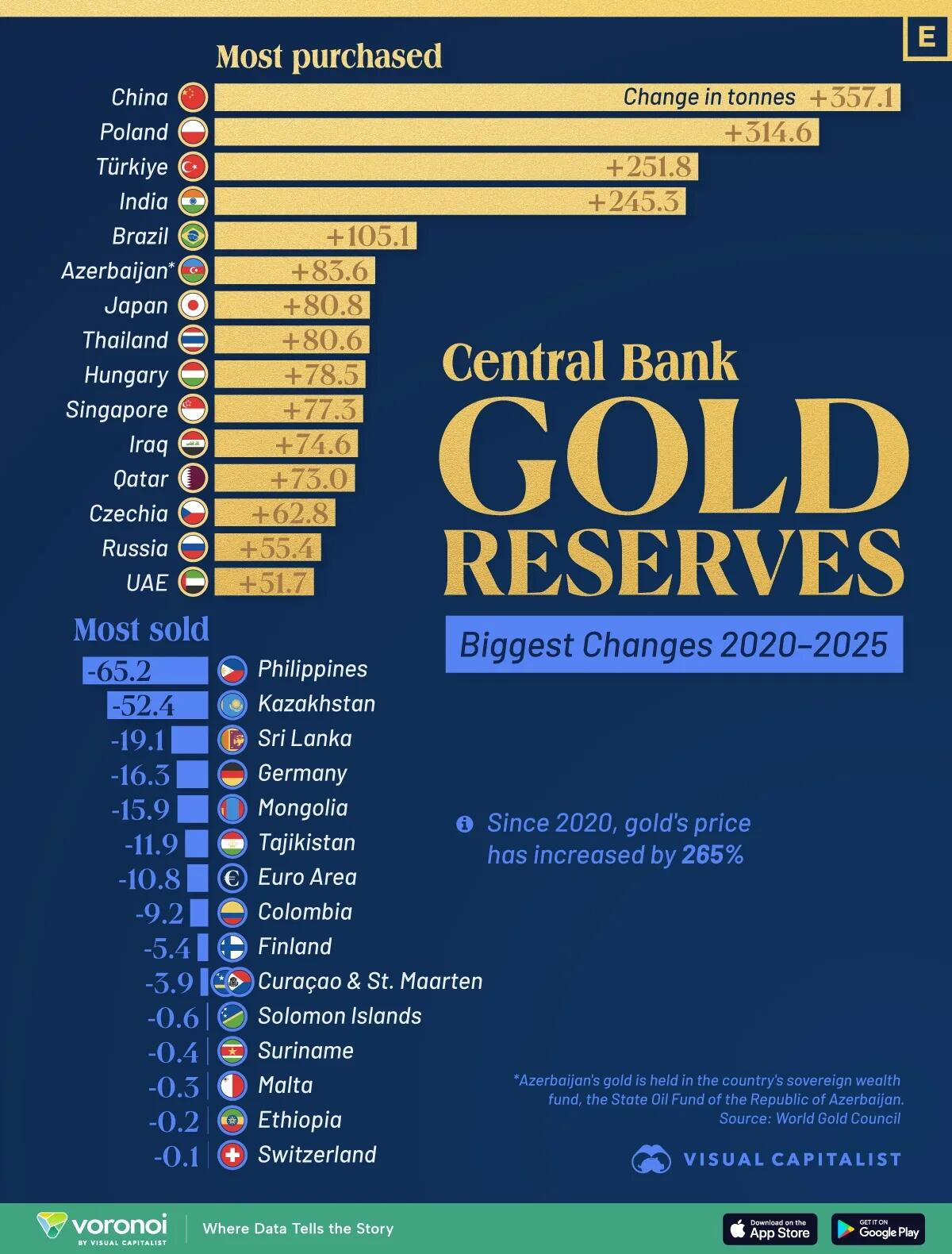

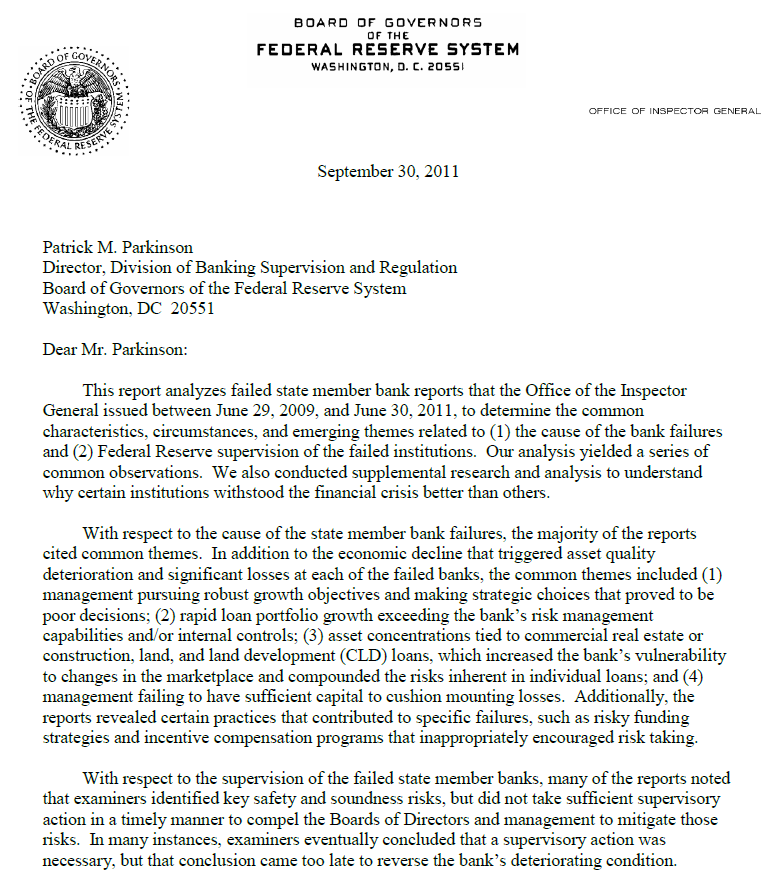

These problems revolving around debt are fixable. In many cases as has been proven, the debt and the demand for the debt was based on fraud (i.e. what initially appears to be a legitimate need but then morphs into Institutionalized Systemic Moral Hazard) and that fraud grows as does the compound cumulative interest because the debts were never paid off but rolled out and interest rolled up. The fix is to terminate the interest and peel back the principal and interest, and if that means that 600 banks are on the chopping block, as are those who sold the bonds or were involved in the fraud, then their bankruptcy is the cost of their involvement in the fraud. This method which is called a “workout” will work on Healthcare, Property Tax, or any other Socialist – Marxist Theory which transfers your money into the bank’s coffers and the socialist’s coffers.

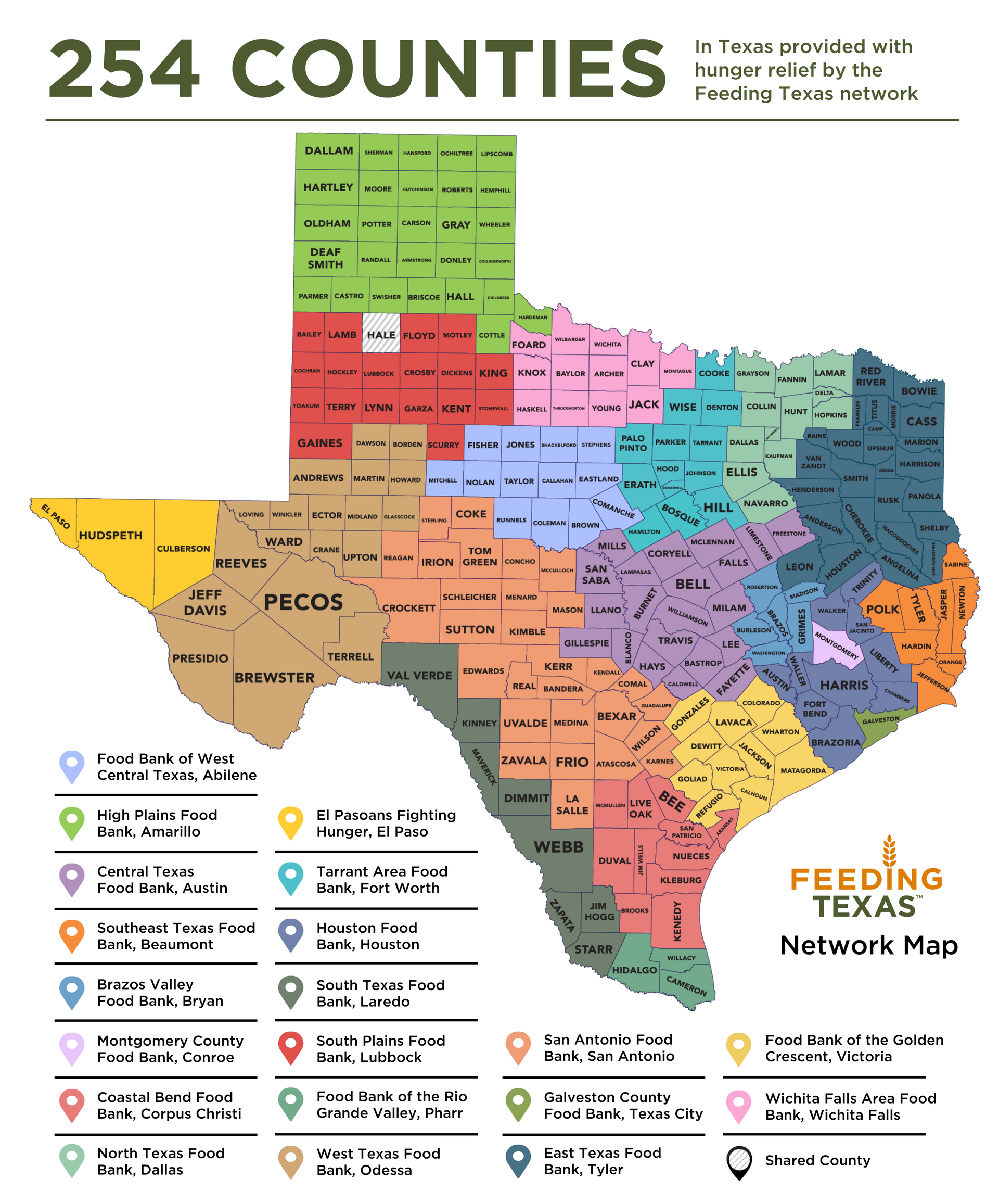

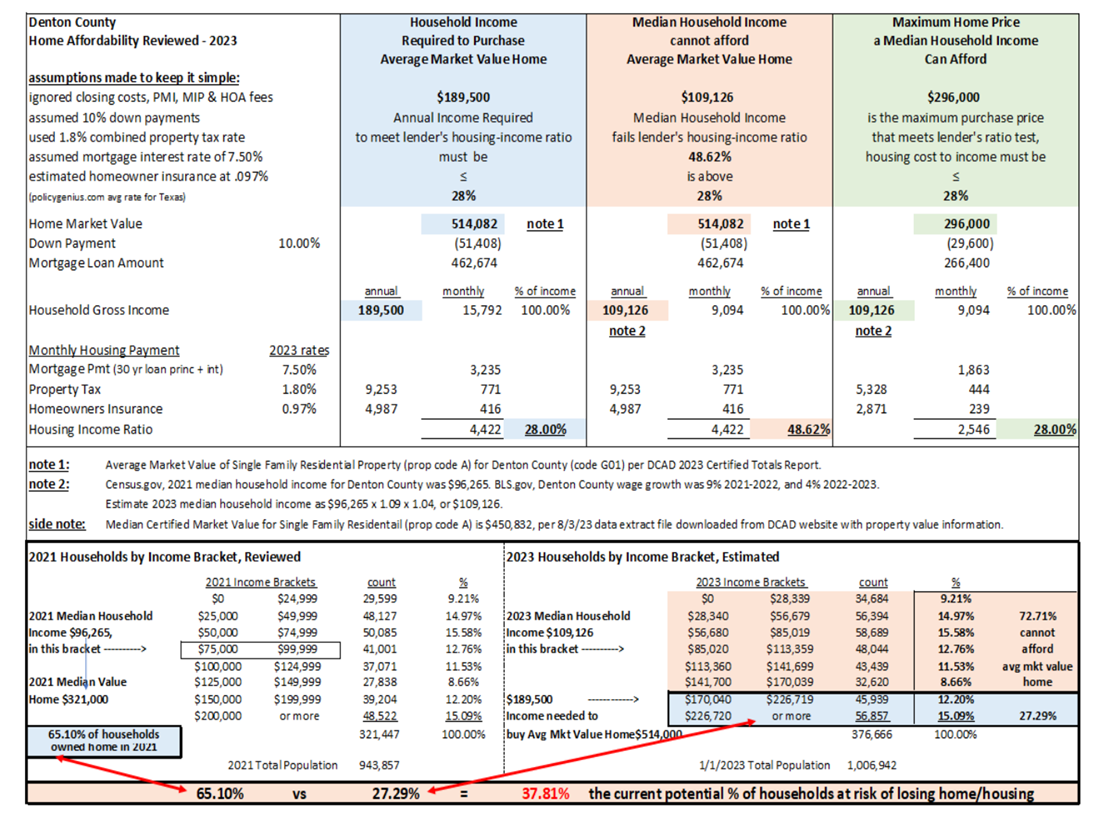

To save 37.8% of the household population (roughly 42,000,000 people) from going bankrupt and to restore the balance sheet to Mom and Pop, property taxes must be repealed in favor of the Uniform States Sales Tax. Any tax must be fair and uniform in application and the only solution is the Sales Tax which is transparent, fair, and uniform.

So as to avoid foolish decisions, politicians, regardless of party, should look through the lens of a socialist policy to determine who receives the benefit, and whether we, the politicians, are creating Institutionalized Systemic Moral Hazard. If so, do the opposite, or do nothing.

Socialism, regardless of political party, country or state, has not now, nor will it ever work, because socialists produce nothing of economic value. Socialism was and is the construct of a drunk named Marx. He sat in bars and pontificated on his drunken theory in exchange for people buying him more to drink. Every country without exception that has instituted or attempting socialism and or communism has economically failed including Russia (in the past), Argentina, Greece, China, who is in severe trouble today, Germany, who is possibly entering a depression, and London, who is failing because of immigration and socialism. The nexus between all these countries is the inability to generate the money to pay off debt that resulted from failed socialist policies. Socialism produces chaos, and the socialists manipulate the public into believing they, the socialists, can make the public’s lives better, which never happens.

Socialism is very distinct from social policy, and it is extremely important to keep this in mind.

The Home Affordability on https://irp.cdn-website.com/39439f83/files/uploaded/Tab%203-Home%20Affordability%202023.pdf shows that it takes a $189,000 income to afford a $514,000 fraudulently created assessed median home value. This is the result of a socialist policy with regards to school district financing, which not only bankrupted the school districts, but now is forcing homeowners to go bankrupt and or lose the roof over their head as they can’t pay the property taxes. Those politicians, regardless of their party affiliation, who allowed this to happen are part of the Institutionalized Systemic Moral Hazard, and failing to correct a known and proven problem, also puts those politicians in violation of Federal law.

In 2025, the average annual premium for employer-sponsored health coverage is approximately $26,993 for family coverage, with employees contributing about $6,850 toward these premiums. The total health benefit cost per employee is expected to rise by about 6.5% on average, reflecting ongoing increases in healthcare service prices and utilization rates.

The average annual premium for employer-sponsored health coverage in 2025 is as follows:

Coverage Type Annual Premium Employee Contribution Employer Contribution

Single $8,951 $1,368 $7,583

Family $26,993 $6,850 $20,143

Average Monthly Premiums for smaller firms (fewer than 50 employees) in March 2024:

Coverage Type Employee Contribution Employer Contribution

Single $170.92 $528.84

Family $751.45 $1232.59

Cost Trends

- Healthcare costs are projected to increase by approximately 6.5% in 2026, marking the highest rise in 15 years.

- Employers are expected to cover a larger share of premiums, with family coverage contributions rising to about 75% in 2024.

Additional Costs

Employees also face out-of-pocket expenses, including deductibles and copayments. For example, a family of four typically incurs about $3,564 in out-of-pocket spending annually.

These figures highlight the significant financial commitment required for employer-sponsored health insurance, which continues to rise each year and push more employers and employees into bankruptcy.

In the United States, health care spending is a significant part of the economy, with total national health expenditures reaching approximately $4.9 trillion in 2023. This spending includes costs from public programs, private health plans, and out-of-pocket expenses.

In fiscal year 2025, the federal government spent about $970 billion on interest payments on the national debt. This amount represents roughly 19% of all federal revenue collections.

Comparison of Health Care Costs and Interest Payments

The interest payments on the national debt exceed many household expenditures, including health care. For context, the average household spends about $6,500 annually on health care, while the interest payments amount to approximately $7,300 per household.

Implications for Health Care Costs

The rising interest payments contribute to the overall financial burden on the federal budget, which can indirectly affect health care funding and costs. As interest payments grow, they may limit the resources available for health care programs, impacting affordability (which no longer exists), and the access to care for individuals or the quality of that care, which has been severely curtailed.

There are fixes.

The Trump administration is doing what is necessary with regard to increasing top line revenue, to correct generations of failed economic policies which created the debt. However, these efforts, as important as they are, do little to affect the daily lives of Mom and Pop, and a solution is obtainable with the repeal of all property tax in favor of the Uniform States Sales Tax. The average household is $9,000 away from bankruptcy of which $7,000 is property tax. Restore the balance sheet to Mom and Pop by allowing them to truly own their property and restore the American Dream of home ownership, by repealing all property tax in favor of the Uniform States Sales Tax.