The Game (aka Your Life) is Rigged

By Mitchell Vexler, August 10, 2025

This is one more article in a series, that builds upon each other and allows my thought process to become more direct with the goal of helping distill the issues in byte size elements of understanding of both the macro and micro picture of debt and taxes mandated to support that debt.

After more than 35 years of doing what I do, one thing is absolute and that is truth doesn’t sell - but it saves you if you're willing to adhere to it.

Liquidity dries up. Sentiment reverses. Price discovery returns like a sledgehammer swung by the comedian George Carlin.

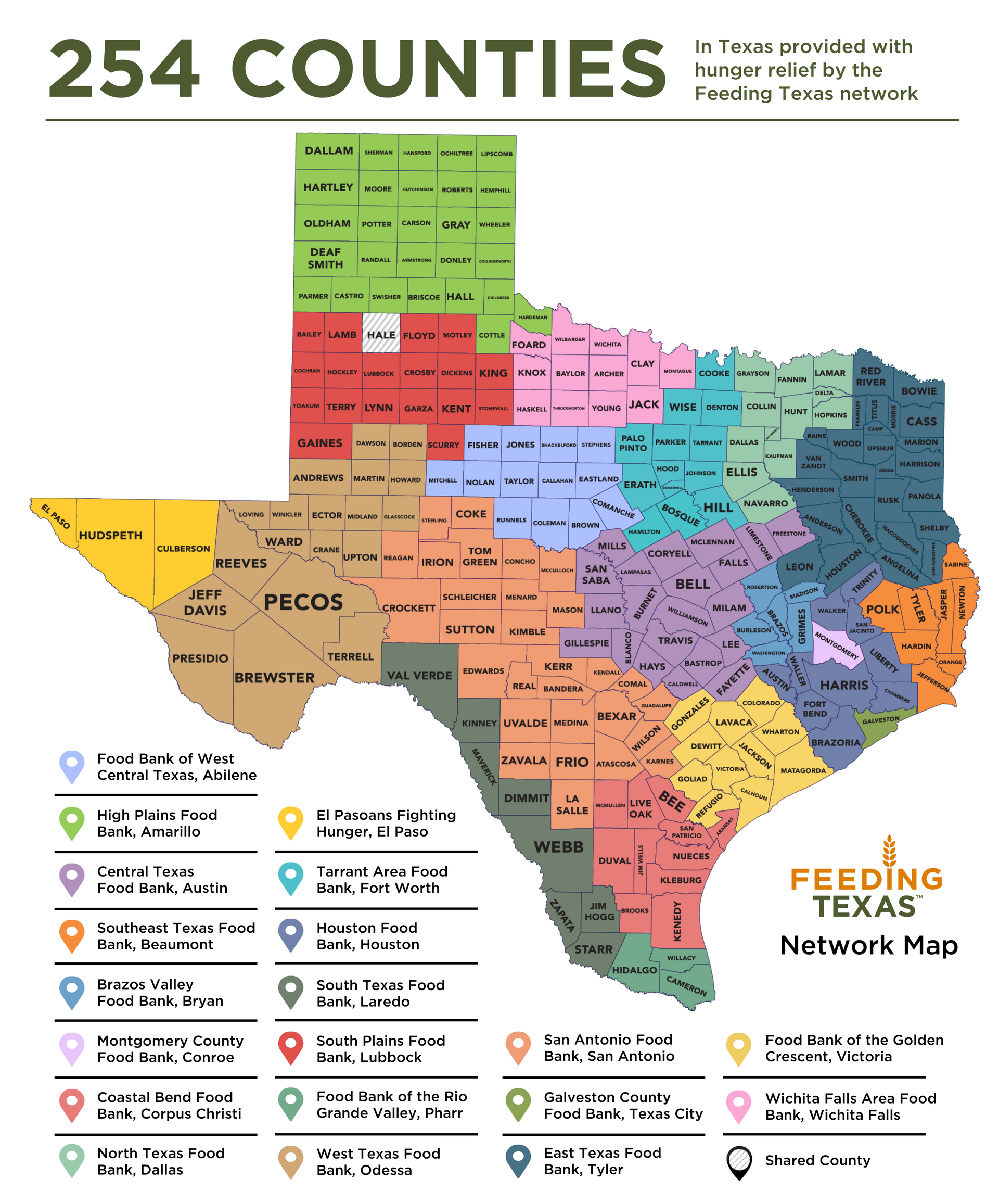

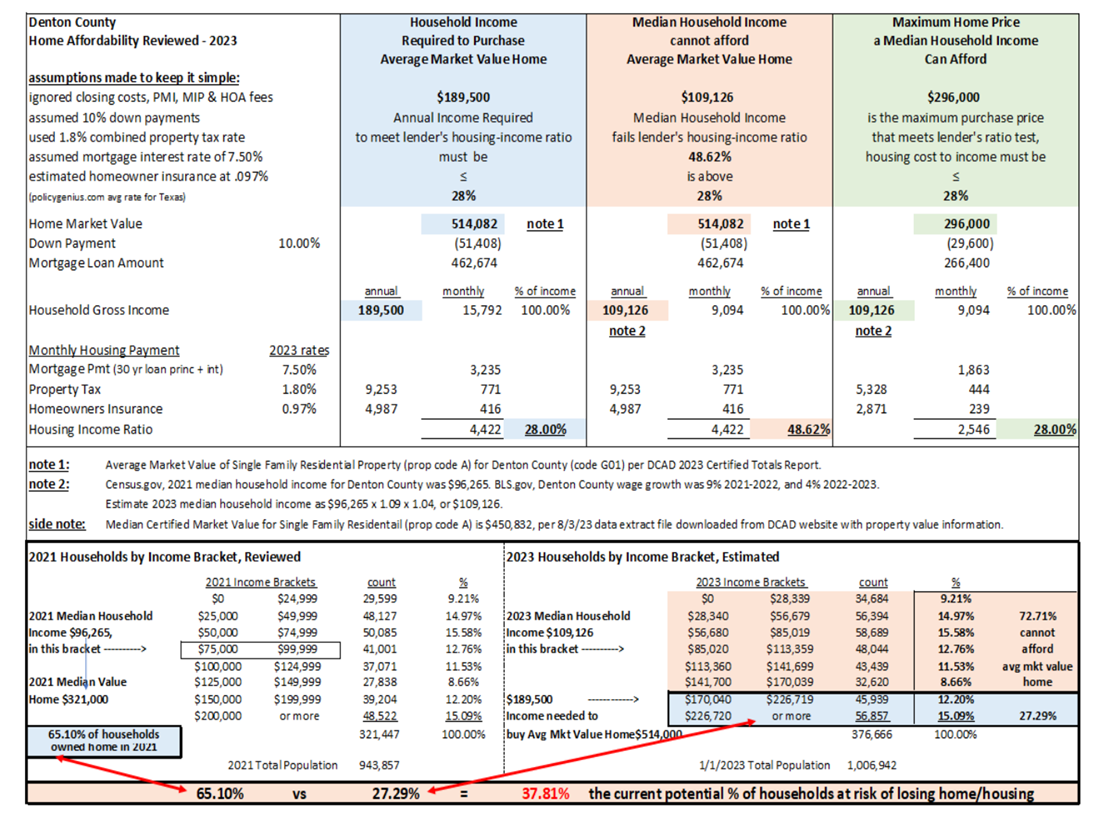

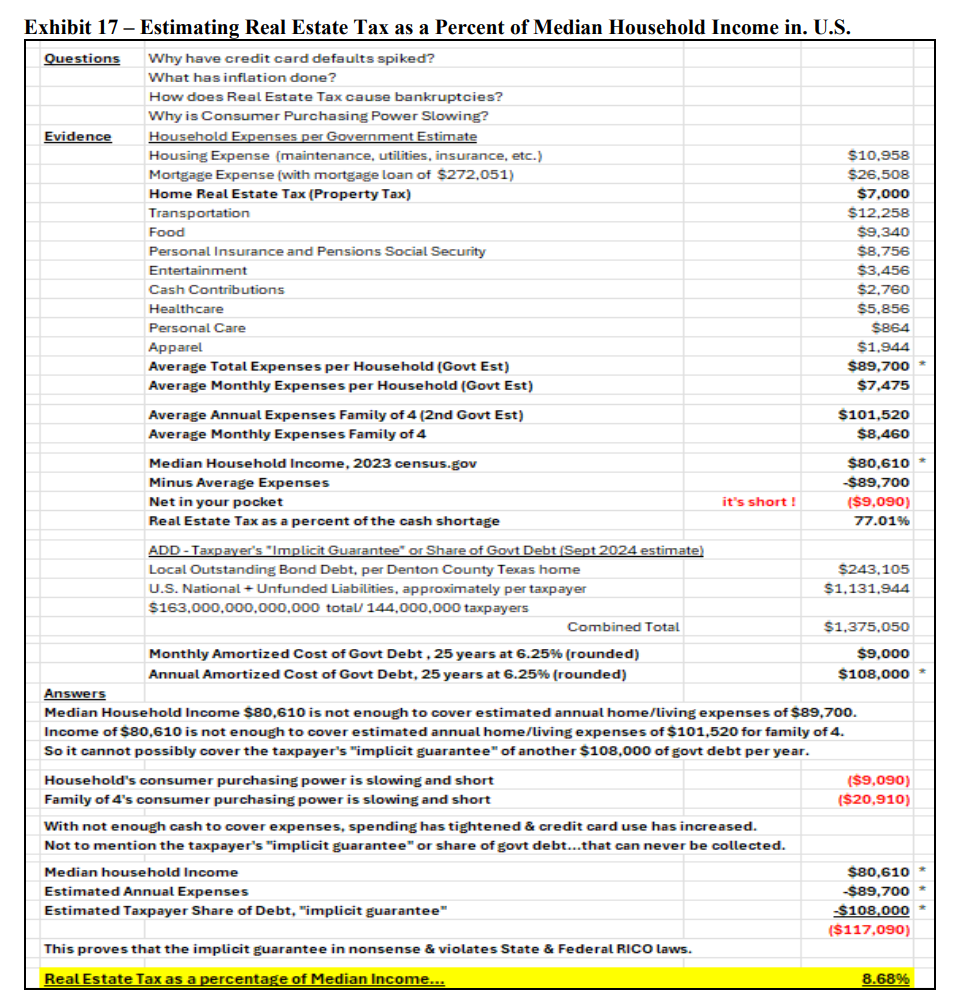

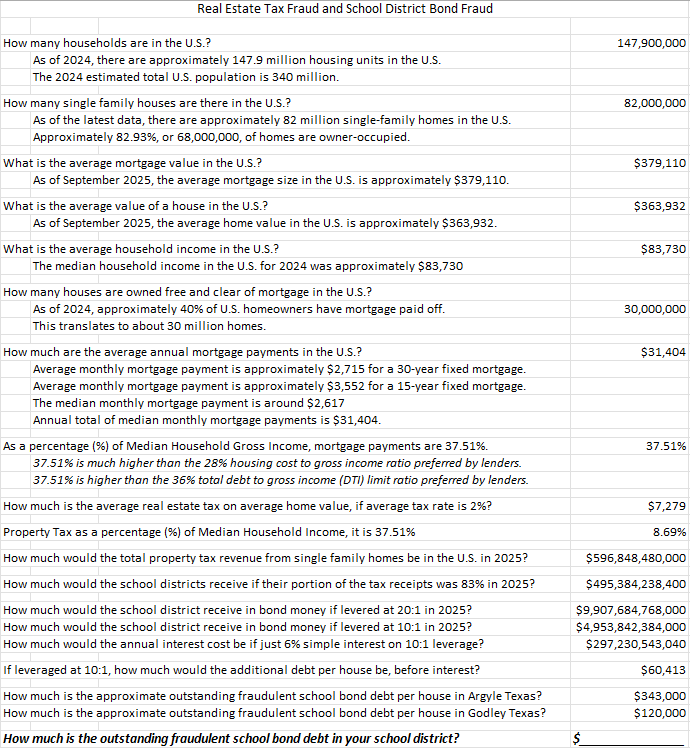

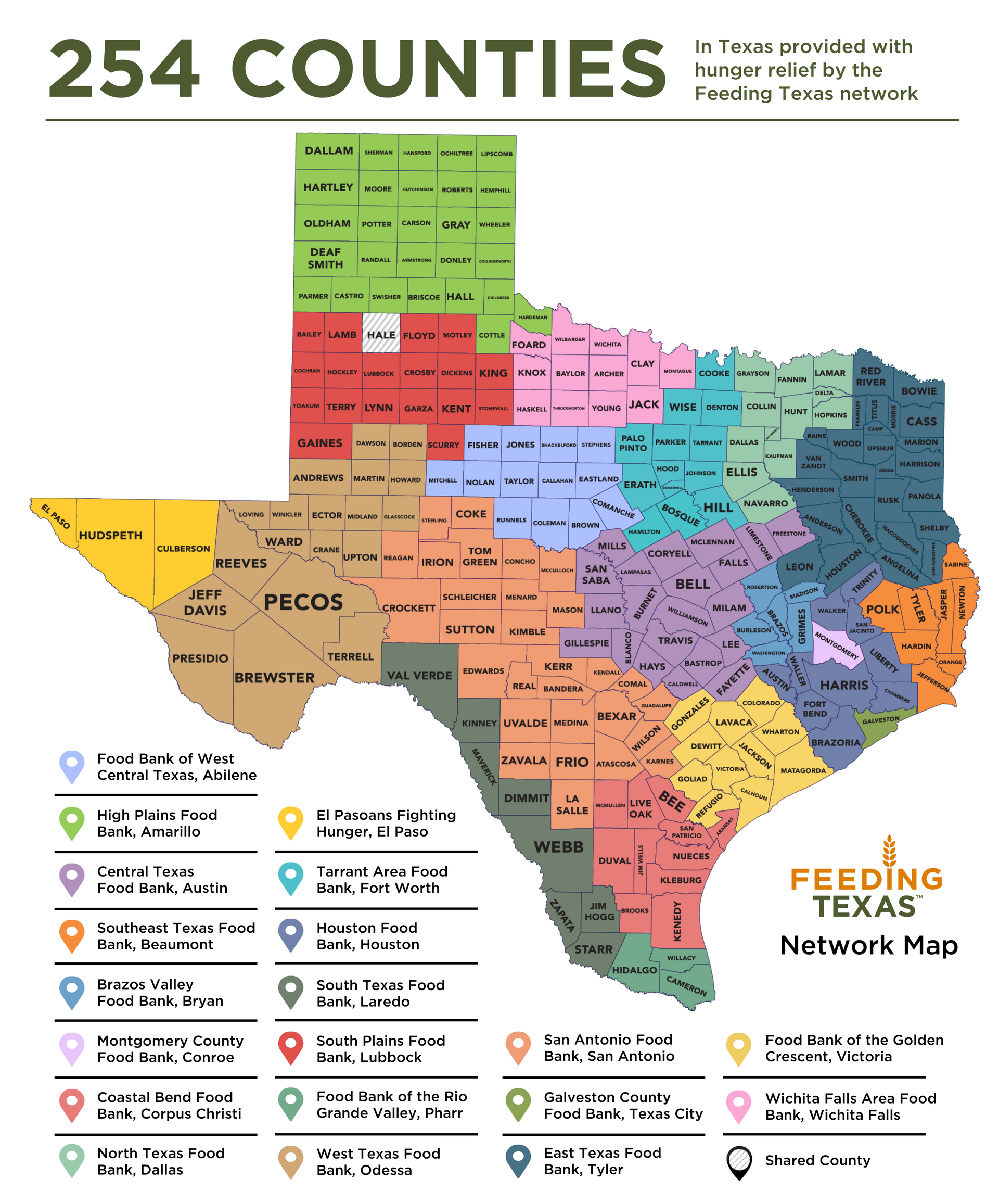

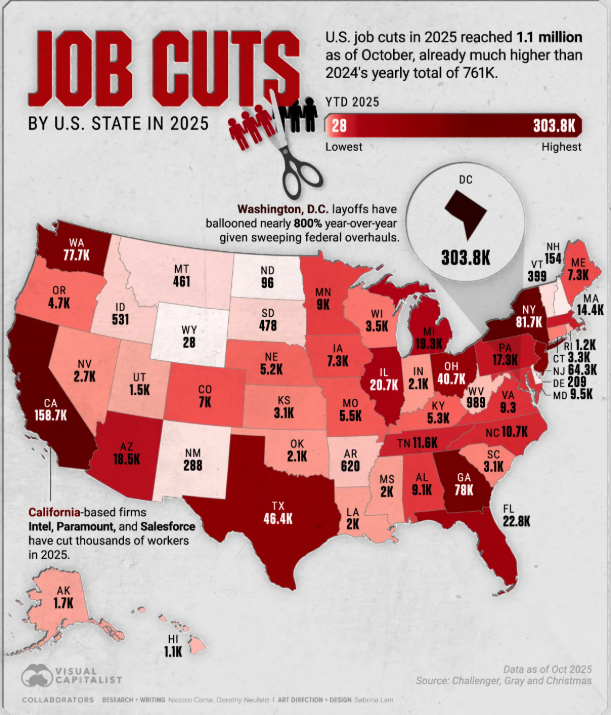

Rising debt levels at State, School District, Federal, and personal as well as the real taxes necessary to feed the interest on those rising debt levels including outstanding fraudulent school district bond debt, raise nightmarish concerns.

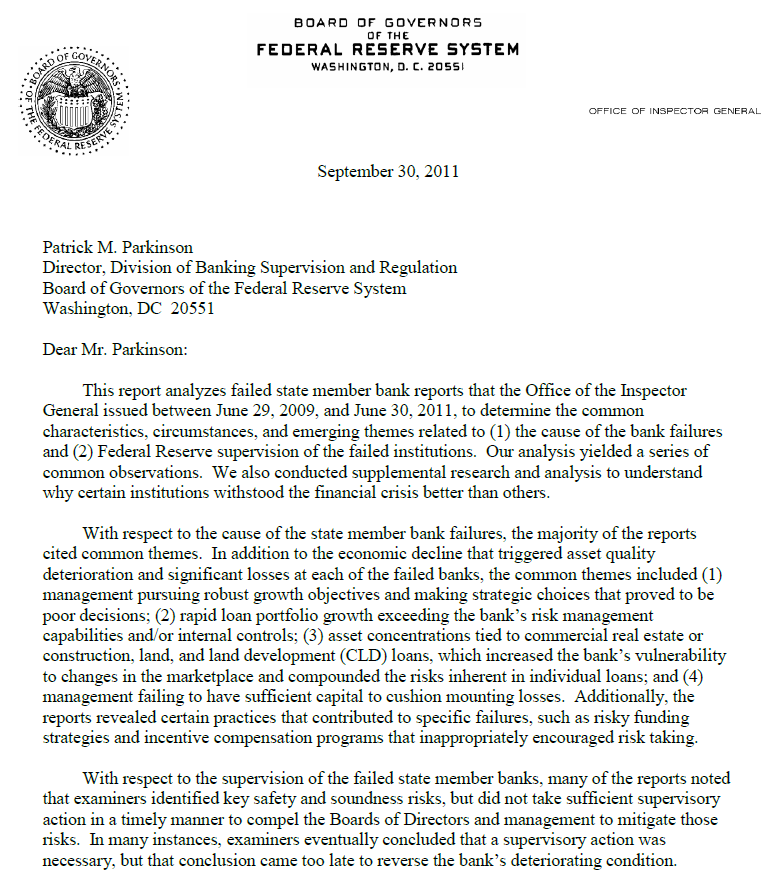

However, the problem of rising debt levels is Option A) default or Option B) a continued degrading of economic growth which without immediate course correction has a very high probability of leading back to Option A. Regardless of State, Federal, School District, corporate or individual, debt is debt, and one should know if that debt is productive debt or non-productive debt.

Let’s consider at the State and Federal levels, increases in debt, under which there would be little to no economic growth. This is because all government debt winds up in the economy and the household’s balance sheet through lending, credit, or direct payments. We know this by looking at the dollars of debt required to create a dollar of economic growth.

https://www.mockingbirdproperties.com/public-debt-as-distinct-from-corporate-debt

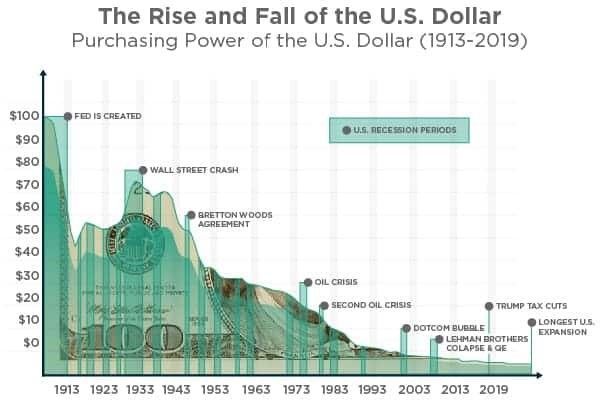

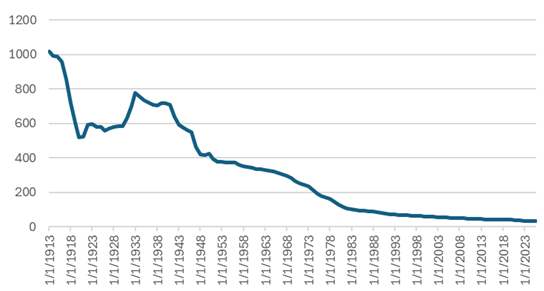

Since 1980, the increase in debt has usurped the entire economic growth.

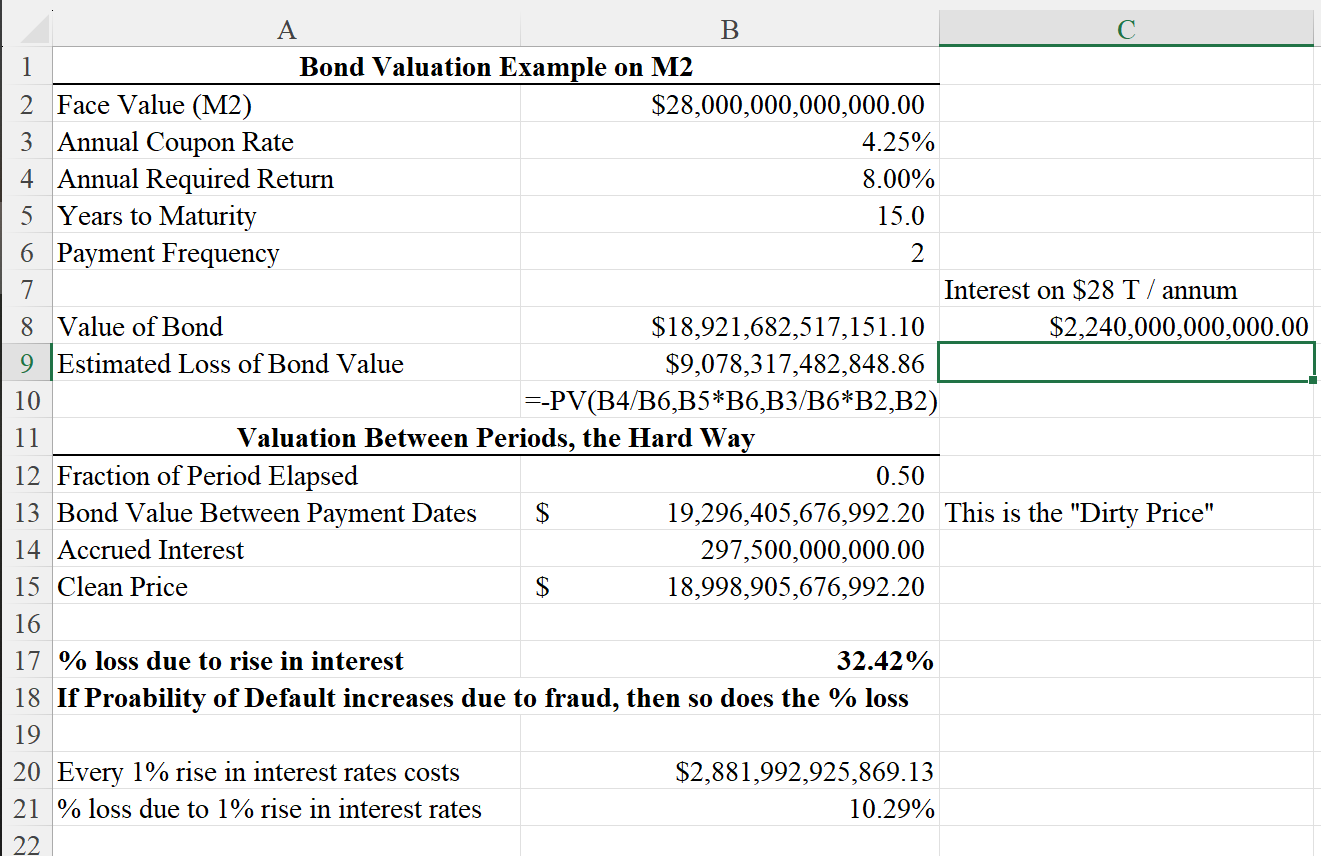

Look up the Rule of 72. The benefit of the Rule of 72 goes to the lenders who collect the interest. The more money printed, the higher the M2, the higher the dollars required to service the debt. On a local level, the school districts follow the same model, except the money to pay on the outstanding fraudulent school district bond debt is extorted from the property owners. The compound interest calculator link below, shows how fast the debt grows regardless of school district and is applicable across the U.S.

https://irp.cdn-website.com/39439f83/files/uploaded/Compound+Interest+Calculator+-+Godley+Texas.pdf

The problem with the growth in debt is that it diverts tax dollars away from productive investments into debt service and social welfare. We know that one could consider social welfare the equivalent of what the school districts have created.

https://www.youtube.com/watch?v=IiDf5cxPvOM

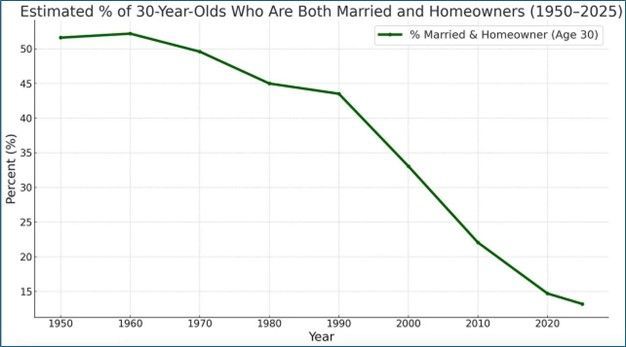

This leads to the school districts insatiable appetite for your property taxes to pay for the interest on the outstanding fraudulent school district bond debt and thus the unaffordability of the average home based on the median household income.

https://irp.cdn-website.com/39439f83/files/uploaded/Tab%203-Home%20Affordability%202023.pdf

Without debt at the Federal Government level, there has been no organic economic growth since 2015. Thus, the debt and subsequent deficits must continue to expand to sustain economic growth.

Without debt at the school district level, there has been no economic growth of quality education, and in fact a degradation of education where the net result is an awakening of the population that they have been defrauded by intentional propaganda, not education.

A corporation with net free cash flow after all expenses has an economic yield. The Federal Government and the School Districts have no net free cash flow and thus they have created fraud which is the liquidity trap where interest rates must remain low and their fraudulent debt grows faster than the economy, just to keep both from failing sooner, rather than later.

https://www.mockingbirdproperties.com/fed-analysis-cpi-the-ultimate-big-lie

The problem with the current issuance of debt at both the Federal and School District levels is that it is non-productive debt.

As I have stated in multiple videos, one must understand how to handle debt and most people do not. They do not know how insidious manipulation has become on the economy, or persons. Productive debt refers to borrowing used for investments that generate long-term economic returns, such as infrastructure, research, or business capital expenditures, and on a personal level, one’s education. These types of investments ultimately pay for themselves and deliver a yield on the investment.

Non-productive debt funds consumption or transfers that do not yield a measurable economic return. In the U.S., social welfare and interest payments on existing debt are such non-productive debt, as is the roughly $5.1 Trillion in outstanding fraudulent school district bond debt from which property taxes are being used to pay the interest and not pay down the debt. Another way to think about it is that a Ponzi scheme = non-productive debt + interest on that debt.

The data per the Federal Reserve shows that of every dollar spent by the Federal Government, roughly 73% is “mandatory” spending on social welfare and interest expense not to mention the $1.8 Trillion deficit in 2024, on the U.S. National debt and this does not include the unfunded liabilities.

There is no disagreement about the need for government spending. The disagreement is with the abuse, and waste, of it. It is the politicians who allowed for the demand of the unjustified social spending, as it is the banks and those invested in U.S. Treasuries, that receive the yield on those funds lent. However, as I have stated, the higher the risk, the higher the required return for the dollars loaned on the investment. Just because the Federal Reserve may drop interest rates .25 bps does not mean the lenders will follow suit and does not mean there will be a measurable difference to Mom and Pop at any level. If the Federal Reserve over say 12 months dropped interest rates by 2% (200 bps) that might start to have an effect, except, what does that say about the economy?

Spending must be designed to raise productive capacity, potential growth, and return on investment in a measurable form.

Increasing real GDP to 4% annually would vastly improve the current predicament. If interest rates drop by just 1%, this could reduce Federal spending by $500 billion annually, helping to ease fiscal pressures, but stability and long-term legal measures to maintain that stability are paramount.

Forced debt reduction via bankruptcy in a very specific area, being the school districts, is the solution for roughly $5.1 Trillion. And as compared to the overall debt growing with each tick of the clock, eliminating the school bond debt is not economically damaging to society, as compared to the overall debt compounding minute by minute, but would ensure the return of the balance sheet to Mom and Pop such that all property owners own the land beneath their asset thus ensuring the economic engine being the Citizens of the U.S. are able to attain the American Dream of Homeownership.

I will leave this article with two quotes from Thomas Paine.

“The greatest tyrannies are always perpetuated in the name of the noblest causes.”

“It is the duty of every man, as far as his ability extends, to detect and expose delusion and error”

P.S. Does the political will exist to steer the people away from the fiscal cliff into stability??

Repeal all property tax in favor of the Uniform States Sales Tax.